Net Interest Income (NII) grew by 29.33% YoY to Rs873 crore, versus Rs675 crore in the previous year

FinTech BizNews Service

Mumbai, 20 October, 2024: Punjab & Sind Bank has announced its financial results for the quarter and half-year ended 30 September 2024, showcasing solid growth across key metrics.

The bank reported a Net Profit of Rs240 crore for Q2FY25, marking a 26.98% increase, from Rs189 crore in Q2FY24. Total Income rose by 15.86% YoY to Rs3,098 crore, up from Rs2,674 crore a year ago. Operating Profit surged 76.15% YoY to Rs458 crore, compared to Rs260 crore in Q2FY24.

Net Interest Income (NII) grew by 29.33% YoY to Rs873 crore, versus Rs675 crore in the previous year, while the Net Interest Margin (NIM) increased by 38 bps to 2.71%, up from 2.33% in Q2FY24. The bank’s Core Fee Income increased by 35.88% YoY to Rs178 crore from Rs131 crore in the same period last year.

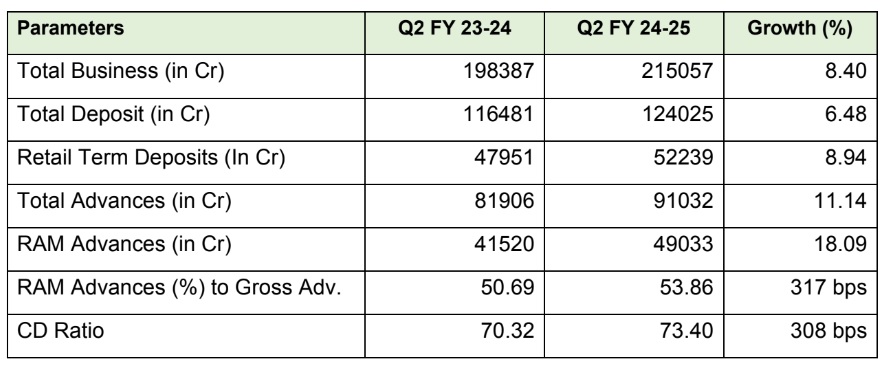

In terms of growth, Total Business grew by 8.40% YoY to Rs2,15,057 crore, up from Rs1,98,387 crore a year ago. Total Deposits increased by 6.48% YoY to Rs1,24,025 crore (vs Rs1,16,481 in Q2FY24), with Retail Term Deposits registering an 8.94% YoY growth to Rs52,239 crore (vs Rs47,951 in Q2FY24). Total Advances rose by 11.14% YoY to Rs91,032 crore (vs Rs81,906 crore in Q2FY24), driven by a 18.09% YoY growth in RAM Advances, which increased to Rs49,033 crore in Q2FY25, up from Rs41,520 crore in Q2FY24. RAM Advances (%) to Gross Advances improved by 317 bps to 53.86% in Q2FY25 (from 50.69% in Q2FY24).

Operational improvements were evident with the Cost-to-Income ratio reducing by 958 bps to 62.82% in Q2FY25 vs 72.40 in Q2FY24. The Return on Assets (ROA) improved by 13 bps to 0.65, compared to 0.52% in Q2FY24.

Asset quality also strengthened during the quarter under review compared to the same period last year. GNPA decreased by 202 bps YoY to 4.21% from 6.23% and NNPA fell by 42 bps YoY to 1.46% from 1.88%. The Yield on Advances improved to 8.75% from 8.62% YoY, and the Yield on Investment rose to 7.06% from 6.76%.

The Provision Coverage Ratio (PCR) improved by 48 bps quarter-on-quarter.