Japan's economy slipped in to recession after unexpected contraction of 0.4% in Q4CY23 was noted (-3.3% in Q3CY23)

Jahnavi Prabhakar,

Economist,

Bank of Baroda

Mumbai, February 15, 2024: The recently released macro data has pushed back the rate cut expectations by Fed from as early as Mar’24 to Jun’24. Chicago Fed’s President Goolsbee noted Fed will remain on path of achieving 2% target even if the prices increase a bit more than expected in the coming months. Additionally, Fed Vice Chair Barr stated the path to achieve the target might be a ‘bumpy one’ and it is too early to talk about whether the ‘economy will end up with soft landing or not’. Separately, Japan’s economy slipped in to recession after unexpected contraction of 0.4% in Q4CY23 was noted (-3.3% in Q3CY23). This was on account of dip in private consumption which has major share (-0.2% versus estimate of 0.1%). Given this weaker than expected print, investors see the possibility of any rate hike might not be justified in the near term. With this, Germany becomes the third largest economy as Japan slips to 4th position.

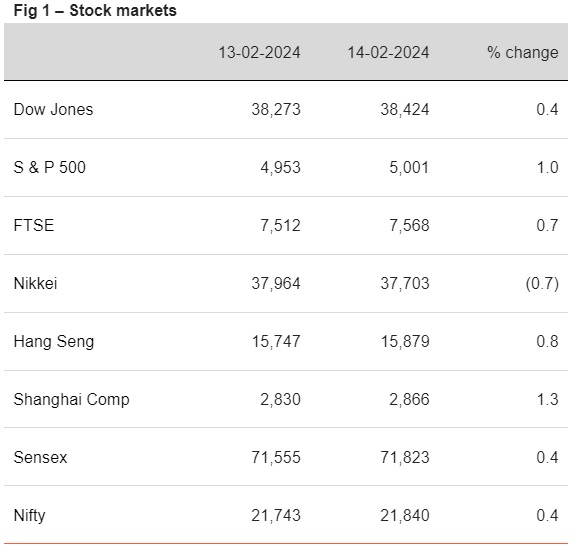

Barring Nikkei, other global indices closed lower. US indices rebounded as investors monitored earnings, supported by gains in stocks of ride-hailing platform. US markets are now amongst the 3rd most valuable globally. Sensex (0.7%) lifted up, led by sharp gains in oil & gas and power stocks. It is trading higher today, in line with other Asian stocks.

Global currencies closed mixed against the dollar, with EUR and JPY gaining and GBP declining. DXY fell by 0.2%, awaiting remarks from Fed officials and awaiting retail sales data. INR ended flat, despite dip in international oil prices. However, it is trading higher today, in line with other Asian currencies.

Barring yields in Asia (higher), other global 10Y yields ended lower. 10Y yield in UK fell the most. Lower than expected CPI print in the UK has refuelled hopes of an early rate cut by BoE. Investors in the US also await comments from Fed officials for guidance on rates. India’s 10Y yield was up by 1bps. However, following global cues, it is trading lower today at 7.0%.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)