The deceleration in gross capital formation from 32.6% of GDP in FY23 to 31.4% of GDP in FY24 is a matter of concern.

Dr. Soumya Kanti Ghosh

Group Chief Economic Adviser

State Bank of India

Mumbai, March 1, 2025: Reaffirming positive bias in country’s endeavours to bring traction to all encompassing holistic growth, India clocked 6.2% GDP growth in Q3 FY25, recovering smartly from the blip witnessed in Q2FY25, a 7-quarter low growth of 5.6%. Robust growth in Agriculture and Industry, especially manufacturing activities during the quarter ensured GVA increasing by 6.2% in Q3FY25 (5.8% in Q2FY25).

Based on the FY25 GDP growth estimate of 6.5%, Q4 GDP growth is derived at 7.6%. However, we expect there will be revision of quarterly numbers in May 2025. Also, Real GDP Growth Rate of 9.2% for 2023-24 is the highest in the previous 12 years except FY22 growth (9.7%, which is highest since independence).

Real GDP growth for FY23 and FY24 have been revised upwards by 62 bps and 104 bps, respectively as both yearly and quarterly past growth numbers have been revised. There are also large revisions in the quarterly number of FY24. The quarterly GDP growth numbers of FY24 increased by 142 bps to 9.7% in Q1, 126 bps to 9.3% in Q2, 94 bps to 9.5% in Q3 and 60 bps to 8.4% in Q4. For the current fiscal, while Q1 numbers have been revised downward by 13 bps to 6.5%, Q2 numbers stand revised upward by 22 bps to 5.6%. The upward skewness in revisions augurs well for the economic resilience, we believe.

As a corollary, due to revision in nominal GDP numbers (FY24 by 245 bps and FY25 by 16 bps), the fiscal deficit as a % of GDP will be revised in FY24 as 5.5%(11 bps) and FY25 as 4.7% (10 bps).

On a structural basis, Agriculture & Allied activities has showed a strong growth of 5.6% in Q3 FY25 led by robust Kharif crop output due to a favourable monsoon and holistic farm-allied sector synchronization that is also fortifying perennial income generation for farmers. The industrial sector too rebounded and grew by 4.5% in Q3 FY25 (3.8% in Q2 FY25), led by robust growth in Manufacturing (3.5%). While both Electricity, Gas, Water Supply & Other Utility services and mining and quarrying grew by 5.1% and 1.4% respectively, Construction activities declined to 7% in Q3 FY25. In services, both ‘Financial, Insurance, Real Estate & Professional Services’ and ‘Public Administration, Defence and Other Services’ increased by more than 7%. Overall, the sector grew by 7.4% in Q3. In FY25,services is expected to grow at 7.3%, compared to 9.0% growth in FY24.

With better policy making and proofing leakage of benefits through DBT, the per capita GDP at current prices is estimated stood at Rs 2.35 lakh in FY25, with decadal CAGR growth of 9.1% . Interestingly, in the last two fiscals, the per capita GDP has jumped by more than Rs 40,000 at current prices.

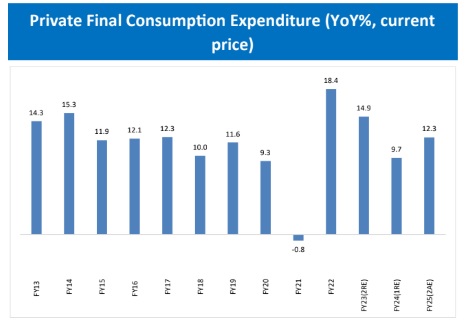

The latest annual GDP estimates and for the Q3FY25 show improvement in general demand conditions. The annual figures show that PFCE can register a real growth of 7.6% in FY25, improving from 5.6% of the previous year. Based on the itemized trends till 2024, the rise in private consumption is propelled by health expenditures, services consumption such as hotels and education. Per capita private consumption accordingly registered better growth of 6.6% from 4.6% in FY24. The capital formation is expected to register a growth of 6.1% down from 8.8% in FY24. The weakening of rupee boosted the exports growth in rupee terms at 7.1% and slowdown in capital formation and commodity prices resulted in degrowth in imports.

Due to various policy/regulatory measures, duly anchored by banks, India’s financial inclusion improved significantly and now more than 80% of adults in India have a formal financial account, compared to ~50% in 2011, improving the financialization of savings rate of Indian households. India savings rate, released today for FY24 at 30.7% of GDP, is higher than the global average of ~28.2%. The Private sector savings (largest share) exhibited slight deceleration to 28.8% in FY24 (29.6% of GDP in FY23). Among private sector, the household savings decelerated 7-year low to 18.1% of GDP in FY24 due to decline in savings in physical assets from 13.4% of GDP in FY23 to 12.8% of GDP in FY24.

The deceleration in gross capital formation from 32.6% of GDP in FY23 to 31.4% of GDP in FY24 is however a matter of concern. The private sector investment which had attained its peak of 25.8% of GDP in FY23 (since FY13) has decelerated to 24.0% of GDP in FY24. Thus, we believe, revival in private investment (particularly of private corporations) will be a major key to the future growth trajectory. Public sector investment though increased and reached to an all-time high level of 8.0% of GDP in FY24 (since FY12).

GDP GREW BY 6.2% IN Q3FY25; FY25 GROWTH IS

ESTIMATED TO BE 6.5%

As expected, India’s GDP grew by 6.2% in Q3 FY25 after a

7-quarter low growth of 5.6% in Q2FY25. GVA increased

by 6.2% in Q3FY25 from 5.8% in Q2FY25, due to robust

growth in Agriculture and Industry, especially manufac-

turing activities during the quarter.

The full year FY25 estimate is revised upward to 6.5% in

SAE from 6.4% in the FAE, which was published on 07

Jan’25.

Based on the FY25 GDP growth estimate of 6.5%, Q4

GDP growth is derived at 7.6%. However, we expect

there will be revision of quarterly numbers in May

2025.

Both yearly and quarterly past growth numbers have

been revised. Real GDP growth for FY23 and FY24 have

been revised upwards by 62 bps and 104 bps, respective-

ly. There are large revisions in the quarterly number of

FY24. The quarterly GDP growth numbers of FY24, in-

creased by 142 bps to 9.7% in Q1, 126 bps to 9.3% in Q2,

94 bps to 9.5% in Q3 and 60 bps to 8.4% in Q4. For the

current fiscal, Q1 numbers have been revised downward

by 13 bps to 6.5%, while Q2 numbers have been revised

upward by 22 bps to 5.6%.

Due to revision in nominal GDP numbers (FY24 by 245

bps and FY25 by 16 bps), the fiscal deficit as a % of GDP

will be revised in FY24 as 5.5%(11 bps) and FY25 as 4.7%

(10 bps).

Agriculture: The Agriculture & Allied activities has

showed a strong growth of 5.6% in Q3 FY25 led by ro-

bust Kharif crop output due to a favorable monsoon. For

FY25, agriculture is expected to grow by 4.6% as com-

pared to 2.7% in FY24. In the last decade, the share of

allied activities in Agriculture has increased from 35% in

FY12 (Livestock: 22%) to 46% in FY24(Livestock: 31%).

Industry: The industrial sector rebounded and grew by

4.5% in Q3 FY25 compared to 3.8% in Q2 FY25, led by

robust growth in Manufacturing, which grew by 3.5% in

Q3. While both Electricity, Gas, Water Supply & Other

Utility services and mining and quarrying grew by 5.1%

and 1.4%b respectively. Construction activities declined

to 7% in Q3 FY25. On annual basis, Industry is estimated

to grow at 5.6% in FY25, compared to last year growth of

10.8%.

Services: In services, both ‘Financial, Insurance, Real

Estate & Professional Services’ and ‘Public Administra-

tion, Defence and Other Services’ increased by more

than 7%. Overall, the sector grew by 7.4% in Q3. In

FY25,services is expected to grow at 7.3%, compared to

9.0% growth in FY24.

Annually, GDP deflator exhibited huge deceleration

from 5.9% in FY23 to 2.6% in FY24. While in Q3 GDP

deflator increased mildly to 3.7% as compared to 3.5%

in Q2 FY24. So, the full year FY25, GDP deflator is esti-

mated to be 3.2%.

With the Government's efforts to ensure quality of life

for all citizens and stopped leakage of benefits through

DBT, the per capita GDP at current prices stood at Rs

2.35 lakh in FY25, with decadal CAGR growth of 9.1%.

In constant prices too per capita GDP has increased to

Rs 1.33 lakh in FY25. In the last two fiscals, the per cap-

ita GDP jumped by more than Rs 40,000 at current

prices.

GENERAL DEMAND AND EXPENDITURE TRENDS

The latest annual GDP estimates and for the Q3FY25

show improvement in general demand conditions. The

annual figures show that private final consumption

expenditure can register a real growth of 7.6% in

FY25, improving from 5.6% the previous year. Based

on the itemized trends till 2024, the rise in private con-

sumption is propelled by health expenditures, services

consumption such a hotels and education. Per capita

private consumption accordingly registered better

growth of 6.6% from 4.6% in FY24.

The government final expenditure growth has deceler-

ated in line with fiscal consolidation path of the gov-

ernment. The real growth of government expenditure

is expected to settle at 3.8% down from 8.1% in FY24.

The capital formation is expected to register a growth

of 6.1% down from 8.8% in FY24. The valuables have

seen a sharp slowdown in growth in FY25, falling by

13.4% to 1% in FY25.

The weakening of rupee boosted the exports growth in

rupee terms at 7.1% and slowdown in capital for-

mation and commodity prices resulted in degrowth in

imports.

The quarterly movement in the expenditure heads till

Q3 FY25 show no noticeable deviations from the se-

quential trends in previous two quarters. Better rural

income on account of growth in agriculture value add-

ed is expected to keep the demand impulses strong for

Q4 FY25. A revival in manufacturing can further give

boost to domestic consumption.

TRENDS IN GROSS SAVINGS & GROSS CAPITAL

FORMATION

Gross Savings

Due to various measures, India’s financial inclusion

improved significantly and now more than 80% of

adults in India have a formal financial account, com-

pared to ~50% in 2011, which is improving the finan-

cialization of savings rate of Indian households.

India savings rate, released today for FY24 at 30.7%

of GDP, is higher than the global average of ~28.2%.

The Private sector savings (largest share) exhibited

slight deceleration to 28.8% in FY24 (29.6% of GDP in

FY23). Among private sector, the household savings

decelerated 7-year low to 18.1% of GDP in FY24 due

to decline in savings in physical assets from 13.4% of

GDP in FY23 to 12.8% of GDP in FY24.

General Government savings which has been on con-

sistent decline is still in negative zone. Public Sector

Savings is hovering around 3.0% of GDP.

Gross Capital Formation (Investment)

The deceleration in gross capital formation from

32.6% of GDP in FY23 to 31.4% of GDP in FY24 is a

matter of concern. The private sector investment

which had attained its peak of 25.8% of GDP in FY23

(since FY13) is decelerated sharply to 24.0% of GDP

in FY24. Thus, we believe, revival in private invest-

ment (particularly of private corporations) will be a

major key to the future growth trajectory.

However, both public and Government investment

exhibited growth in FY24 as compared to FY23. Even,

public sector investment reached to an all-time high

level of 8.0% of GDP in FY24 (since FY12).

For FY25, given the current trends, we estimated

both savings and investment to increase to 31% and

32% of GDP, respectively.

CREDIT GROWTH CONTINUED IN Q4

As per the fortnightly data of SCBs, credit continued

to grow upward. For the fortnight ended 07 Feb,

SCBs credit incrementally grew by Rs 1.5 trillion. The

sector-wise credit growth indicates, growth is pick-

ing up in all sectors, especially in industry.