While it is broadly thought that the RBI is done with its cutting cycle, any further easing of monetary policy will be linked to sizeable growth erosions.

FinTech BizNews Service

Mumbai, 6 December 2025: The Monetary Policy Committee (MPC) held its 58th meeting from December 3 to 5, 2025, under the chairmanship of Shri Sanjay Malhotra, Governor, Reserve Bank of India. The MPC voted unanimously to reduce the policy repo rate under the liquidity adjustment facility (LAF) to 5.25 per cent. Consequently, the standing deposit facility (SDF) rate shall stand adjusted to 5.00 per cent and the marginal standing facility (MSF) rate and the Bank Rate to 5.50 per cent. The MPC also decided to continue with the neutral stance.

YES BANK has come out with its latest research report, authored by Indranil Pan, Chief Economist and Khushi Vakharia, Economist:

Contrary to our expectations, RBI cut the policy repo rate by 25 bps to 5.25% and kept the

stance unchanged at “neutral”. Guidance on inflation was dovish as it reduced its

inflation forecast for FY26 further by 60 bps to 2.0%. RBI preferred to use the space

opened by low inflation to cut policy rates further and to ensure transmission it also acted

preemptively on the liquidity front by announcing INR 1 trn of OMO purchases and a

USD 5 bn (approx. INR 450 bn) buy-sell swap for December. The confidence on growth

remains strong as the RBI suggest that the economic activity has held up in Q3FY26,

though acknowledging that external uncertainties pose some downside risks. We

consider this as a dovish cut but indicate that RBI will continue to remain data driven.

While we broadly think that the RBI is done with its cutting cycle, any further easing of

monetary policy will be linked to sizeable growth erosions.

Confidence on benign inflation and robust growth continues: Inflation has largely

undershot forecasts with Headline CPI inflation at 0.25% (last reading) as food prices,

especially vegetables remained contained alongside favourable base effects and GST cuts.

Acknowledging the same, RBI has again revised its inflation forecast down to 2.0% for FY26

from 2.6% earlier while the forecasts for Q1FY27 is lowered to 3.9% from 4.5% earlier. YES

Bank forecasts inflation for FY26 at 1.8% while Q1FY27 expectation is at 3.0% (Exhibit 3).

Broadly, the RBI indicates that the inflation outlook is benign due to the exceptionally soft

food prices. Both the Headline and the Core retail inflation are expected to remain anchored

at around the 4% levels in H1FY27.

There also appears to be confidence with growth performance. The RBI acknowledged that

high frequency indicators have held up well in Q3, on the back of GST cuts and policy

accommodation. Rural demand continues to outdo urban demand, while there is some

indication of private investments gaining ground. RBI assesses growth prospects to be good

but with some downside risks due to external uncertainties, especially impacting the

exports sector. RBI revises up its growth forecast for FY26 to 7.3% (6.8%) earlier, broadly

confirming to YES Bank estimates.

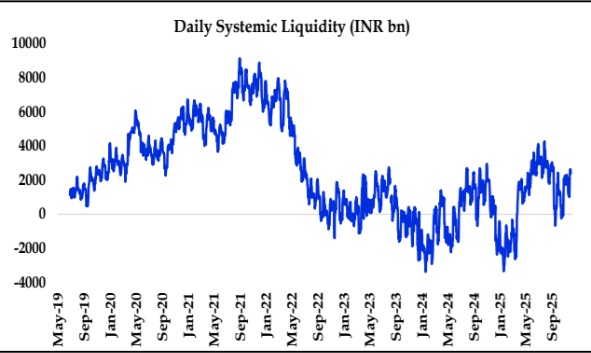

OMO calendar is what the market was hoping for an they get it: Of late, RBI had been

buying securities through the secondary market and the market was hoping for a calendar

on OMO purchases to be announced in this policy. Even as system liquidity currently is at

a surplus of INR 2.7 trn on the back of government’s monthly expenditures, the RBI

announced two tranches of INR 500 bn of OMO purchases (December 11 and 18) along with

a tranche of USD 5 bn of buy-sell swap for December 16. Thus, total liquidity infusion in

December is around INR 1.5 trn. While this measure, on one hand provides a comfort to the

bond market with RBI stepping in with incremental demand for Government securities, it

also empowers the RBI to contain further volatilities in the USD/INR as needed. However,

with the RBI clarifying that the OMO measure is to be seen more as a liquidity tool rather

than a yield signal, 10-year bond yields largely retraced its post policy announcement gains,

to close the day at around 6.49% (generic 10-year G-sec yield). On the other hand, RBI also

clarified that it is likely to continue with its daily actions on liquidity as necessary, thereby

indicating its intention to anchor the Weighted Average Call Rate (WACR) to the policy

repo rate of 5.25%.

What next? dovish forward guidance, but bar for next rate cut is high: We were not

expecting any rate cut in this policy as we had seen growth being robust while the inflation’s

fall was led by food and GST, hence a possibility for the RBI to see through the same and

retain the monetary firepower to be used when needed. Thought process of the MPC

members could have been – now or never – something that will be clear when we read the

minutes of the MPC meeting. Having said, we think that the last of the rate cuts have

probably been delivered. We ascribe the following reasons for the same: 1) The inflation

expectations for H1FY27 are placed at 4% and with the current repo rate at 5.25%, the real

gap is at 1.25%. While there is no clear mathematics that can be employed here, a real gap

of this extent is though to be adequate in an atmosphere of strong growth; 2) The next policy

will be delivered post the Union Budget and with redemption pressures high for FY27 at

INR 5.5 trn (implying a high G-sec gross borrowing), the RBI will have to be mindful of the

India-US rate differential, necessary for foreign participation in Indian G-sec market; 3)

Mospi will come out with its new CPI index in February 2026, that will have a lower weight

for foods and higher weight for core and the RBI may not want to risk any further rate action

on the lower side before having seen the inflation readings under the new series.