Stock market movements

Mumbai, April 2, 2024: AS fiscal FY24 has come to an end , Sonal Badhan, Economist, Bank of Baroda, has captured the trends and patterns of the Stock market movements.

In FY24, we observed that Indian equity markets (Sensex for the purpose of our analysis) was one of the best performing markets after Japan’s Nikkei and US’ S&P 500. For comparison purpose, we assumed Mar’23 to be the base and analysed performance during the year. Sector-wise, Realty, Utilities and Power sector buoyed the growth. Key reason for India’s equity market outperforming others lies in the strength of its domestic economy (fastest growing major economy) and resultant net FII inflows in the equity segment. Going forward, as major Central Banks begin to cut rates this year, other global equity markets may also post significant gains. Domestically, we remain confident that GDP growth will settle in the range of 7.8% in FY25, buoyed by consumption and investment demand. This will be positive for equity markets as well.

India versus Global Markets:

In FY24 (Apr’23-Mar’24), India’s Sensex was one of the best performing markets amongst other major indices. Compared with Mar’23, Sensex was up by 24.9% during the year (till 28 Mar 2024), only behind Nikkei (+44%) and S&P 500 (+27.9%). Dow Jones was up by 19.6%, while FTSE registered smallest gain of 4.2% during this period. On the other hand, Hang Seng index fell by (-) 18.9% during FY24. The chart below shows that, Nikkei and Sensex throughout the year performed equally well, and only toward the end of Dec’23/beginning of Jan’24, Nikkei surged significantly as buoyed by stronger corporate performance, weaker Yen and FII inflows into equity segment. Interestingly, even S&P 500 closely tracked gains in Sensex and only marginally surpassed our domestic index towards the end of Feb’24. Increased expectations of a rate cut by US Fed in Jun’24 has supported gains made in techheavy S&P 500. Apart from Hang Seng, FTSE has been a significant under performer as elevated inflation and uncertainty around BoE’s rate cut timing has kept investors on edge. Also since investors were giving preference to tech stocks (S&P) more than financial, energy, and materials stocks (41% weight in FTSE versus 16% weight in S&P) is also another reason why UK’s stock market has seen muted growth. However, energy prices rebounding maybe positive for FTSE in the coming months.

Sectoral growth in Sensex:

Amongst different sectors, following notable trends were observed:

· Out of the 20 sub-indices tracked, 16 registered gains more than the headline index (Sensex).

· Realty, utilities and power sectors gained the most during FY24 (Mar’24/Mar’23), reporting over 80% YoY growth.

· Sectors noting 70-80% growth in FY24 included industrials, capital goods, auto and services.

· Following this, in 60-70% YoY bracket came Telecom, energy, consumer discretionary goods & services, and healthcare.

· Oil & gas and metal stocks also performed well.

· Consumer durables, commodities and IT while performed better than Sensex but gains were not as large.

· Improvement in tech and finance sector stocks was close to Sensex’s overall perforce.

· FMCG and BANKEX while registered gains during the year, but significantly underperformed compared to other sectors.

Drivers of Growth:

In India’s case, sustained improvement in economic growth has helped its stock markets. India remains the fastest growing major economy in the world, and as per NSO’s 2nd advanced estimates it is poised to grow by 7.6%in FY24, up from 7.3% in FY23. In FY25 also, momentum is expected to be maintained supported by government and private investment, and domestic consumption. We expect a growth of 7.8%. In FY24, high frequency data also supports NSO’s growth estimates. Air passenger traffic growth was up by ~15% (YoY), with absolute numbers of passengers touching 374mn, thus surpassing 345mn during pre Covid-19 period (FY19). Rail freight volume growth in FYTD24 (till Feb’24) at 4.9% is also seen inching back to pre Covid-19 period level (5.2% in FYTD19). Port cargo traffic in FYTD24 (4.7%) has surpassed FYTD19 level of 3% growth. Volume of toll transactions reached 3.8bn in FY24, 12% higher than last year. In value terms, toll transactions climbed up to Rs 64k crore (+18.6% YoY) from Rs 54k crore last year. Bank credit growth has jumped by 16.5% (as of 8 Mar 2024) from 14.8% last year.

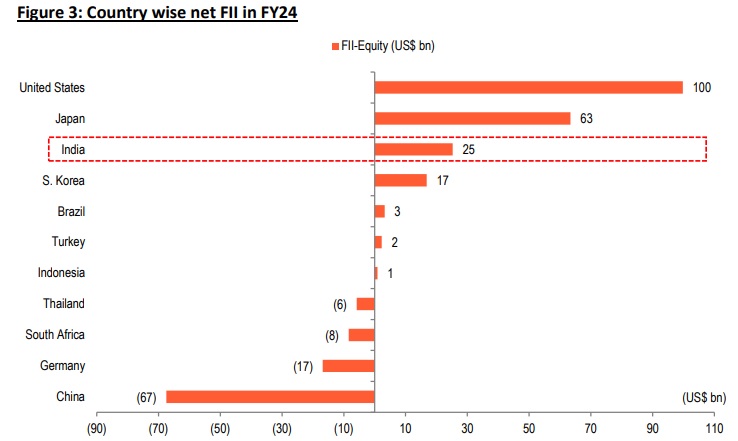

In India, FPIs in general have seen a turnaround in FY24, with net inflows at US$ 41bn, compared with outflow of US$ 5.5bn in FY23. Within this, US$ 25.3bn has been net inflows in equities, which in turn has in turn supported the gains made in Sensex. Compared with other countries, this is the highest amount amongst Asian (ex-Japan) economies. In contrast, other major economies like Germany and China have seen net outflows during the same period.

Going forward, movement in global equity indices will closely track the timing and quantum of rate cuts by major Central Banks (Fed, BoE, and ECB). In addition, volatile geo-political tensions in the Middle East, and weather conditions (impact food supply chains) may impact global commodity prices and inflation. While higher prices will be positive for respective stocks in the short-term, in the longterm it may dent demand prospects and Central Bank rate cuts. Domestically, consumption and investment demand will remain propellants of growth. RBI’s prospective rate cut in Q2FY25 will further support the ongoing momentum. This may in turn support FII inflows in both equity and debt segment and fuel growth in Indian stock market.

Disclaimer The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. Bank of Baroda Group or its officers, employees, personnel, directors may be associated in a commercial or personal capacity or may have a commercial interest including as proprietary traders in or with the securities and/ or companies or issues or matters as contained in this publication and such commercial capacity or interest whether or not differing with or conflicting with this publication, shall not make or render Bank of Baroda Group liable in any manner whatsoever & Bank of Baroda Group or any of its officers, employees, personnel, directors shall not be liable for any loss, damage, liability whatsoever for any direct or indirect loss arising from the use or access of any information that may be displayed in this publication from time to time.