IT reduces the time-inconsistency problem of monetary policy; IT offers more flexibility, inflation targets are set as a medium-term goal; consequently, short-term deviations from the target may not harm credibility. IT also allows stabilizing output without sacrificing the inflation target

FinTech BizNews Service

Mumbai, September 12, 2024: The success of Inflation Targeting in India is largely a byproduct of a vibrant financial ecosystem where RBI, Government and the Banks are working closely in unison in ushering in market reforms...However, it is important that we also undertake reforms in data infrastructure for a bottom-up policy making, states a research report from the Economic Department of State Bank of India titled ‘The success of inflation targeting in India is largely a byproduct of a vibrant ecosystem’. The report has been authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

India’s tryst with inflation targeting has been largely successful. Although the potential benefits of IT adoption are clear from the literature, the empirical evidence on its impact on inflation performance in India supports that India had a

largely successful inflation targeting regime.... Compared to advanced economies like the USA, Germany, and

France, India had one of the lowest deviations from its inflation target in the triennial average inflation from 2021-2024

❑ The success of India’s inflation targeting is also a byproduct of close co-ordination with the Government. Monetary and

fiscal policy coordination in India has worked seamlessly since pandemic

❑ Also, effectiveness of monetary policy in India’s pre–Inflation Targeting regime was constrained by several India

specific factors that affected transmission of the policy impulses through the interest rate channel. Some of the major

factors were: i) sustained fiscal dominance, ii) large informal sector & significant presence of informal finance, and iii)

bank’s behaviour in pricing loan products. All these have been addressed successfully through the assiduous efforts of

the Government, RBI and the Banks in unison in the last decade

❑ The argument that food inflation remains sticky but core inflation has moved down and hence it is better to target

headline inflation excluding food is actually counterfactual. It is precisely that successful inflation targeting by RBI has

anchored inflationary expectations and thus the spillover from higher food to core. The more the RBI communicates

that 4% is the inflation target, the more will be the successful anchoring of inflation targeting

Following the recommendations by an expert panel in 2014, and RBI Act amended by the Government to bring

the provisions of regarding constitution of MPC into force on June 27, 2016, which formally established an

inflation target of 4% (and a tolerance band of ±2%), by constituting the six member MPC in September 2016

❑ India became the 36th country to adopt an inflation targeting monetary policy regime

• Prior to that, in February 2015, a Monetary Policy Framework Agreement (MPFA) was signed between the Government of

India and RBI, and it was decided that RBI will target CPI inflation in the range of 4+2% for all subsequent years

❑ So, India’s history of inflation targeting (IT) is very short. Before this, RBI followed a multiple-indicator approach,

with low and stable inflation as just one of the objectives. Under the multiple-indicator approach, policy

perspectives were drawn by juxtaposing output data against interest rates or rates of return in different markets,

along with movements in currency, credit, fiscal position, trade, capital flows, inflation rate, exchange rate,

refinancing, and transactions in foreign exchange.

❑ The fortunes of IT and India’s first MPC were intertwined over a tumultuous period by any reckoning. The latter

held 50 meetings in total, including two off-cycle

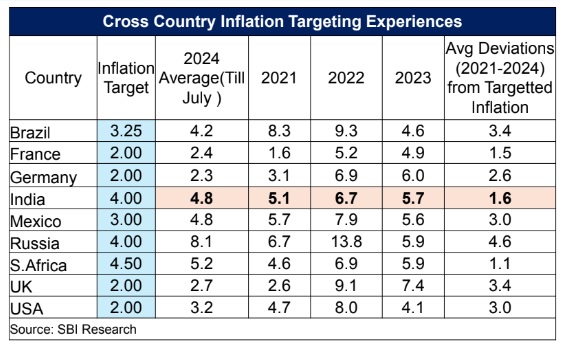

Cross country data of Inflation Targeting shows India has done remarkably well...

❑ Being a late entrant to the club of countries that have been practicing monetary policy making in an

IT framework since the 1990s, India adopted the best practices and procedures for the decision-

making process

❑ Despite the challenges posed by global demand-supply imbalances due to ongoing geopolitical

tensions, India's inflation rate was within its target range of 2-6% in FY24 so far. Compared to

advanced economies like the USA, Germany, and France, India had one of the lowest deviations from

its inflation target in the triennial average inflation from 2021-2024

Way Forward

❑ The review of the inflation target in March 2025 in India will coincide with many expected other changes – CPI

base change; household consumer expenditure survey; and census

❑ We believe that composition of CPI is a major factor that do affect the India’s IT framework. Apart from an

imminent revision that has eluded the CPI basket since 2012, the CPI basket in India may be also relooked into

to include mortgage interest payments

❑ In countries like UK, mortgage interest payments is included as an item in CPI, to make the transmission more

effective (absent in India). For example, in UK, the weight for mortgage interest payments is based on a modeled

mortgage incorporating both repayment and endowment components over a long period. Each of these is

updated annually and expressed in terms of average weekly expenditure

❑ Such mortgage interest payments are included in CPI basket in countries like UK, to make the transmission

impact more effective

❑ The inclusion of interest-sensitive items in CPI basket will make it more appropriate for policy formulation

❑ India’s IT framework, with a tolerance band of ±2 per cent, already has in-built characteristics of a “make up”

strategy. Structural changes – globalisation; e-commerce; climate change – may test this embedded flexibility