The rally last year was far stronger in mid- and small-cap companies

Tirthankar Patnaik, PhD

Chief Economist

National Stock Exchange of India Limited (NSE)

Mumbai, January 30, 2024: In the monthly publication issued by the Economic Policy and Research (EPR) department of the National Stock Exchange of India, titled Market Pulse, a review of major developments in the economy and financial markets for the month gone by, is undertaken.

January effect…as January goes, so does the year?

The so-called ‘January effect’ is a well-known adage on the behaviour of the equity markets around the new year. Investors in the US were found to book capital gains/losses in their financial (calendar) year, buying in the new year, leading to a favourable January. This oft-repeated adage about markets was based on the performance of the US market in the ‘1920s and has been much tested. Over the years, the phenomenon has been seen enough to be recognised as an anomaly. For instance, data since the 50s for the US and Japanese markets shows that January’s performance matches with the year nearly 70% of times. However, the evidence is unclear in recent decades. Indian markets have a different financial year, so the ideal metric would be to test if performance in April matches with the fiscal. January’s return matches with the year 45% of times since in last four decades but shift to April and the percentage rises to 64%. Here again, the evidence is inconclusive—just 39% since 2000.

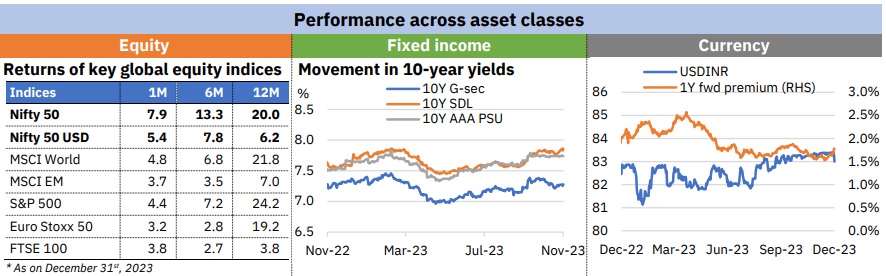

Favourable For Global Markets

The ‘January effect’ is not really an anomaly for now. After a solid 2023, January has otherwise been favourable for global markets, with US markets at record levels, on a decent earnings season. Rate cut hopes from central banks have driven sentiments in the last two months, but appear receding with Fed commentary, while the ECB might deign in summer. Inflation, their main cause of worry seems to be receding gradually worldwide, with minor exceptions. For Japanese markets, January this year has seen levels unseen since January 1990 (Yes). From an annual perspective, global equities ended the year 2023 on a high note, as expectations of rate cuts coming through sooner than previously expected in the light of easing inflation and emerging signs of economic slowdown buoyed investor sentiments. Developed equities (MSCI World Index) ended the year 2023 with a gain of 21.8%, almost entirely reversing the loss in the previous year. Emerging equities also caught up in the latter part of the year and registered a gain of 7% in 2023, weighed down by lacklustre performance of Chinese equities. Global debt also rallied sharply in the last quarter of 2023 on expectations of imminent rate hikes, offsetting the sell-off in the previous two quarters. Consequently, the US 10-year yield ended the year 4bps lower at 3.9%, while that in the UK and Europe ended 13bps and 53bps lower at 3.5% and 2.0% respectively.

Indian Equities

Indian equities followed global suit and generated strong returns last year. The benchmark Nifty 50 Index rose by 7.9% in December—the highest monthly gain in 17 months, translating into a return of 20% in 2023. This marked the eighth year in a row of positive returns for the benchmark Nifty 50 Index. Favourable global cues apart, strong corporate earnings, robust economic indicators and strengthened buying by foreign institutional investors adding to the buoyed sentiments. Notably, net FII buying of US$7.9bn in Indian equities was the highest in the last three years. The rally last year was far stronger in mid- and small-cap companies, with the Nifty Midcap 50 and Nifty Smallcap 50 Indices rising by 50.2% and 64.3% this year respectively.

Indian Debt

Indian debt, on the other hand, remained on sidelines, weighed down by a hawkish RBI stance, tighter liquidity conditions and stringent capital norms for unsecured lending by banks and NBFCs, partly offset by inclusion of India sovereign debt in JP Morgan Global indices. The year 2023 saw a decline in prices of hard commodities, reflecting the impact of rising interest rates and slowing Chinese demand, while gold prices rallied amidst heightened geopolitical turmoil. The Indian Rupee traded in a range-bound manner through the year, starkly so in the second half, aided by aggressive RBI intervention.

Macro Data

The year 2024 started on a subtle note in terms of macro data. While the CSO’s first advance estimates (FAE) pegged the real GDP growth at an optimistic 7.3% for the current fiscal year, industrial activity indicators (IIP and eight-core) dipped substantially vis-à-vis previous months. Further, in line with expectations, headline inflation continued to inch up for the second consecutive month to 5.7% in December (however lower than Consensus), thanks to the persistent rise in veggie prices over the last two months of the year gone by. That said, the momentum of increase has come-off. In addition, the decline in retail prices in the first two weeks of January for vegetables and pulses indicate that Headline CPI might have peaked out in December.

External Front

On the external front, while the escalating attacks on shipping in the Red Sea— constituting 12% of the global trade, and the consequent suspension of the route pose a major headwind to trade and transport, India’s trade deficit narrowed to a five-month low owing to falling imports and increasing exports. The Centre’s fiscal position remains comfortable ahead of the Budget 2024. While the nominal GDP is expected at 8.9%, lower than 10.5% estimated as per the Budget last year, the Centre is likely to meet its target for FD of 5.9% of GDP, thanks to robust tax collections and muted growth in revenue expenditure (3.6% in 8MFY24).

Expectations From Budget

Moreover, even as the upcoming Budget will be a Vote on Account, we expect the Union to maintain the focus on capital expenditure while remaining on the path of fiscal consolidation. Our ‘Story of the Month’ looks at one of the major emerging issues of our world. Global debt today dwarfs output (349% of global GDP) and has especially increased during and after the pandemic. It is higher for the high-income countries and rising but has reached unsustainable levels in terms of service in poorer nations. High leverage has implications on fiscal room and cost of capital, eventually lowering the potential growth trajectory and resiliency to future shocks.

We have analysed these vulnerabilities using IMF Fiscal Monitor data. Our Insights section this month has four papers. The first three papers are summaries from the CBS team at IIM Ahmedabad. The first of these three leads to the compelling inference that consumers are willing to pay premiums for plants with eco-labels and that logos alone are more attention-grabbing than logos with text. The second paper explores how prior exposure to the risk of loss influences subsequent risk-taking actions. The third paper looks at how analysts' local economic conditions influence their forecasts for firms located elsewhere and identifies the presence of negativity bias in forecast and also herding behaviour as initial analysts result in significantly more negative biases in subsequent analysts' forecasts.

The last paper summarized by the EPR team provides a detailed characterization of the impact of price limit rules on equity markets and finds that they reduce excess volatility and curb sentiment-based trading but adversely affect the liquidity. Market activity has remained on an upward trend in the past few months. To cite a just a few indicators; turnover rose 40% MoM to Rs21 lakh crore in December for the CM segment, and 33% MoM to Rs32 lakh crore for the F&O segment. Average daily turnover has been over Rs70,000 crore this fiscal year for the cash segment, with over 1.2 crore participants in December, and nearly 90% trading below Rs10lakh, contributing to 2.8% of the Rs21 lakh crore turnover.

Global Economy

Meanwhile the global economy is likely to slow down further this year, according to the World Bank, in its ‘Global Economic Prospects’ report; tight monetary policy, restrictive financial conditions, and consistently weak global trade and investment are expected to lead to a 2.4% growth figure. The report also finds diverging trends in growth trajectories of developed and emerging markets, with better prospects for the latter, underlining our thesis of India’s standout performance in this regard. Despite the headwinds outlined above and added risks of a China slowdown, sustained geopolitical disruptions on the general economic environment, the Indian economy has managed to plough through the pandemic and related events well, with reasonable macro-fundamentals in the near and medium-term.

Authors of Market Pulse January 2024: Tirthankar Patnaik, PhD; Prerna Singhvi, CFA; Ashiana Salian, Prosenjit Pal, Smriti Mehra, Ansh Tayal, Anand Prajapati, Shuvam Das.

(To be continued)

(This report is intended solely for information purposes. This report is under no circumstances intended to be used or considered as financial or investment advice, a recommendation or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset. The Report has been prepared on best effort basis, relying upon information obtained from various sources. NSE does not guarantee the completeness, accuracy and/or timeliness of this report neither does NSE guarantee the accuracy or projections of future conditions from the use of this report or any information therein. In no event, NSE, or any of its officers, directors, employees, affiliates or other agents are responsible for any loss or damage arising out of this report. All investments are subject to risks, which should be considered prior to making any investments.)