5 Options before RBI

Dr. Soumya Kanti Ghosh

Group Chief Economic Adviser

State Bank of India,

Mumbai, January 14, 2025: Well defended by RBI against manic volatilities post pandemic, Rupee seems poised to move beyond the present pains once the cacophony impacting EM currencies dies in coming months as it readjusts to its neutral levels....

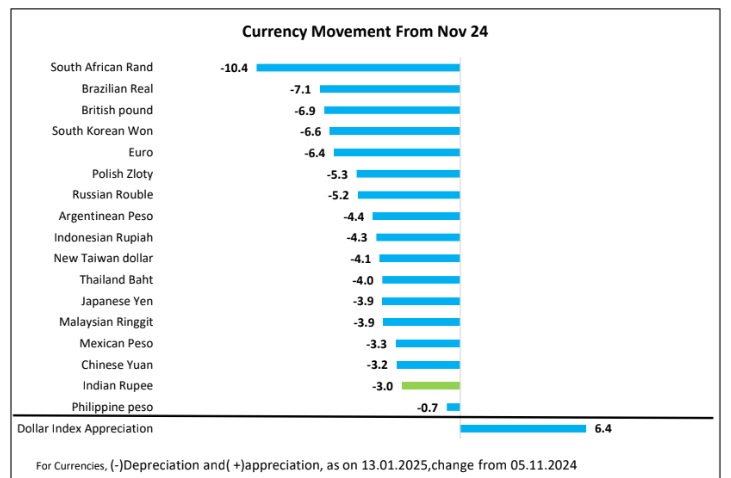

Rupee weakening since Nov’24 is still at almost the lowest end of spectrum....

❑ Despite the episodes of volatility in international foreign currency markets and the strengthening of the US dollar relative to other currencies, the domestic foreign exchange market has stayed steady in the H1, buoyed by capital inflows following the inclusion of Indian bond in global bond indices

❑ However, INR began to weaken in H2 due to capital outflows and further the US President-elect Trump in Nov led to the dollar strengthening against almost all currencies around the world beginning Nov’24. Till date, rupee has depreciated by 3% against US dollar, still in lowest echelon when compared with other countries...

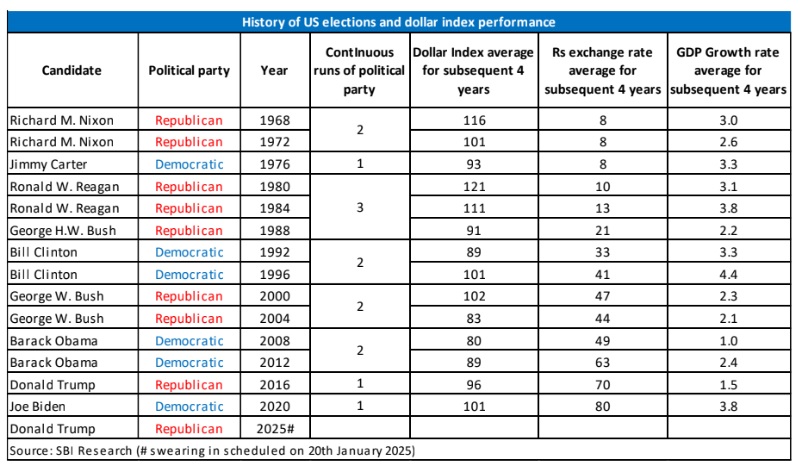

.....Contrary to market perceptions, Rs seems more susceptible in a Non Trump regime/

Democratic regime...Until now we have been bracing for a Trump Tantrum..

❑ Glancing back at the US presidency through the Nixon years, rupee appears more stable during the Republican regimes as against its performance through the Democratic occupants at the Oval office...however, the volatility in near term is nowhere reminiscent of the heydays of Taper Tantrum, forcing us to believe that Trump Tantrum for INR will be a short-term phenomenon and home currency should adjust post the initial shock of early days of presidency.

The movements in Rupee has also been influenced by an almost managed Yuan, the renminbi has been instrumental in currency war of mainland hitherto!

CNY has broken its long term trendline resistance, implying a likely severe downward adjustment in an uncharted territory... the ripple effect could be far and wider for EM currencies given the aggressive push on internationalization of renminbi in recent years and trade dependence on it.

Since early Nov’24, the steep fall in CNY has been exacerbated by the ‘real’ pricing of impeding adverse policy implications....

China remains the elephant in the room, from a pure currency and trade perspective!

Rupee weakening and strengthening of Dollar Index has been nearly synchronous

❑ Ideally, a substantial weakening of Rupee vis-à-vis strengthening of Dollar Index should indicate that the movements in the value of the rupee is more dictated by weak macro fundamentals

• Feb 2012 till May 14 when the Dollar Index appreciated on an average 0.7%, at a minimal level, but the depreciation of rupee on an average was much as 17%

❑ In the most recent period since Mar’21, the movements in Rupee and Dollar Index has been mostly synchronous (17.5% depreciation for Rupee and 17.9% appreciation of Dollar Index)

❑ The analysis of duration indicates that on an average while the period of appreciation last for 11 months, the period of depreciation last for 14 months

Using Markov Regime Switching reveals that a steady depreciation bias in the value of rupee has crept in since August 2022 when the rupee crossed 80 against $...

❑ We have used the Markov regime-switching model to understand the structural shifts in Rupee-Dollar exchange rate

❑ The Markov regime-switching model is a popular type of regime-switching model which assumes that unobserved regimes are determined by an underlying stochastic process known as a Markov-chain

❑ A key characteristic of a Markov-chain is the estimation of transition probabilities.

The transition probabilities describe the likelihood that the current regime stays the same or has changed

❑ We have run the Markov regime-switching model for Rupee-Dollar exchange rate from July’18 to Dec’25 (monthly data). Our results indicate that:

• Regime 2, which is the current regime, has average exchange rate of 82.3 per dollar with 98.1% probability of remaining in the same regime

• The current regime of high exchange rate is expected to remain for 23 additional months (after Jan’2025) i.e. till Dec’2026

Predicted Probabilities of Exchange Rate remaining in regime 2

❑ We also predict the probability of being in the various regimes. We have only two regimes, and thus the probability of being in (say) regime 1 / regime 2 tells us the probability for both regimes

❑ Our predicted probability juxtaposed against Rupee-Dollar exchange rate indicates -

▪ In Aug’22, there was a regime switch from low exchange rate to high exchange rate in terms of jump in probability and it has continued to remain so in the upper regime for the next few years

Around two-thirds of ECBs remain hedged...thus gyrations in rupee value has more to do with Dollar Index..

❑ Around two-thirds of ECBs remain hedged as of Sep-24 (as compared to 55% hedged two years back)

❑ Among the unhedged part while some portion is guaranteed by the Government of India and a portion of the unhedged ECBs retain natural hedges where the borrower’s earnings are in foreign currency (1.5% as of Sep-24)

What the current turnover in FX market indicate?

❑ Indian rupee has remained under pressure from the strong US dollar and foreign portfolio investors (FPIs) outflows and hence RBI has intervened in the exchange rate market.

❑ During Oct/Nov 2024 the spot excess demand in merchant category is one of the highest in the last few years. The combined excess demand in spot merchant was $28.7 billion during Oct/Nov months

❑ The same valid for forward merchant market, where the excess demand was $34.5 billion the Oct-Nov months. The combined excess demand in merchant market was $63.2 billion, which was unprecedented and sought timely intervention

❑ Regular intervention by the central bank on both sides by selling the dollar to prevent sharp depreciation and on some days buying the dollar when the rupee is appreciating has helped the rupee remain less volatile through the year

Intervention in FX market by RBI has resulted in drawdown of liquidity.....

❑ The RBI, in its annual report for 2023-24, said the central bank has plans to enhance intervention toolkit to undertake focused foreign exchange operations to curb undue volatility in the USD/INR exchange rate

❑ From an all-time high FX reserves level of $705 billion in September, the latest number stands at $635 billion, a rundown of $70 billion in three months

❑ A rough estimate indicates that if RBI had not intervened in the market, rupee may possibly have depreciated by 4% and the rupee could have closer to 88/$ as the minimum threshold level...

....However Government cash balances has been an elephant in the room....

Impact on Banking System Liquidity Apr'24- Dec'24(Rs Bn)

Autonomous factors

Increase in Currency leads to decrease in liquidity 494↓

Drawdown of GoI cash balances with RBI through auction leads to increase in liquidity 158↓

Forex Purchase leads to increase in liquidity (70)↓

Policy driven (Discretionary) factors

OMO Purchase leads to increase in liquidity (240)↓

Drawdown of Excess reserves leads to increase in liquidity 678↓

RBI, Increase (↑); Decrease (↓)

Liquidity Management FY25

❑ The system liquidity remains tight due to tax outflows, increase in currency in circulation, forex market intervention and volatility in capital flows. Further with the implementation of Just in Time (JIT), the system liquidity has been impacted....

....Government cash balance and WMA proxy to structural liquidity...volatility in Govt cash balances is also posing significant problems to structural liquidity management

❑ In the current FY, Govt cash balance was at the peak of Rs 5.03 lakh crore on 21 June’2024, which has subsequently declined to Rs 15,773 crore on 06 Dec’2024

❑ However, due to the advance tax flows, the Govt cash balances has increased to Rs 2.69 lakh crore as on 10 Jan 2025

❑ With Govt cash balances turning to negative in April 2023, Govt resorted to WMA of Rs 2.89 lakh crore.... After a gap of nearly 1.6 years, Government again resorted to WMA of Rs 11,973 crore on 15 Nov 2024 and Rs 11292 crore on 06 Dec24

❑ This alternating shift from positive Government cash balance to resorting to WMA and thereafter again a positive balance is posing significant problems in structural liquidity management....in addition to intervention in forex market...

Spikes in forwards premium and NDF are temporary

❑ The forward premiums have been on the higher side for most part of December and January till now, which can be attributed to following factors:

• Depreciative Bias: The currency has been on a controlled depreciating streak for now, however the anticipation of continued depreciation has led the forward premia higher across the curve

• Domestic Liquidity Scenario: System liquidity has largely been in negative during most part of the months of December and January barring the first week of January where salary credits had led to some respite. RBI is conducting regular Variable Rate Repos (VRRs) to inject liquidity in the system; However, the INR requirement is compelling the market to do Sell Buy USDINR Swaps in the overnight market leading to a rise in forward premia

• Forward Curve Inversion: The near-term depreciative bias in USDINR has led to inversion in the forward curve till 1Y as the near month rates are currently trading in the range of 3.10% to 3.55% on annualized basis, however the 1Y forward is currently trading at 2.71%. This leads to overall shift in the curve towards higher side

• Higher Dollar Holdings: Banks are holding large amount of Dollars in their NOSTRO accounts, that can be attributed to huge decline in Dollar Holdings of the Reserve Bank of India. These holdings compel the banks to conduct Sell Buy USD INR swaps in the near term, leading to higher forward premia.

Cutting a rather long story short, the spell of pains with rupee appear to be a knee jerk reaction, pricing in the uncertainties as tensions mount between geographies and should abate soon with India’s sound macro-economic outlook.....

Spikes in forwards premium and NDF are temporary. The Central Bank has been judiciously engaging in near maturity Forwards that are not a significant part of its reserves....

Options before RBI

Option 1 :....RBI needs to inject liquidity via forex swaps amid crunch

❑ Rupee forward points surged to a level unseen since early 2021. Meanwhile, the one-year

implied forward yields on the rupee hovered near two-year highs, reflecting high costs of

guarding against rupee volatility.

❑ To manage liquidity, the RBI can also intervene in the forward markets through sell buy

swaps where the RBI sells the dollars now to buy it back at a future date and paying a

premium. Intervention in forward market is an important aspect of maintaining financial

stability, although the move has been gradual

❑ The swaps would entail the RBI purchasing dollars from banks against the rupee while

contracting to sell the greenback at a future date. When the central bank buys dollars, it

injects an equivalent quantum of rupee liquidity

❑ Such operations would be expected to bring down elevated funding costs. And by acquiring

dollars over the first leg of the swap, the central bank would bolster its foreign-exchange

reserves, which have dropped to a seven-month low amid interventions to shield the rupee

from excess volatility.

❑ The last time the RBI carried out such a long-term swap was in April 2019 for a tenure of

three years and an amount of $5 billion. Already initiated $ 3 bn swap

❑ Interestingly, going by John Sparos (1959) the best way to fight currency speculation is to

deliberately let the forward premia rise to unreasonable levels and thereby penalise the

currency speculators as their exchange rate expectations about a depreciating domestic

currency are belied

Option 2: NDF needs more data segregation

The offshore NDF markets, long restricted to London, HK, Singapore and US has seen substantial shift to onshore (post-2022) thanks largely to concerted efforts by the RBI

❑ NDFs, due to their very nature are traded across the multiple geographies and encompass many types of products like exchange traded F&O, forwards, structured products etc. CCIL has been providing both Interbank and Client NDF data since 2022. The regulator can look at disseminating the information and trends at periodic levels to ensure the big banks of the world, acting as market makers in NDF, do not step over the boundaries

Quarterly BIS review in Dec’19 titled ‘Offshore markets drive trading of emerging market

currencies’ conclude that...

• FX markets for the currencies of emerging market economies grew more rapidly than those for major currencies between 2016 and 2019, rising from 19% to almost 25% of global turnover. At the same time, these currencies attracted a wider range of participants and saw a rapid increase in offshore trading activity

• Global demand for emerging market assets and the electronification of trading drove recent growth.

• During times of FX market stress, offshore markets for EME currencies tend to drive onshore prices

Option 3: Attracting Non-Resident Deposits through a CRR cut on such products can be a stealth weapon in fight against volatility!

Non-resident deposits have cumulatively grown at a tepid pace in the past decade, with incremental flows accumulated in FCNR(B) during Taper Tantrum (2013-14) imbibing diversion later though there has been a trend reversal post March’23... Interest rate disparity between US and India, as also liquidity gush expected in developed markets, can lead to incremental flows now and the regulator will do well to sweeten the deal for both investors, as also Banks, doing away with CRR provisions FIRST on these deposits en masse that would facilitate release around Rs 50-55,000 cr in the system...

Option 4: CRR may be brought down to 3%, that was prevailing in March 2020, this will boost money multiplier and hence monetary aggregates

❑ The next couple of years will be the biggest challenge for the RBI liquidity management to take care of an estimated Rs 7.5 trillion fund flow through IFMIS. Thus, we strongly recommend that CRR may be brought down to 3% , that was prevailing in March 2020. This could release an additional Rs 2.32 trillion in the banking system

❑ Further, the reduction in CRR may not mathematically translate to any change in deposits and lending rates, however, it may have positive impact on margins of the banks. The CRR cut will reduce the M0 so the money multiplier will increase and it will have a positive impact on M3

❑ With the new business models and evolving digital technology, growth in money supply has been

endogenous ...money multiplier is now more a function of behavioral aspects notably in an inflation

targeting regime.... systemic liquidity becomes the more relevant metric than reserve money for

achieving the specified short-term rate.....

Option 5: Alternate options for managing exchange rate volatility

❑ The recent sharp depreciation in rupee has also brought to light the need for better mechanism for managing rupee volatility in the spot

❑ Currently RBI has many options at its disposal which it uses in combination

• Direct intervention in spots

• Off balance sheet forward transitions

• Engaging in FX swaps

❑ At the time of taper tantrum RBI has also used the exceptional measure of directly selling to OMC they by managing the demand in interbank FX market

❑ One of the drawbacks of the existing mechanisms is that it either impacts the money supply or affect the RBIs income

• M3 slowdown is influenced by reduction net FX assets of RBI

❑ Another option that RBI may explore is to write an option to lend its FX reserve to major FX buyers such as OMC at time of stress when USD/INR crosses stress threshold

• Issue foreign exchange liquidity option??

Interestingly.....the Greenback has been losing the Dominance in Global Fx reserves at a stretch!

Greenback’s loss has come at the cost of gains in JPY, CNY, Euro, CAD etc....

Rip Van Winkle.... in a hallucinated state of sleep induced haze!

Rip Van Winkle, the protagonist of Washington Irving’s short story “Rip Van Winkle” is a native Dutch-American, often at loggerheads with his estranged wife,

over time having inculcated a rewarding habit of avoiding useful works. Wandering to Catskill mountains (at the periphery of New York then) one day, accompanied by his dog, Wolf, he hears someone calling his name and meets an old-fashioned man carrying a keg, whom Van Winkle duly assists in carrying the load uphill to a cleft. Once inside, Van Winkle discovers a thunderous party underway.....

Van Winkle duly helps himself with free alcohol flowing from the flagon that he helped carry all the way to the mysterious cave. Filled to the brim, he loses consciousness soon and falls asleep

He awakens a good 20 years later to find the world completely changed, quite unaware of the tectonic event that took place while he was in a lucid state of sleep;

The American Revolution in 1770s. Strolling back in the village, that has changed much to his amusement, he declares himself a loyal subject of King George III, a faux pas akin to treason in a free Americas. With a stroke of luck, Rip Van Winkle, being an adaptable type, soon settles into this new, transformed world – thanks in part to the support of his children, and extended family, little missing his spouse though

Some Rip Van Winkles back home, questioning with an intensifying curiosity (sans innocence) the central dogma and future trajectory of RBI’s calibrated strategy post pandemic to manage the Impossible Trilemma, in particular the exchange rate, are not that adaptable, still in somewhat a state of flux to fully grasp the changed realities where select EMs are posing a formidable challenge to DMs due to their demographic dividends, technological marvels and public centric explosion in Phy-gital / social infrastructure that is fast bridging the digital divides. Central banking has also changed fast, as have been the Capital markets during the intermittent period posing diverse interwoven loops of challenges to regulators.

While the overarching objectives remain the same – price and financial stability – the means to achieve them have evolved in response to shocks such as First, the Great Financial Crisis and later, the Covid19 pandemic / geopolitical aggression, and divergence in the economic and financial structure while old foes remain or have re-appeared – such as the surge in inflation/regional conflicts– and new ones have come on scene – just think of digitalization (source: BIS’2023)

Rip Van Winkles would do well to understand that the sole purpose of RBI intervention all through the years has been mitigation of intense, speculation led propagated volatilities that act as blood for the speculating sharks, attracting global players with financial muscles at scale to profit from the free falling currency through offshore induced financially engineered products... Rupee has been allowed to depreciate against the Greenback in a calibrated manner and has lost ~20% of value since mid-21 but has not gyrated or tangoed like many other currencies left on their own......There lies the wisdom and forbearance of RBI