The Fed, BoE, ECB and BoJ are scheduled to meet this week, but no rate action is expected

Dipanwita Mazumdar

Economist,

Bank of Baroda

FinTech BizNews Service

Mumbai, December 12, 2023: Markets remained broadly cautious refraining from holding any strong positions before a plethora of central bank policy meetings and also awaiting CPI data releases of major economies such as US, Germany and India. In the US, CPI is expected to post a flat reading sequentially, as per estimates. However, some sequential momentum might be observed on core inflation, as the growth picture is still uncertain. New York Fed’s 1Yr inflation expectations on the other hand has softened. Elsewhere in UK, property asking prices have fallen beyond usual trends, signalling some correction. In Japan, moderation in price pressure continued as reflected in its PPI reading. On domestic front, any upside surprise to inflation reading might be uncomfortable for markets especially wrt. the direction of yields.

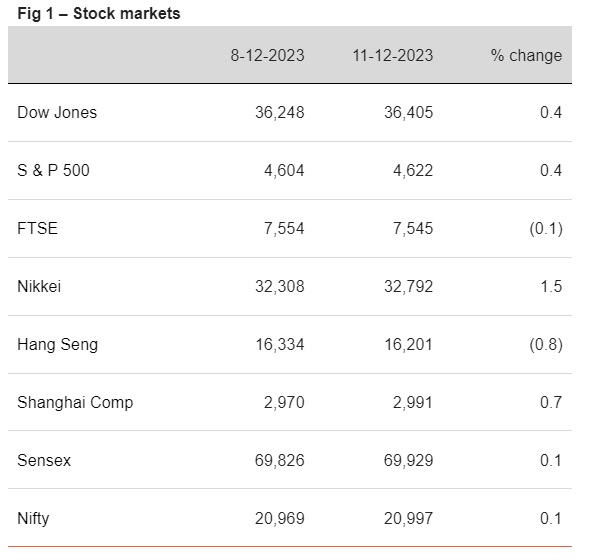

§ Barring FTSE and Hang Seng, other global stocks edged up. Investors await US CPI data as well as key central bank decisions. Nikkei surged the most by 1.5%, tracking a fall in yen. US stocks ended higher as NY Fed survey indicated a softening in consumers’ inflation expectations. Domestic stocks ended 0.1% higher. Real estate and capital goods stocks registered the maximum increase. It is trading higher today, in line with other Asian markets.

§ Except JPY, other global currencies traded in thin ranges ahead of key central bank meetings. The Fed, BoE, ECB and BoJ are scheduled to meet this week, but no rate action is expected. News reports quashed the possibility of any possible tweak in BoJ’s ultra-loose monetary policy, which weighed on JPY. INR is trading stronger today, in line with other Asian currencies.

§ Global yields closed mixed looking for fresh cues in upcoming policies of major central banks. Only UK’s 10Y yield has risen by 4bps amidst reports that some hawkish tone might be hinted in the upcoming policy. China’s 10Y yield fell by 2bps amidst expectation of stimulus in the CEWC meeting. India’s 10Y yield rose a tad by 1bps and is trading at 7.28% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)