Rupee touched its record low level in last few days of the 1st fortnight of Sep’24 (83.98/$), at a time when US$ was showing some signs of strengthening

Sonal Badhan,

Economist,

Bank of Baroda

Mumbai, September 17, 2024: The Economics Research Department of Bank of Baroda has come out with the currency update.

Currency update

INR was broadly stable as it was down by only 0.03% in the first fortnight of Sep’24, following 0.2%

decline in Aug’24, to currently trade at 83.90/$, bouncing back from its lifetime low of 83.98/$. In the

1st week of Sep’24, US$ dollar fell more sharply than in the 2nd week. US macro data is providing a

mixed picture of the economy, with headline CPI tracking the expected path, but core CPI springing an

upside surprise. Labour market is also so far signalling a moderate slowdown. This has kept the

investors guessing the quantum of Fed rate cut in the meeting later this week. Towards the end of the

fortnight, market participants revived their bets on a supersized rate cut (50bps) by Fed in Sep’24, thus

leading to revival in weakness of US$. As a result, INR traded in the range of 83.90-83.98/$. Its

performance was helped by robust FPI inflows (both equity and debt segment) and steep decline in oil

prices (MoM basis). Continued dollar demand by importers offset any significant gains made by the

currency. In the next fortnight, we expect movement in INR to remain range bound. Domestic currency

is expected to benefit from renewed FPI inflows and weak oil prices. However, any hawkish surprise in

the tone of Fed’s policy statement may support the US$. Further, any escalation in geo-political

tensions in the Middle East will also impact oil prices and also increase the demand for safe haven

currencies, thus adversely impacting INR. We thus expect INR to trade in the range of 83.8-83.9/$.

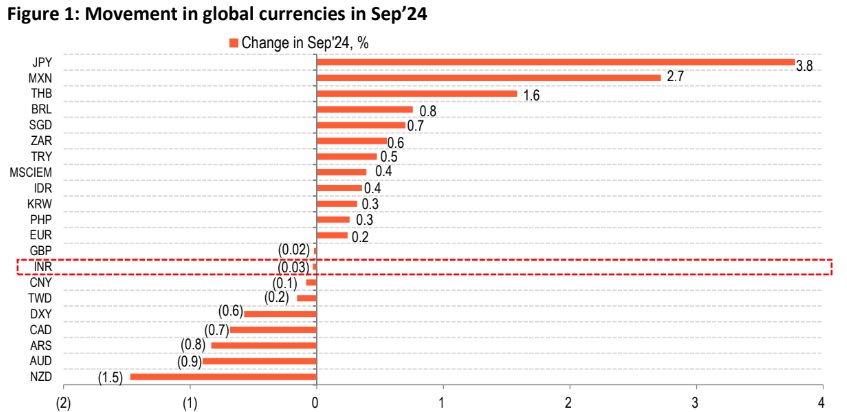

Movement in global currencies in Sep’24

In the first fortnight of Sep’24, major global currencies continued to appreciate against the dollar. The

movement in global currencies was led by ongoing weakness in dollar. DXY index, measuring the

dollar’s value against a basket of currencies was 0.6% lower in Sep’24 so far (till 13 Sep), following

2.3% decline in Aug’24. While DXY index fell by (-) 0.5% in the 1st week, it regained some ground in the

early part of 2nd week but closed the week (-) 0.1% lower. This was due to revival in dollar weakness,

as analysts expect that a possibility of 50bps rate cut by Fed in Sep’24 meeting still remains. Earlier in

the month, US reported mixed macro data points. On one hand, headline CPI has come in line with

market expectations (0.2% in Aug’24 unchanged from last month), initial jobless claims were seen

rising (230k for week ending 7 Sep versus 228k), and non-farm payrolls rose (142k in Aug’24) much

less than expected (165k). On the other hand, core CPI sprung a surprise and rose by 0.3% (est.: 0.2%)

and even headline PPI inched up (0.2% versus 0.1%). These developments have kept the markets

largely guessing whether Fed will opt for a 25bps or 50bps cut in the meeting later this week. First

Presidential debate between Harris and Trump also played on investor sentiments. Amongst the major

currencies, JPY has made most significant gains. There are two keys reasons for this. One, the policy

divergence between Fed and BoJ continues and second, investors are also holding it as a safe haven,

ahead of US presidential elections in Nov’24 and awaiting cues on Fed’s rate cut trajectory. Apart from

JPY, MSCI-EM index and EUR also gained, while GBP slipped. Weakening economic outlook

(unexpected decline in monthly GDP estimate for Jul’24) has worried the investors.

Performance of rupee

In contrast to most global currencies which rose against the dollar, INR was broadly stable. In the first

fortnight of Sep’24 it was down by only (-) 0.03% compared with (-) 0.2% decline seen in Aug’24,

hovering at 83.9/$, bouncing back from its lifetime low of 83.98/$. However, INR’s performance

remains in contrast to the performance of MSCI EM index, which gained 0.4% (+2% in Aug’24) due to

dip in DXY index. Notably, amongst the set of 8 currencies, which fell against the US$, it fell the least

along with GBP. New Zealand Dollar (-1.5%) and Australian Dollar (-0.9%) fell the most. Signs of

economic slowdown in China have impacted commodity prices and hence the currencies of

commodity exporters like New Zealand and Australia. INR has managed to hold ground in Sep’24 so

far, supported by robust FPI inflows (US$ 3.3bn in equity segment alone versus US$ 873mn in Aug’24)

and moderation in oil prices(-9.1% decline in Sep’24 MoM basis). However, continuous dollar demand

by importers has offset the gains made, resulting in broadly steady rupee value.

Outlook

Rupee touched its record low level in last few days of the 1st fortnight of Sep’24 (83.98/$), at a time

when US$ was showing some signs of strengthening. However, as dollar began falling once again,

following revival in hopes of 50bps rate cut by Fed in the meeting later this week, INR bounced back.

In the next fortnight, we believe, that movement in INR is expected to remain range bound. The factors

that will continue to support the domestic currency include: weakness in international oil prices and

higher FPI inflows. However, downside pressure may arise if Fed springs a surprise in its next policy

meeting or the tone of the policy is less dovish than expected. Any escalation in geo-political tensions

in the Middle East will also increase upside risks to oil prices and demand for safe haven currencies,

thus adding pressure on INR. On balance, we expect INR to trade the range of 83.8-83.9/$ in the next

fortnight.