As at June 30, 2025, GNPA was 1.48% & NNPA was 0.34% (GNPA was 1.39% & NNPA was 0.35% at June 30, 2024). As at June 30, 2025, Provision Coverage Ratio stood at 77%.

FinTech BizNews Service

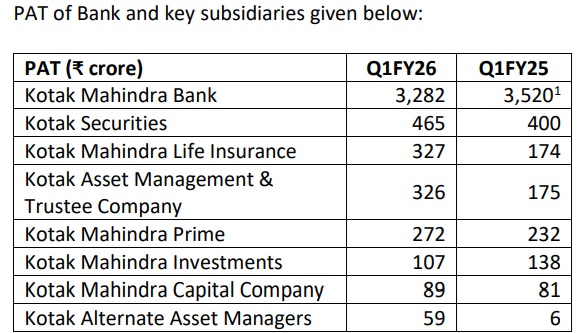

Mumbai, July 26, 2025: The Board of Directors of Kotak Mahindra Bank (“the Bank”) approved the unaudited standalone and consolidated results for the quarter ended June 30, 2025, at the Board meeting held in Mumbai, today. Consolidated results at a glance Consolidated PAT for Q1FY26 increased to Rs 4,472 crore, up 1% YoY from Rs 4,435 crore in Q1FY25 (excluding gain of KGI divestment in Q1FY25).

Consolidated Customer Assets, which comprises Advances (incl. IBPC & BRDS) and Credit Substitutes grew to Rs 557,369 crore as at June 30, 2025, up 13% YoY from Rs 494,105 crore as at June 30, 2024. Total Assets Under Management as at June 30, 2025 grew to Rs 750,143 crore , up 18% YoY from Rs 636,311 crore as at June 30, 2024. The Domestic MF Equity AUM increased by 22% YoY to Rs 357,323 crore as at June 30, 2025.

Consolidated Networth as at June 30, 2025 was Rs 164,903 crore. The Book Value per Share increased to Rs 829 as at June 30, 2025, up 17% YoY from Rs 710 as at June 30, 2024. At the consolidated level, Return on Assets (ROA) for Q1FY26 (annualized) was 2.03%. Return on Equity (ROE) for Q1FY26 (annualized) was 11.13%. Consolidated Capital Adequacy Ratio as per Basel III as at June 30, 2025 was 23.7% and CET I ratio was 22.7% (including unaudited profits). Average Liquidity Coverage Ratio stood at 138% for Q1FY26.

Average advances (incl. IBPC & BRDS) for Q1FY26 grew at 14% YoY. Net Advances increased 14% YoY to Rs 444,823 crore as at June 30, 2025 from Rs 389,957 crore as at June 30, 2024. Unsecured retail advances (incl. retail microcredit) as a % of net advances stood at 9.7% as at June 30, 2025.

Average Total Deposits grew to Rs 491,998 crore for Q1FY26, up 13% YoY from Rs 435,603 crore for Q1FY25. Average Current Deposits grew to Rs 67,809 crore for Q1FY26, up 9% YoY from Rs 62,200 crore for Q1FY25. Average Savings Deposits grew to Rs 124,186 crore for Q1FY26, up 2% YoY from Rs 122,105 crore for Q1FY25. Average Term Deposits grew to Rs 300,003 crore for Q1FY26, up 19% YoY from Rs 251,298 crore for Q1FY25. CASA ratio as at June 30, 2025 stood at 40.9%. TD sweep balance grew 23% YoY to Rs 59,098 crore. Cost of funds was 5.01% at Q1FY26. Credit to Deposit ratio as at June 30, 2025 stood at 86.7%.

Customers as on June 30, 2025 were 5.4 crore (5.1 crore as on June 30, 2024). Net Interest Income (NII) for Q1FY26 increased to Rs 7,259 crore, up 6% YoY from Rs 6,842 crore in Q1FY25. Net Interest Margin (NIM) was 4.65% for Q1FY26. Fees and services for Q1FY26 stood at Rs 2,249 crore (Rs 2,240 crore in Q1FY25).

Operating profit for Q1FY26 increased to Rs 5,564 crore, up 6% YoY from Rs 5,254 crore in Q1FY25. The Bank’s PAT for Q1FY26 stood at Rs 3,282 crore (Rs 3,520 crore in Q1FY25 excluding gain of KGI divestment).

As at June 30, 2025, GNPA was 1.48% & NNPA was 0.34% (GNPA was 1.39% & NNPA was 0.35% at June 30, 2024). As at June 30, 2025, Provision Coverage Ratio stood at 77%. Standalone Return on Assets (ROA) for Q1FY26 (annualized) was 1.94%. Return on Equity (ROE) for Q1FY26 (annualized) was 10.94%. Capital Adequacy Ratio of the Bank, as per Basel III, as at June 30, 2025 was 23.0% and CET1 ratio of 21.8% (including unaudited profits)