India Economic Perspectives

Tanvee Gupta Jain,

Economist at UBS India

Mumbai, March 4, 2025: India’s real GDP stood at 6.2% YoY in the December 2024 quarter compared with 5.6% YoY and 6.5% YoY in the previous two quarters.

Real GDP recovered to 6.2% YoY in Dec quarter; upward revisions to past data

The growth in the quarter was largely in line with the consensus expectation but slightly below our estimate. Notably, past annual real GDP growth was revised upward c100bps to 9.2% YoY for FY24 and c60bps to 7.6% YoY for FY23. The Ministry of Statistics now expects slightly higher real FY25 GDP growth, at 6.5% YoY, as per its second advance estimate (from 6.4% YoY earlier and 6.3% UBSe). The implied real GDP growth in the March quarter comes to 7.6% YoY, which seems optimistic to us. Looking at the details, on a seasonally adjusted sequential basis, India’s real GDP was up 2.2% QoQ (vs. 0.8% QoQ in the September quarter). On a real gross value added (GVA) basis, growth picked up to 6.2% YoY (from 5.8% YoY in the September quarter). The growth pick-up in the December quarter was largely led by a household consumption recovery (primarily on revived rural demand) and a higher contribution of net exports, even as fixed capex growth remained soft. On the industrial side, growth was supported by robust agriculture output and improved manufacturing growth in the December quarter. Nominal GDP grew 9.9% YoY, with a GDP deflator of 3.5%, in the December quarter.

FY26 real GDP growth likely to be below consensus on global uncertainty

The UBS India Composite Economic Indicator (UBS India-CEI), our leading indicator, with 15 high-frequency data points, suggests economic momentum likely improved in January. On a seasonally adjusted sequential basis, CEI was up 1% MoM in January (vs. 0.7% MoM and 0.5% MoM in the previous two months). We expect India’s FY26 real GDP growth to stabilise at 6.3% YoY but to remain below consensus (6.5% YoY), building in an uncertain global backdrop (especially US trade policies and the risk of reciprocal tariffs on India). Looking at the details, we expect household consumption to largely stabilise toward 6% YoY in FY26 as cyclical rural demand recovers and urban demand stabilises. While public capex is likely to stabilise and residential property demand to remain supportive, we expect a further delay in a private corporate capex recovery due to the risk of China offloading excess capacity in the manufacturing sector. The contribution of net exports could remain tepid and will depend on global growth. That said, fiscal and monetary support measures are being taken to strengthen the economic recovery and contain macro risks. We maintain that there is scope for further 50bp repo rate easing this cycle (after 25bp policy easing earlier this month). We also expect the RBI to take measures to improve interbank liquidity and maintain currency flexibility.

Expenditures: Consumption up and net export contribution improved

India’s real GDP growth (at market prices) picked up to 6.2% YoY in the December quarter (vs. 5.6% YoY in the previous quarter). Looking at the breakdown, growth picked up in private consumption expenditures (6.9% YoY vs. 5.9% YoY in the September quarter) and government spending (8.3% YoY vs. 3.8% YoY in the September quarter). The household consumption recovery reflects festive/marriage season demand, improved rural sentiment (on higher agriculture sector growth) and improved overall government spending in the December quarter. On the other hand, fixed capex growth softened to 5.7% YoY (vs. 5.8% YoY in the September quarter). The net export contribution improved to +2.5ppt, as exports grew 10.4% YoY and imports contracted 1.1% YoY in the December quarter.

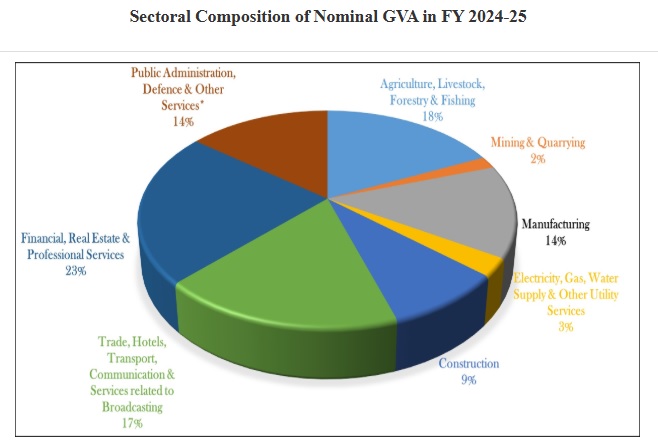

Production: Agriculture and manufacturing largely led the improvement

On a real GVA basis, growth improved to 6.2% YoY in the December quarter (from 5.8% YoY in the previous quarter). Looking at the breakdown, agricultural and allied sector growth picked up further to 5.6% YoY (vs. 4.1% YoY in the September quarter), buoyed by higher summer crop (kharif) output (up 6% YoY). Industrial segment growth improved to 4.5% YoY (vs. 3.8% YoY in the September quarter), largely led by a growth pick-up in the manufacturing sector (3.5% YoY vs. 2.1% YoY in the September quarter). The manufacturing growth pick-up was largely in line with the operating profit growth improvement of listed manufacturing companies, partly on lower input cost. Construction sector growth softened marginally to 7% YoY (from 8.7% in the September quarter). Notably, growth in electricity, gas, water supply and others (5.1% YoY vs. 3% YoY in the September quarter) and mining (1.4% YoY vs. -0.3% in the September quarter) inched up in the December quarter. Service sector growth remained robust, at 7.4% YoY (vs. 7.2% in the September quarter). While growth in the trade, hotel, transport and communication segment (6.7% YoY vs. 6.1% in the September quarter) improved, growth in financial services, real estate and professional services (7.2% YoY) and public administration, defence and others (8.8% YoY) remained largely stable.