Tariff-related turbulence lies ahead as the US upped the ante with reciprocal tariffs, with India also in view; India’s tariff rates are higher than the US and Asian peers, which makes the economy susceptible to retaliatory as well as reciprocal tariff action.

Radhika Rao

Executive Director and Senior Economist

DBS Bank

Mumbai, February 26, 2025: 4Q24 (3QFY25) real

GDP growth is expected to improve to 6.3% yoy

from 5.4% in 2QFY; latter was the slowest in seven

quarters.

A catch-up in government capex spending, passage of

idiosyncratic factors including unfavourable

weather, better kharif crop output, festive

demand, and better production numbers are

few of the factors which should lift 3QFY25

output.

This is counterweighed by an absence of pick-

up in corporate profitability and service sector

activity, signaled by slowing credit growth and

moderation in GST collections.

External trade fared well as services and

merchandise shipments improved. Notably,

monthly service exports surpassed goods

shipments in January 2025, pointing to

improved resilience in the trade account.

We are also mindful of revision to past data,

which can materially change the quarterly

growth profile, including the first half of FY25.

Bearing that uncertainty in mind, we retain our

forecast for growth to average 6.3% this year.

With downside risks to the latter and February

inflation expected to edge towards the 4%

target, the central bank is poised to stay on a

calibrated dovish path. We expect at least 50bp

more cuts in this cycle after a 25bp reduction

in February.

Liquidity measures will be equally crucial to

facilitate policy transmission. On this front, the

central bank supplemented ongoing measures

with a 3Y USDINR buy/sell swap of the largest-

ever notional amount of $10bn, due on

February 28. Expectations are that partially

hedged ECBs and fresh issuance would tap into

this auction. This follows the RBI’s earlier six-

month $5bn USDINR swap auction on January

31 (which will reverse on August 4), with market

participants pinning hope on a longer duration

swap in recent weeks to provide longer

duration relief. We also recall that the RBI

conducted two buy/ sell auctions in March-April

2019, about three weeks apart for $5bn each.

Since late 2024, the RBI has infused ~INR 3trn

worth of durable liquidity, tapping a

combination of VRR auctions, swaps, and open

market operations.

Banking system liquidity remained at a deficit of

INR 1.9trn (7D average) in late-February, even if

narrower than INR 2.5trn in end-Jan, driven by

FX intervention and frictional drivers like tax

outflows and currency in circulation flows.

Notably, the RBI’s outstanding net forward

dollar sales had jumped sharply to $67.9bn as

of December 2024, signaling measures to

stabilise the currency.

Tariff turbulence ahead

• US’ premise

News flow on potential trade and tariff action

from the US continues to trickle in. While the

jury is out on whether these will be imposed or

are negotiating tactics, there is heightened

uncertainty amongst key stakeholders. In mid-

February, the US government proposed to

impose a ‘Fair and Reciprocal Plan’, which not

only covers import tariffs but also non-trade

barriers, including value-added taxes and

exchange rates, amongst others that might put

US firms at a disadvantage. The official release

highlights the motivation for the US to correct

longstanding trade imbalances. Examples were

cited including Brazil, which has an 18% tariff on

ethanol imports from the US, whilst the US tariff

on ethanol is low at 2.5%. India also finds a

mention, with the average applied MFN tariff at

39% vs. US’ 5% highlighted as a mismatch,

besides India’s 100% tariff on US motorcycles

(vs. US’ 2.4% on Indian motorcycles).

Besides mainstream tariffs, data on non-tariff

barriers shows that US has a larger number of

commercial policy interventions (as a proxy for

non-tariff barriers) than India. VAT rates are

higher in the European countries compared to

Southeast Asia and India.

• India’s trade linkages

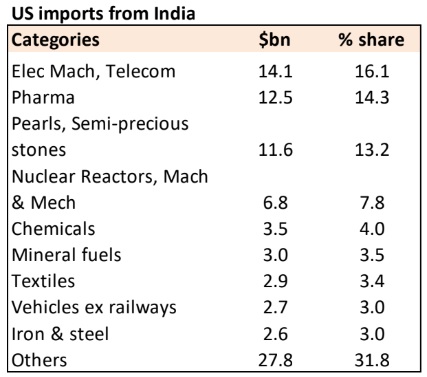

The US runs a trade deficit with India, with the

bilateral gap doubling between 2015 and 2024.

While India’s share in US imports stood at 2.7%

in 2024, the US is India’s largest export

destination (18% share), led by sectors like

pharma, electronics, pearls & semi-precious

stones, iron & steel, textiles, mineral fuels, etc.

The annual goods trade deficit widened considerably

in the past four years.

While the issue of tariffs and trade barriers is

high in the goods trade, North America, the US

in particular, is an important destination for

India’s service exports. Software capabilities as

well as services through GCC (Global Capability

Centres) have pushed up the trade balance in

favour of India.

Tariffs under the scanner

India’s tariff rates are higher than the US and

Asian peers, which makes the economy

susceptible to retaliatory as well as reciprocal

tariff action. The trade-weighted average tariff

rate in 2023 stood at 12% vs 2.2% in the US.

India’s rate on agricultural products was high at

65% (2022) on average, but imports under this

category amounted to 5% of total imports. The

rate on non-agricultural product lines was 9%,

amounting to the bulk of the imports – see

chart.

India imports more raw materials and

intermediate goods from the US, whilst it

exports more consumer goods. Key categories

of India’s exports to the US have changed in

recent years, with electrical machinery and

electronics rising to the top, followed by legacy

sectors like pharma, pearls, semi-precious

stones, chemicals mineral fuels etc – see table.

Mapping product categories by differing tariff

rates – those levied by India on purchases from

the US and US imposes on India (see chart),

shows that across-the-board India’s tariffs are

higher, giving merit to the debate over the need

for India to balance the trade/ tariff

arrangement. Out of the top categories,

sectors ranging from iron & steel, pharma,

electronics, chemicals and precious stones

face a tariff gap of 5% to 22% (average 9%).

Negotiations

India’s Prime Minister Narendra Modi visited

the US in mid-February to kickstart negotiations

on trade and investments. As a pre-emptive

step, India had lowered sector-specific import

tariffs in the February’s budget.

For example, basic customs duty on luxury cars,

chemicals, solar cells, and machinery was

lowered, besides a reduction in the peak import

tariff from 150% to 70% and the average tariff

rate falling to 11% from 13% earlier. Effective

duty rates, however, stay high as an Agriculture

Infra Development Cess in the range of 5% to

70% was raised on around 32 items, including

luxury cars.

Post the bilateral meeting, India assured that

various means would be explored to narrow the

trade imbalance, including increasing energy

purchases (initial target at $25bn), defence

equipment (F-35 warplanes), etc. On defence,

higher purchases will add to the existing US-

origin arsenal, including Hercules and Apache.

The launch of an Indian Ocean Strategic venture

coincides with Meta’s undersea cable project.

India is also likely to reassess laws to allow US

nuclear energy participants and cooperation in

the sector. Other sectors in focus will be AI,

chips, security, IMEC corridor (convene

partners within the next 6 months), amongst

others.

• Way forward

Higher energy imports

Under Trump 1.0, India had begun to increase

energy imports from the US to lower the trade

deficit and more is likely under the latest push.

The breakdown of key import markets for crude

purchases shows that the US is India’s 5th

largest crude oil supplier, after Russia and the

Gulf countries in the first 8MFY25.

The US will seek to increase its market share in

the Indian crude import basket, besides seeking

a larger pie of the LNG pool. The substitution

effect is unlikely to materially improve India’s

trade deficit (with a risk of deterioration at the

margin on the count of prices and currency) as

a narrower the trade deficit with the US will be

offset by a potential widening in deficits with

other trading partners.

Bilateral trade agreement

In the post-meeting statement, India and the US

agreed to negotiate the first tranche of a

mutually beneficial, multi-sector Bilateral Trade

Agreement (BTA) by fall of 2025. Both sides

have committed to designate senior representatives

to advance these negotiations

and to ensure that the trade relationship fully

reflects the aspirations of the COMPACT

(Catalyzing Opportunities for Military

Partnership, Accelerated Commerce &

Technology). The proposed BTA aims to

strengthen and deepen bilateral trade across

the goods and services sector and will work

towards increasing market access, reducing

tariff and non-tariff barriers, and deepening

supply chain integration. We note that the

proposed BTA doesn’t constitute a traditional

free trade agreement, i.e., FTA (much broader

in scope and results in overall trade

liberalisation), but rather aims to improve

terms of trade under which “Mission 500” i.e.,

aim to double bilateral trade to $500bn by 2030

will be achieved. Given difficulties in passing the

‘trade pillar’ in the existing US-led Indo-Pacific

Economic Framework for Prosperity (IPEF)

platform, for which India is a signatory,

achieving a satisfactory common ground will be

a challenge.

Sectors under watch

− Pharma: The US is the largest market for

India’s pharma shipments (dominated by

generic drugs), with the country accounting

for close to a third of the total segment’s

exports. Sectoral estimates are that India

imposes 10% tariff on imports from the US,

while the latter’s at a modest 0.2% according

to WTO data. Top Indian drugmakers are

heavily dependent on US exports, with the

latter accounting for almost half of sales for

few of the firms. While a uniform tariff

increase will retain India’s lead, reciprocal

action will raise costs for domestic firms and

narrow margins. The pharma sector was

highlighted as one of the target sectors,

besides semiconductors and automobiles,

for the US’ reciprocal action.

− Electric Vehicles: Terms of an existing policy

that promoted the manufacturing of EVs

(cars for a start) might be modified, likely

beginning with the need for the carmakers to

show a smaller turnover of INR 25bn in the

second year compared to the revenue

targets of INR50bn in the fourth year and

75bn in the fifth year, according to the

. The draft policy, released last year,

had mandated a concessional import duty of

15% on completely knocked down units of

electric cars for five years (for cars above

$35k and above) against an initial

investment of at least $500mn. From release

to approvals and eventual imports, the

timeline will likely extend from March to

August/ September. Notably, US EV player

Tesla reportedly plans to start its retail

operations in 2H25. It remains unclear for

now if the US carmaker will assemble cars in

India to avail of the reduced tariff. For now,

plans are presumably to import fully built

cars from Germany, one of its three

manufacturing facilities around the world.

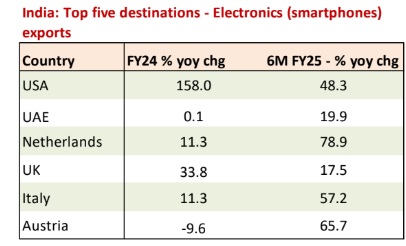

− Electronics/ semiconductors: The share of

electronics in India’s exports continues to

rise, climbing to the third spot just behind

petroleum products and engineering goods

in 8MFY25. According to industry estimates

cited by the press, the average duty on

India’s electronics imports is 9% compared

to 1% in the US (fourth-fifth are zero-duty

bound), signalling a significant gap and hence

likely reciprocal action. Clarity is awaited on

how the reciprocal action might be

undertaken – based on HS codes or average

tariffs in a category or average MFN rates –

with the impact likely to be dictated

accordingly.

India’s semiconductor ecosystem is still in its

early stages and is unlikely to attract

counteraction for now. Currently, five

projects are underway, including an ATMP

(assembly testing marking and packing)

facility by US’ Micron. Moreover, players

expect India’s semiconductor manufacturing

to operate under a contract manufacturing

model owned by Western countries or

Northeast Asia, thereby minimising impact.

Conclusion

Impact on India’s growth from slower trade

activity is likely to be small as net exports

accounted for less than 3% of GDP on average

in recent years. Nonetheless, at the sectoral

level, the impact will be asymmetric as we

highlighted in the relevant section. The US is

likely to draw confidence from incremental

action in the coming months, albeit further

concessions from India will be expected. This

will be no easy feat as countries that run a

substantial deficit with the US would move to

lower or cut the tariffs on their purchases to

avoid counteraction from the US. However, that

would conflict with the Most Favoured Nation

(MFN) clause (would amount to treating

different countries differently). For now, India is

better positioned to negotiate a deal with the

new US government vs Europe and China. We

expect continuous two-way dialogue between

the two countries to counteract any one-sided

action on trade barriers. As a counterbalance,

India-UK trade talks have also resumed,

intended to strengthen trade and investment

ties.