Hawkish hold expected, Liquidity actions turn crucial

Indranil Pan, Chief Economist

Deepthi Mathew, Economist

Economics Knowledge Banking

YES BANK

Mumbai, December 6, 2023:

MPC preview: Hawkish hold expected

With growth numbers surprising higher and with 4% inflation target continuing to elude, the only option for the RBI is to hold policy rates at the December policy and keep the stance of “withdrawal of accommodation” unchanged. Given its worry on the personal credit space, the RBI is also unlikely to change its thoughts on tight liquidity conditions. While liquidity conditions are difficult to predict given volatility in flows, we think there ought to be more clarity on OMOs and the plans around the same. While the situation remains fluid, the current growth-inflation mix in India leads us to believe that the earliest rate cut chance is for August 2024.

Volatility in food prices, a continuing risk:

Post the tomato price spike in July 2023, the pressure on vegetable prices have subsided. The arrival of winter vegetables in the coming months can also provide further support. However, the onion crop damage caused by unseasonal rains in Maharashtra has built pressure on onion prices. As per the NHB data, onion prices have increased 40% MoM in November. Another major risk that needs attention is the impact of El Nino and low reservoir levels on rabi production. Though too early to raise a red flag, delayed kharif sowing has resulted in delayed rabi sowing. As per recent reports, rabi sowing is down 5% compared to last year, with both pulses and wheat underperforming. Our model indicates an average Headline CPI of 5.5% for FY24. Importantly, with the waning support from the base effect, we are not expecting any sharp downward correction in inflation in the coming quarters.

Resilience in growth is good but posing problems for RBI policymaking

The upward surprise in GDP print to 7.7% average for H1FY24 can provide some difficulty in the RBI’s attempt to push Headline CPI sustainably to the 4% target. Importantly, with the potential GDP at less than 7%, a 7.7% print clearly indicates that inflation can continue to remain higher than comfort levels for longer. There is expectation for H2FY24 GDP to average lower than in H1FY24 on the back of a) lagged impact of rate hikes, b) global growth slowdown, c) demand weakness, especially for the rural segment due to weaker agricultural production and higher inflation, d) tightening of credit standards through increase in risk weights for some categories of personal loans. While we have moved our GDP expectation higher to 6.6% (earlier 6.1%), we think that the RBI could be retaining its forecast at 6.5% and provide an upward bias to the same. Global growth conditions can also be a crucial determinant of domestic growth.

Financial conditions to stay tight, liquidity actions turn crucial

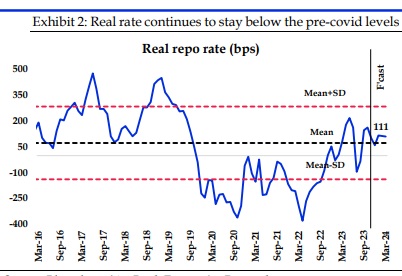

We expect the RBI to maintain status-quo on rates and stance. Given the growth-inflation dynamics, the RBI will maintain a restrictive monetary policy for a longer period. RBI’s Q1FY25 Headline CPI expectation of 5.2% and the current repo rate of 6.5% indicate a positive real interest gap of around 130 bps. This is still lower than the positive gap that existed in the pre-Covid period. However, with global central banks indicating a pause, any further rate increases by the RBI to counter the robust growth dynamics are unwarranted. Thus, the RBI will wait for the inflation to moderate so that the real repo rate moves more towards the positive side. With rate hike chances low, the focus of the RBI would continue to keep liquidity tight. RBI assessed that excess liquidity could be inflationary and hence have strived to keep it on the tighter side. Calculations on liquidity can be difficult, mostly as it must deal with an unknown quantum of FX flows, that the RBI might want to mop out of the system to prevent appreciation of the INR. Our liquidity model, that does not take into consideration FX operations by the RBI, predicts for a surplus of around INR 1 tn in January and February 2024 on the back of known anticipated flows. Post Union Budget in February 2024, there could be some front loading of flows into the bond segment ahead of the JP Morgan index inclusion in June 2024. The RBI then can mop up excess FX flows to replenish its reserves, and subsequently use OMO sales operations to suck out the excess rupee liquidity. We would expect the RBI to bring out more clarity on its liquidity stance, especially with respect to the OMO operations that it had flagged at the October meeting. Further, the RBI is likely to harp on the fact that the monetary policy transmission is still not complete. After most central banks appear to have moved into a pause, markets currently expect the US Fed to start cutting rates from May 2024.

Consequently, and guided by our current inflation projections, we think the RBI will be able to reduce rates at the August 2024 meeting.

(Disclaimer: Information gathered and material used in this document is believed to have been obtained from reliable sources. However, YES Bank makes no warranty, representation or undertaking whether expressed or implied, with respect that such information is being accurate, complete or up to date, nor does it assume any legal liability, whether direct or indirect or responsibility for the accuracy, completeness or usefulness of any information in this document. YES Bank takes no responsibility for the contents of those external data sources or such third party references. No third party will assume and direct or indirect liability, whose references have been provided in this document. It is the responsibility of the user of this document to make its/his/her own decisions or discretion about the accuracy, currency, reliability and correctness of information found in this document.)