FOMC: A Bold First Step

Indranil Pan, Deepthi Mathew,

Economics Knowledge Banking,

YES Bank

Mumbai, September 20, 2024: As widely expected, and as was signaled by the Fed at the previous policy,

the FOMC delivered its first rate cut at its September policy, the first since 2020. Pre-policy, the market

was divided on the extent of the move – 25 bps or 50 pts. Fed opted for a 50 bps, probably

justified as the associated projection sheet showed a reasonable deterioration in the

economic conditions from the June levels. While inflation was on course moving gradually

towards the 2% target, the concern emerges with the sudden sharp softness in the labour

market, thereby leading the Fed to do a catch-up. The forward guidance as indicated by the

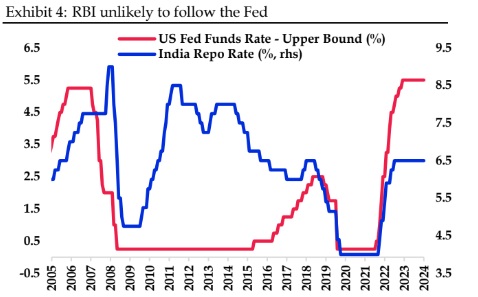

dot plot points to another 50-bps cut in CY24 and a 100-bps move in CY25. We do not think

there is any imminent need for the RBI to follow the Fed and maintain our view that the bar

for a rate cut from the RBI remains high, given the domestic growth-inflation mix.

Catchup by Fed with aggravated labour market risks: No doubt the Fed has taken a bold first

step in moving away for its restrictive monetary policy. But this decision to move rates down

by 50 bps needs to be seen in context to the otherwise robust statements that the Fed Chair made

on the economy during the press conference. The Fed continued to guide for a “soft landing”

and consistently played down any recession risks for the economy. The message that

consistently was driven through during the press conference was that the economy was doing

decently well, and growth was holding up. The question then arises as to why a 50 bps was

delivered. The answer could be in the concerns on the labour market. Even as the

unemployment level is currently not too high in the historical context, the change in the non-

farm payroll as per the last reading was at 142k (Bloomberg market expectation was at 165k)

while the prior was also revised down. But the biggest game changer could have been the

following: As per a normal exercise, the US Bureau of Labour Statistics significantly revised

lower the number of jobs created in the 12 months till March 2024 by 818K. this is the largest

revision in the data since 2009 and brings the job creation per month to 174k against the earlier

estimate of 242k. Probably, if this knowledge was available to the Fed policy setters at the time

of the previous meeting, the rate cutting cycle could have started then itself. Effectively, the 50-

bps reduction in the policy rates could be considered a catch-up by the Fed.

Dot pot points to another 50 bps in CY24: The projections published with the September policy

decision contrasts sharply with the previous projection that was published in June. Compared

to the June projection of the unemployment rate at 4.0% and 4.2% for 2024 and 2025 respectively,

these were moved higher to 4.4% for both the years. On the other hand, the PCE inflation

projections for 2024 and 2025 were respectively lowered by 30 bps and 20 bps. Effectively, there

is a broader understanding that the upside risks to inflation are now lower while the downside

risks to labour markets are higher. As per the policy statement, the committee “judges that the

risks to achieving its employment and inflation goals are roughly in balance”. The other

important point to note from the projections is that the unemployment rate is not anticipated to

decline very sharply from the current levels, thereby pointing to a soft landing. The dot plots of

the members also reflect the change in projections. In June, it was judged that there could be

just a 25-bps reduction in the policy rate in 2024, that has now moved up to 100 bps (of which

50 bps have been delivered. This sets up expectations for a 25-bps reduction each for November

and December 2024. For 2025, there is another 100-125 bps that is penciled in.

Fed to remain data dependent: As indicated earlier, after the large dose of 50 bps in this policy,

the guidance is for another 50-bps cut in 2024 itself. However, there is no commitment from the

Fed if there will be more front-loading of rate cuts, implying two more cuts of 25-bps each over

the rest of the year. However, economic conditions remain uncertain and there has been a

relatively sharp correction in the labour market of late. Thus, the decision of the dosage of future

cuts will be dependent on the developments in the labour market.

From India’s perspective, we do not see the RBI in any hurry to follow the Fed. RBI had been

consistently guiding for risks to inflation domestically and how food inflation could lead to

negative build-up on inflation expectations. Given the domestic growth-inflation dynamics, we

think that the bar for the RBI to cut rates remain high.

For the financial markets, it was a classic “see the news”. The yield curve in the US bear-

steepened with the UST 10-year moving higher to around 3.75% now. The 2-year UST also

moved up to 3.62%. DXY also is seen to broadly consolidate and market moves indicated that

most of the Fed action was already in the price. USD/INR appreciated to around 83.68 but the

strengthening bias could be limited by RBI’s intervention moves. On the other hand, the rally

in the India yields could sustain given the excess demand conditions arising from FPIs.