The regulator can tweak its communication with respect to Government cash balance trajectory, offering visibility / a glide path of quarterly liquidity condition (akin to Fed Dot Plot) taking in estimation of market participants on likely course charted by individual drivers

More changes in RBI Liquidity Management Framework Likely: 5 Options

FinTech BizNews Service

Mumbai, January 20, 2025: The Economic Department of State Bank of India has come out with a Research Report titled “More changes in RBI Liquidity Management Framework Likely.”

The report authored by Dr. Soumya Kanti Ghosh Group Chief Economic Adviser State Bank of India, predicts that more changes in RBI Liquidity Management Framework likely...Daily VRR the first step...Such changes and frontloading next round of moves are smart and pragmatic by RBI...Delicate mix of temporary and permanent liquidity injection /withdrawal remains a work in progress.

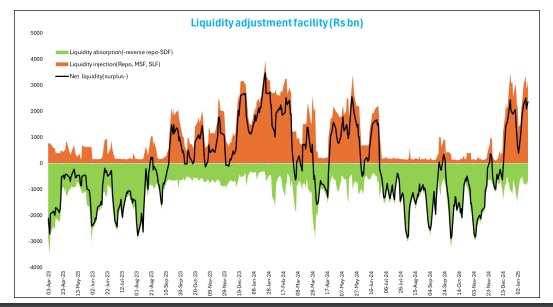

System Liquidity Position

❑ The system liquidity situation remained tight and turned to injection mode since 16 Dec’2024, due to many reasons like tax outflows, GST payment, forex market intervention and volatility in capital flows. Further with the implementation of Just in Time (JIT), the system liquidity has been impacted through movements in Government cash balances ❑ System liquidity moved from a surplus of Rs 1.35 lakh crore crore in November to a deficit of Rs 0.65 lakh crore in December, further to Rs 1.58 lakh crore deficit in January (till 16 Jan). If we look at the injection-absorption ratio, which has increased to 4 X, indicating persistent borrowings from the LAF window

Steps taken by RBI

To ease the liquidity pressure, RBI has injected Rs 11.5 lakh crore to the banking system via variable rate repo (VRR) operations of 1-7 days maturity during December 16, 2024, to January 15, 2025. However, the liquidity pressure did not ease ❑ RBI announced to conduct daily variable Rate Repo (VRR) auctions with effective from 16 Jan 2025, with prior notified amount

❑ Post notification, RBI has notified Rs 50,000 crore on 16 Jan’25 but bids received/allotted of Rs 30,706 crore at 61.4%. On 17th Jan, RBI auctioned Rs 50,000 crore again (Tenor: 3 days) and allotted Rs 33,467 crore (66.9%)

❑ During the last 1-month, RBI has announced Rs 18.2 lakh crore but allotted only Rs 12.13 lakh crore, which is 70% only. This could be the result of friction between RBI and bidding banks yield expectations

Why Daily VRR was reintroduced

❑ RBI has been consistent with its primary liquidity management, adjusting the size according to the market requirement. Quite often such operations are left undersubscribed though the system deficit was higher than the auction amount. This is due to the uncertainty around flows over a fortnight and expectation of fine-tuning operations from RBI

❑ As both these operations tend to clear around similar rates, banks prefer to leave some deficit to be covered in fine-tuning operations, thus leaving the main operation often under subscribed

❑ Fine-tuning operations are ad hoc and are often announced intra-day in response to hardening of overnight rates. RBI tended to prefer tenors up to 7 days in fine-tuning ops. However, the overnight tenor was only used sporadically and was not the preferred tenor

❑ Though fine-tuning ops have been able to address the liquidity deficit, quite often the tenors do not suit the market requirement. Market has been demanding that RBI shifts their VRR auctions to overnight as most of the money market volumes are concentrated in the overnight segment. Moreover, Primary Dealers who fund most of their holding using the repo route, are only permitted in overnight VRR auctions

❑ In this context the announcement of Overnight VRR auctions to be conducted daily is a welcome move by RBI. This will help anchor the overnight rates better around the Repo rate and reduce volatility. RBI is also in a better position to assess the daily liquidity needs as a significant component of the liquidity fluctuation emanates from their forex operations, which the market may not be immediately able to gauge

The announcement of daily VRRR is pragmatic and has the market alignment…..

❑ This move, in sync with other credible measures initiated by the regulator like loosening the strings on CRR, will provide assurance of continuous support from RBI until more durable measures are taken. This might curb the excessive volatility in overnight rates and will provide more certainty to the market participants

❑ This helps the PDs to better manage their borrowing and become less reliant on costlier source of funding (viz Call money, Market Repo). However, as the repayment of VRR is to be made before the next one is to be availed, we understand that this could pose some challenges to their operations (initially), especially auctions settlements, for which PDs may need to find alternate resources

❑ RBI could consider netting of VRR repayments with fresh drawls, thereby freeing up securities/funds for such settlements

❑ Market is sensing that the new RBI regime is responding positively to the long-standing demands regarding liquidity and is hopeful of more measures that addresses both system liquidity and durable liquidity. This positive sentiment has helped the short end of the G-sec curve to move lower in response to the announcement

Dollar Index might have some run off left…..However like in 2016-2017, a strong currency bounce back for rupee is clearly apparent once the dust settles down….

❑ Dollar Index may have run off left due to a confluence of factors, most notably the reversal of flows to US and the guardianship of ‘Big Tech’ that have endorsed president-elect (to be sworn in on January 20) Donald Trump’s Make America Great Again / MAGA rhetoric

❑ DXY retracing its September’2022 highs can put further pressure on EM currencies (Euro-Dollar parity is already being weaved in forward calculations at Big banks….

❑ Benchmark US yields remain suspended in animated action.. If inflation vaults due to impact of tariff on import prices, hardening of yields can be seen further…Jobs markets do not seem to be helping either with Tariff-Tax spiral in the offing

Brent can imbibe volatility due to Russia factor…Indian basket at a premium!

❑ Brent is on a roll, with hardening anti-Russia measures being penciled under new Trump regime anchoring its up move

❑ Indian crude basket (weighted average of sour Oman and Dubai average with sweet Brent prices on FOB basis) is already hovering around $84/bbl and with crude advancing 8% in 2025 (YTD), the financing of imports could have another frontier

Pursuing a WACR aligned Target Rate may not be reflective of the changed realities…

The WACR regime is not reflective of the changed realities as more players have shifted to TREPS / CBLO, overtaking Market REPO transactions too… this regime shift needs to be aligned with Monetary policy / Liquidity management toolkit of the regulator towards identifying a true target rate

…. The WACR might be an ineffective representation of target rate

❑ RBI’s decision to conduct daily variable repo is laudable but we still believe that the call rate is an ineffective representation of target rate because of various reasons

❑ For example, it is often seen that while WACR remains within the RBI corridor, due to restricted participation (only SCBs, Co-operative banks and Standalone PDs), other money market rates can vary wildly. Also, given the small size of call money market compared to TREPS or Market Repo or even CD/ CP markets, WACR is unrepresentative of actual system liquidity

❑ Thus, we believe a risk spread say between repo rates and CD rates could be also used to understand the tightness in liquidity and clearly distinguish between banking liquidity and market liquidity…this needs to be calibrated with systemic reading of the C/D ratio attributes

…Also WACR is Liquidity Agnostic

❑ It is rather strange (or, not!) thus that WACR is not much affected by liquidity situation. During Jul-Nov’24, liquidity surplus as given by average net LAF deficit was in the range of Rs 1000-1500 billion, but the WACR was around 6.52% only

❑ Even when the liquidity deficit was as high as Rs 1500 billion, the WACR for was only 6.64%

❑ Presumably, WACR has been rangebound, within rigid cap and floor, at odds with the goal of liquidity management

….Call money market share has declined significantly

❑ Over the years, the share of call money has declined significantly (currently around 2% compared to 69% share of TREP market and remaining 29% of market Repo) with market participants, including banks, increasingly relying on collateralized overnight segments, especially TREP, for their overnight liquidity requirements

TREPS has evolved into a better indicator of short-term liquidity requirement

❑ TREPS has cornered most of the trading activity, buoyed by increased participation from a host of players ❑ TREPS AVERAGE VALUE HAS RISEN 3 TIMES SINCE FY’18 (6 TIMES SINCE FY’10)

Temporary Liquidity in lieu of GoI cash balance: Visibility along a glide path would strengthen the ecosystem

❑ GoI Cash Balances build-up are agnostic to systemic liquidity, mostly inversely related to liquidity…. Conversely, a large cash balance ensures the government having flexibility about optimal pricing / yields of raising resources through market borrowings… WMA recourse come handy for GoI in times of duress though in recent times there are fewer instances of Govt taking this recourse…….GoI Cash Balances build-up is Rs 1.2 lakh cr till 16 Jan 24

❑ Given Government cash balances (Overall/Total with RBI or Surplus reckoned for auction at RBI’s end) are a big driver of liquidity and remain largely invisible/unpredictable (as against other attributes like Taxes/GST, credits, Fx intervention and capital flows to some extent where market participants broadly form a view), the regulator can tweak its communication with respect to Government cash balance trajectory, offering visibility / a glide path of quarterly liquidity condition (akin to Fed Dot Plot) taking in estimation of market participants on likely course charted by individual drivers

Permanent Liquidity:

Forex Reserve Intervention & Currency in Circulation

❑ Currency in circulation has increased by another Rs 78000 cr in FY25 (till Jan 10, 2025)…. Total CIC is now around ~Rs 35.9 lakh cr (~11% of GDP)

❑ Net sale of Forex is Rs 1.7 lakh cr till Nov’24 and we believe the same would have comfortably passed Rs 1.7 lakh cr (incrementally) at least as on date given the decelerating rupee

Liquidity Management Options before RBI

Option 1….RBI has indicated of frontloading the introduction of SORR…Amend Liquidity Management Framework to replace WACR with SORR & introduce new indicator to understand liquidity tightness / adequacy ❑ RBI has recently introduced Secured Overnight Rupee Rate / SORR as a new benchmark to replace MIBOR. SORR rate shall be derived from transactions in TREPS and basket repo in CROMS. These two segments together constitute more than 90% of the overnight money market volumes ❑ SORR therefore is a true indicator of the overnight market rate and the liquidity situation. We believe, once SORR is introduced, RBI will frontload the LMF to replace WACR with SORR as the operating target ❑ As an example, Internationally the Secured Overnight Funding Rate (SOFR) has replaced LIBOR and is better reflective of prevailing cost of funds, being pegged to effective Fed Funds rate ❑ Spread between CD and Repo/T-bill rates widen in times of deficit liquidity. The spread is also influenced by banks demand for funds to support credit growth. Going forward, the share of market borrowing like CDs in Banks liabilities is likely to change with demand for credit and banking liquidity. While RBI measures focusing on the overnight rates could yield its results with a more stable overnight rate, the spread between CD and SORR/T-bill will assume a greater role as an indicator of term liquidity/funding position

Option 2: Using daily VRR to neutralize the movements in Government cash balances through a meticulously policy decision….

❑ RBI reckons the surplus cash balance of Government of India for auction while conducting VRR auctions. The amount reckoned is mentioned in the daily Money Market Operations report. Until recently the auctioned amount was adequate to cover the VRR amount. On 10th January RBI conducted two VRR auctions amounting to Rs. 2.75 lakh crore (14-day Rs. 2,25,000 crore and 4-day Rs. 50,000 crore) which were fully subscribed ❑ However, the amount of GoI surplus cash reckoned for auction as mentioned on 10th Jan report was Rs. 1,95,818 crore, indicating that RBI has fully used up the GoI balances and the residual amount (Rs 80,000 crores) was out of RBI liquidity from other sources…RBI may thus neutralise the Government cash balances through a carefully crafted dynamic liquidity management policy…an example of injection of temporary liquidity replacing not only shortfall of temporary liquidity, but also perhaps shortfall in permanent liquidity….. ❑ In principle, the unspent cash balance of the Government is now being auctioned by the RBI through repos, has its limitation in terms of amount and tenor. While RBI’s steps do provide some comfort in terms of liquidity, the cash balances of Government cannot become a part of permanent liquidity as they cannot be transferred to Banking system under the current JIT mechanism and can at best be used to manage only short-term mismatches

Option 3:

Using CRR as countercyclical liquidity buffer akin to countercyclical capital buffer……OMO may be also a preferred option if yields spike….

❑ While the linkage between Govt cash and LAF operations already exists, GoI cash alone may not be adequate to meet the market requirement especially since durable liquidity is in negative territory…..

❑ Thus, we believe using CRR as a countercyclical policy tool could be a right approach from a long term perspective that bodes well for strengthening the domestic credit framework

❑ CRR can be temporarily lowered in times of capital outflow to release durable liquidity and raised again once flows return to the market… the flexibility can effectively be used to hedge the short term rates from embracing unwanted volatilities

❑ Inclusion of a certain portion of CRR towards HQLA as a countercyclical measure to help improve liquidity can be considered

❑ OMO is also possibility but given the lower level of gsec yields, there are doubts whether RBI will use it at this stage. But if yields were to spike towards 7% for some reason, OMO definitely becomes a preferred measure for liquidity injection

Lowering CRR can also have a direct impact on Money Multiplier….

❑ Despite lower reserve money (RM) growth in the current year, the relative stability in M3 growth could be attributed to the increase in the money multiplier (M3/RM), which currently stands at 5.6 compared to 5.3 last year

❑ This increase in money multiplier is brought about by the combined impact of the decline in (i) the currency-deposit ratio (C/AD) from 15.9% in March 2024 to 15.0% in Dec 2024; and (ii) the reserve-deposit ratio (BD/AD) from 4.78% to 4.74% during the same period

❑ In an inflation targeting framework, money supply is endogenous and thus a lower RM extension can still push up money supply growth through a policy induced change in multiplier…

Option 4:

Need to continuously develop the term money market to provide sufficient liquidity beyond the overnight time slot

❑ Though call money market is suitable for managing day-to-day liquidity, it is insufficient for the short-term to medium-term liquidity management purpose due to lack of depth in term money market. The term money market, which has a monthly size of Rs 10-15 lakh crore, in India has four major components. The term money market has the lowest share (1%) in total term market in India. The continuous development of term money market is essential in order to manage liquidity over a short period of time