The regulator remains optimistic on growth

Indranil Pan, Deepthi Mathew & Khushi Vakharia

Economics Knowledge Banking,

YES Bank

Mumbai, February 8, 2025: MPC cuts repo rate by 25bps backed by expectations of inflation aligning to 4% while

growth steadies. However, the MPC strikes a cautious undertone on risks emanating

from global trade policies and adverse weather events, thereby acknowledging tail risks

to inflation. Consequently, no forward guidance on policy rates is provided and the

stance stays at “neutral”. Based on our assessment that the RBI could be comfortable with

a 140-150 bps real policy rate, we see the terminal policy rate at 5.50-5.75%. G-sec yields

moved higher post policy (6.70% as we write) as markets were unhappy with no

incremental liquidity measures.

RBI draws comfort from the inflation trajectory:

After touching a peak of 6.2% in October 2024, inflation has moderated in December 2024

at 5.2%. The winter easing of vegetable prices (January vegetable prices dropped by 19%),

good kharif production and favorable rabi prospects are seen as positives for the inflation

trajectory. We see the next inflation reading at 4.37%, having factored in the above.

On the other hand, core inflation remains comfortable. However, RBI indicated caution on the

upside risks to inflation emanating from uncertainty in the global market, volatility in energy prices

and adverse weather events. As highlighted in our pre-policy note “MPC preview: To do or not to do” we

also see tail risks to the inflation trajectory arising out of the uncertainty of the Trump tariffs,

intensity of the same and its impact on global supply chains and INR depreciation. FY25

CPI inflation has been maintained at 4.8% with Q4FY25 at 4.4% (earlier 4.5%). CPI inflation

for FY26 is estimated at 4.2% with Q1FY26 at 4.5% (earlier 4.6%), Q2FY26 at 4.0%, Q3FY26

at 3.8% and Q4FY26 at 4.2%.

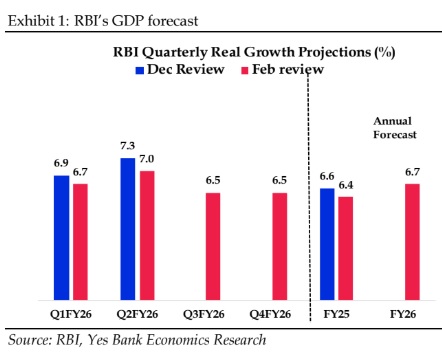

Remains optimistic on growth: After a slowdown in H1FY25, RBI remains optimistic on

growth with recovery expected in the manufacturing sector and with agricultural activities

remaining healthy. The rural economy is stated to exhibit strength on the back of healthy

reservoir levels and with good rabi harvest while some concerns on the urban economy

were raised on account of mixed signals from high frequency indicators. However, RBI

remains confident that urban household consumption would revive given the tax relief by

the government and with inflation moderating. After the FAE for FY25 GDP at 6.4%, RBI

estimates FY26 real GDP growth at 6.7% with Q1FY26 at 6.7% (earlier 6.9%), Q2FY26 at 7%

(earlier 7.3%) Q3FY26 and Q4FY26 are expected at 6.5%, respectively.

Unanimous decision for a 25-bps rate cut: After keeping the rates at 6.50% for 2 years, RBI

started the rate cutting cycle by delivering a 25-bps cut in today’s meeting with some

comfort from the inflation trajectory that is expected to slide to 4% target level in FY26.

Even though there was some market expectation for a stance change to “accommodative”,

the RBI continued to stay on a “neutral stance” acknowledging that the global atmosphere

remains uncertain due to evolving new dimensions of global trade policy and repeated

weather events. Indeed, there was no forward guidance provided as the Governor in his

statement pointed out “The MPC will take a decision in each of its future meetings, based

on a fresh assessment of the macroeconomic outlook”. At the press conference, RBI

Governor further reiterated that the “neutral stance” provides flexibility to the MPC to

respond to evolving macroeconomic environment. He also did allude to the fact that the

INR depreciation is not good for growth as also for imported inflation.

We expect the RBI to cut the repo rate again in April by 25 bps, armed with two more

inflation prints of 4.4% and 4.2% (YES Bank model predictions for January and February).

This however takes into consideration that there are no big announcements on tariff that

comes from US. Note that the tariff imposition on Mexico and Canada has been put on hold

for a month. We think that the current rate cutting cycle may be shallow. A recent RBI study

had estimated the natural rate of interest for India in the range of 1.4%-1.9%. When asked at

the press conference on the real rate of interest, the Governor indicated that it is currently

around 150 bps and showed some acknowledgement of these levels. Assuming a real rate

of interest at 150 bps and RBI’s inflation forecast for FY26 at 4.2% means a terminal repo rate

of 5.50-5.75%.

Contrary to the market expectation, no incremental liquidity measures were announced in

today’s policy, even as the Governor reaffirmed that the RBI would monitor and act suitably

to ensure that liquidity remains in comfortable. With no new liquidity measures, G-sec 10-

year sold off post policy to 6.70% and is seen in a tight narrow range till end-March. FY26

range seen at 6.30-6.50% on the back of more RBI rate cuts.