he C/D ratio of banks has moved past 80 now, as banks continue to meet the robust credit demand from new as also sunrise sectors (climate transition/ start-ups) though pressure on mobilizing liabilities from non-deposits sources remain

The State Bank of India’s Economic Research Department has prepared a Research Report titled 'RBI maintains status quo for 7th time: With inflation aligned at 4% in FY26.' The report has been authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

Highlights from the report:

Along anticipated lines, RBI MPC Kept policy repo rate unchanged at 6.50% (seventh-time in a row), with one of the six members vouching a different stance to reduce the policy rate by 25 bps. The Central Bank also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. Clearly, the Mint street has more on its minds than what most can gauge as it navigates through the ‘right path’ balancing growth and price prints, with pass-through of exogenous shocks likely to have a toll on the economic well being of nations.

RBI retained its inflation projection for FY25 at 4.5% with Q1 at 4.9%, Q2 at 3.8%, Q3 at 4.6%, and Q4 at 4.5%. However, the outlook for inflation will largely be shaped by food price uncertainties (indications of a normal monsoon on one side while increasing the incidence of climate shocks on the other side). In a worst-case scenario, crude can have a pass-through effect too as select lobbies wage a war on India’s decision to source the oil from Russia. The good thing is however, that with 4% inflation target in FY26, the RBI is possibly guiding the market with a prolonged rate-cut cycle. Possibly with more than a couple of rate cuts. We expect a series of rate cuts beginning October 2024, followed by another in December 2024 and possibly in February 2025. The stance change can happen in October itself.

Real GDP growth projection for FY25 is retained at 7.0% (Q1: 7.1%, Q2: 6.9%, Q3: 7.0%, and Q4: 7.0%) with risks evenly balanced. While agriculture may be supported by an expected normal monsoon in the best-case scenario, manufacturing is expected to maintain its momentum on the back of sustained profitability. With a gross investment rate at 33.3% for FY25 as per professional forecasters, a 7% growth rate assumption by RBI implies an ICOR at 4.75, well above the 4.28 for FY24. Alternatively, the 7% growth forecast for FY24 with a 4.28 ICOR could thus be a clear underestimate and growth could well be higher than if not equal to 7.5% in FY25.

Meanwhile, the global economy exhibits resilience and is likely to maintain a steady growth path with risk balanced on either side. Global inflation is treading down, though stubborn services prices are keeping it elevated relative to targets. The liquidity deficit has declined since the last policy in Feb’24. For efficient market functioning, RBI conducted fourteen fine-tuning variable rate reverse repo (VRRR) operations. Government surplus cash balances have decreased to an average of Rs 2.5 lakh crore post-Feb ’24 policy while durable/core liquidity surplus has come down to Rs 1.76 lakh crore. The fine-tuning of LCR norms will ensure that banks will find to easier to maneuver frictional liquidity mismatches against the backdrop of 24/7 payment systems.

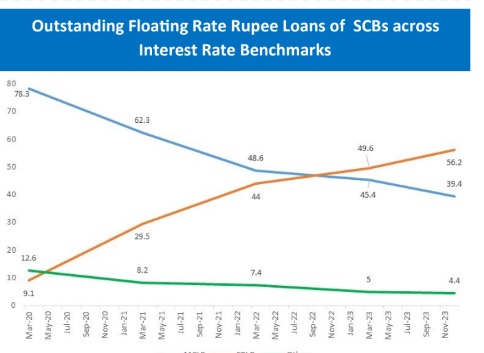

The transmission to banks’ lending and deposit rates continued in H2:2023-24, with banks increasing rates on the back of persistent credit demand. Banks have now passed on the earlier hike of 250 bps to both deposits and lending rates. The share of EBLR-linked loans in total outstanding floating rate loans increased to 56.2% as at end-December 2023. Concomitantly, the share of MCLR-linked loans declined to 39.4%. The increasing share of EBLR-linked loans with shorter reset periods and the increase in the MCLRs aided transmission to WALRs on outstanding loans of SCBs in the current tightening cycle. The C/D ratio of banks has moved past 80 now, as banks continue to meet the robust credit demand from new as also sunrise sectors (climate transition/ start-ups) though pressure on mobilizing liabilities from non-deposits sources remain

Continuing a slew of reforms pitching India as one of the most forward-looking financial markets, Mint Street announced

¨ FPIs access to Sovereign Green Bonds (The cumulative expenditure needed for adaptation without any additionality, is estimated to be Rs 56.68 trillion till 2030 for India, assuming FY24 as the base year). The mop up through Sovereign Green Bonds clearly would need an imminent and big push to smoothen the ambitious targets on carbon neutrality front and deep pocket overseas funds, in particular pension and sovereign funds

¨ Mobile app for common investors to popularize and bring convenience to the revolutionary Retail Direct Scheme,

¨ Proposed changes in LCR dispensation to meet the increased adoption of online banking to maintain sufficient liquidity

¨ Enabling cash deposit through UPI in CDMs

¨ Giving SFBs a level playing field to help hedge interest rate risk in their balance sheet and commercial operations more effectively. SFBs at present have nearly 1% of the systemic (SCBs) deposits but exhibit a higher growth rate, vis-à-vis peers

¨ Boosting participation of non-bank payment system operators to offer wallets as plateauing CBDC-Retail transactions (estimated to have 40 lakh users and 4 lakh merchants, having touched the milestone of 10 lakh transactions per day in December 2023) require new strategies, also testing the platform’s readiness for multi-channel transactions.

¨ Use of third-party UPI apps for making UPI payments from PPI wallets which should go a long way in strengthening the fabric of the markets.