FPI inflows into Indian equities expected to stage a comeback post the election results

FinTech BizNews Service

Mumbai, May 17, 2024: The Economic Research Department of Bank of Baroda has come out with a special report on Forex trend by Aditi Gupta, Economist, Bank of Baroda.

Currency update

INR traded in a thin range in May’24 and depreciated marginally by 0.1%. This was notwithstanding

a drop in DXY as well as lower oil prices. Outflows from domestic equities fueled by uncertainty over

the outcome of general elections weighed on the domestic currency. However, RBI efficient

management ensured that stability in the currency was maintained with a trading range of 83.43-

83.53/$. In the next fortnight, we expect weakness in INR to continue amidst FPI outflows, with an

expected trading range of 83.25-83.50/$. However, FPI inflows are likely to resume following the

election results and we continue to expect INR to end FY25 marginally stronger.

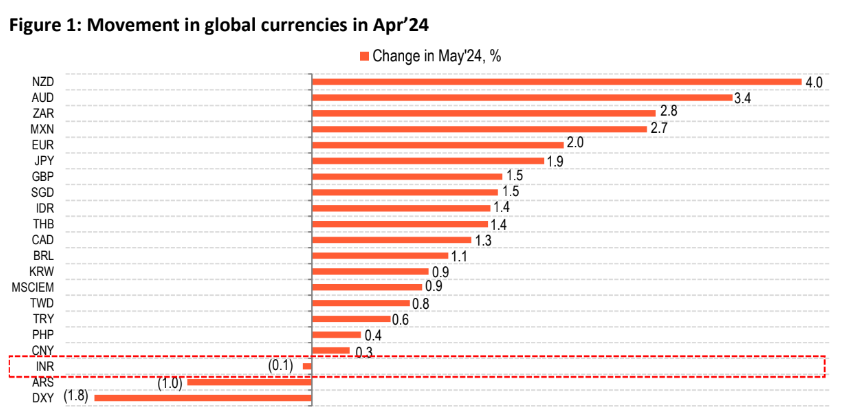

Movement in global currencies in May’24

In May’24, major global currencies appreciated against the dollar. The rally in global currencies was

led by a weakness in dollar. DXY index, measuring the dollar’s value against a basket of currencies is

1.8% lower in May’24, reversing the 1.7% gain it made last month. The dollar’s misfortune can be

attributed to a significant repricing of investors’ rate cut expectations based on incoming data.

Macro data suggests a somber start in Q2, setting up the stage for the start of Fed’s rate cut cycle.

Labour market conditions showed signs of relenting with non-farm payrolls increasing at the slowest

pace in the last 6-months. Wage pressures too eased with increase in hourly earnings falling below

4% mark for the first time in nearly 3-years. Consumer demand too witnessed a sharp slowdown, as

retail sales decelerated sharply in Apr’24. On the other hand, inflationary pressures seem to be

abating. CPI inflation in the US moderated more than expected in Apr’24, after remaining elevated in

Q1 CY24. Given the fact that Fed officials, including the Fed Chair have advocated a data dependent

approach, the macro prints so far look encouraging and may tilt the Fed towards monetary policy

easing. Hence, the probability of a rate cut in Sep’24 has increased significantly to 54% currently

from just 38% as of 30 Apr 2024, as per the CME Fed Watch Tool which is weighing on the dollar.

Performance of rupee

While most global currencies gained against the dollar, INR depreciated by 0.1% in May’24. Even EM

currencies appreciated by 0.9%, as oil prices on average were lower. The weakness in INR stemmed

from a sharp pullback in FPIs from the domestic market. In May’24, FPI outflows from India totaled

US$ 3.1bn, concentrated majorly in the equity segment. Uncertainty over the general elections has

led to increased volatility in the domestic equity markets, which has also been compounded with a

mixed corporate performance of India Inc in the final quarter of FY24. Apart from this, investor

interest in China has returned leading to a diversion of foreign inflows from India. Higher bond yields

in US also attracted investors amidst an anticipated delay in Fed rate cut cycle. Interestingly,

USD/INR remained in a narrow range of just 10 paise in May’24, and traded just shy of a lifetime low

of 83.54/$ it touched in Apr’24.

Outlook

Pressure on INR is likely to sustain in the near term amidst ongoing volatility in the domestic markets

which is likely to keep foreign investors wary of India. On the other hand, a weaker dollar and lower

oil prices will lend some support to the domestic currency. At US$ 642bn, India’s forex reserves give

RBI more than ample buffer to see through the volatility. On balance, we expect INR to continue to

trade in a narrow range of 83.25-83.5/$ in May’24.

Over the medium to long term, we remain optimistic on INR. India’s macro fundamentals remain

strong with moderating inflation, high growth, manageable twin deficits and expansive forex

reserves. Further, we expect FPI inflows into Indian equities to stage a comeback post the election

results. This will be supplemented by India’s inclusion in global bond indices which is likely to bring in

about US$ 25-30bn inflows into the debt segment. Hence, we continue to see an appreciating bias

for INR in FY25.

Disclaimer

The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.

Bank of Baroda Group or its officers, employees, personnel, directors may be associated in a commercial or personal capacity or may have a commercial interest including as proprietary traders in or with the securities and/ or companies or issues or matters as contained in

this publication and such commercial capacity or interest whether or not differing with or conflicting with this publication, shall not make or render Bank of Baroda Group liable in any manner whatsoever & Bank of Baroda Group or any of its officers, employees, personnel, directors shall not be liable for any loss, damage, liability whatsoever for any direct or indirect loss arising from the use or access of any information that may be displayed in this publication from time to time.