CASA deposits are prone to UPI transactions and thus could be moving across the banking system

FinTech BizNews Service

Mumbai, August 19, 2024: The Economic Department of State Bank of India has come out with a very insightful Special Research Report on deposits.

In FY23, ASCBs registered the highest amount of absolute growth in deposits and credit since 1951-52. Deposits grew by Rs 15.7 lakh

crore and credit by Rs 17.8 lakh crore, which pushed the incremental CD Ratio to 113%. The story continued in FY24 (deposits grew

by Rs 24.3 lakh crore and credit by Rs 27.5 lakh crore). Thus, the myth of a flagging deposit growth appears as just a statistical myth with credit growth outpacing deposit growth being tomtommed as a deceleration in deposit growth...Incremental deposit growth at Rs 61 trillion has outpaced incremental credit growth at Rs 59 trillion since FY22...what is thus important is the pricing of deposits and not the quantum, according to a report authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

Historically, there have been episodes of credit and deposit growth divergence persisting for 2 to 4 years...As per a RBI study, we are in the 26th

month of credit and deposit divergence as on June 24....analysing past data, the end of the divergence cycle could be June 2025 –October

2025..Beyond such time, deposit growth could inch up and credit growth should decelerate significantly which signals a rate reversal

cycle.....growth slowdown to some extent looks on the cards

Another interesting trend in banking system is the decline of CASA deposits (41.0% in FY24 from 43.5% in FY23) as SB deposits

declined even though it is somewhat aligned to pre-pandemic level of 42%...additionally with SB deposits now being used as a purely

transaction motive and mostly for UPI transactions, the SB deposits now move across the banking system....stability of SB could be an issue

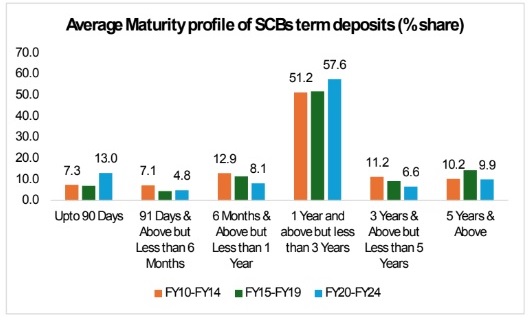

Further, rising return on term deposits has been driving the compositional shift in bank deposits: the share of term deposits in total deposits has

risen to 59.0% in FY24 from 56.5% in FY23 (to be read with decline in CASA deposits). On an incremental basis, term deposits accounted

for nearly 78% of the total deposits in FY24 though the shares of CASA deposits has declined from its 2023 levels. This is obvious as in

an increasing interest rate scenario, CASA moves to time deposits

Among the population group-wise, the share of RURAL & URBAN areas in deposits has almost remain flat at ~10% and ~21% respectively

during FY14-FY24, while the share of SEMI-URBAN in total deposits has increased to 15.7% in FY24 from 14.3% in FY14...The trend clearly

indicate a compositional shift of deposits from Metro to Semi-urban areas, which may be due to the migration of people to Metro from

Semi-Urban areas

PSBs are at the forefront of mobilizing low ticket deposits across the banking spectrum....The average ticket size of SB/Term deposits

of Public Sector Banks comes to Rs 72,577... as against Rs 1.60 lakhs of Private Sector Banks and Rs 10.5 lakhs for Foreign

Banks...PSBs are also more active in RUSU region...this has also helped deposits by women jump as a mass movement across the

banking sector...the SHG linkage is becoming more pronounced

Change in Ownership of deposits of ASCB in the last decade reveal formalization of banking system.... Nonfinancial corporations share

has jumped up. Increased share of Government deposits indicate an efficient DBT transfer system with zero leakages.

Clearly, the Extent of Deposit Growth Problem (or the lack of it!) & Resources Available with Banks for Lending needs new perspectives...We believe the issue needs to be seen along three pillars namely Growth in Reserve Money, Leakages and Regulatory Dispensation

Reserve Money (RM) growth has declined to 5.6% YoY in March 2024 as against 7.8% a year ago, which may be due the decline in CIC to 3.9% in FY24, compared to 7.8% in FY23 (withdrawal of Rs 2000 banknotes too contributing to the decline)....also the digitization is resulting in less usage of cash....The yearly growth of RM in the last two fiscals is less than the decadal average growth. This may be one of the reasons for the low deposits growth as base money is not increasing...Further, Growth in Reserve Money creates Supply of Money in Economy through Money Multiplier

Leakages (Efflux) are another interesting perspective to look at deposits growth....SCBs have garnered deposits worth Rs 24.3 trillion in FY24, of which 55% came from households (~Rs 14.1 trillion)...However, there are leakages from deposits in various forms, as also deposits being appropriated rendering them unavailable for discretionary commercial lending by SCBs....Basis our calculations, the leakages from the system could be around Rs 7.5 trillion under base case scenario, out of which Rs 2.1 lakh crore could be due to tax on interest income on deposits (Rs 76,000 crore) and self assessment tax (Rs 1.29 lakh crore)

Entering the regime of regulatory dispensation slightly unconventionally, after deducting all the pre-emptive regulations like CRR, SLR, LCR etc, banks are left with only Rs 41.9 for commercial lending with every deposit of Rs 100...Of this Rs 41.9, almost Rs 15 leakage in the form of currency with public + Government cash balances takes place.....In the last 2-years, RBI has tightened many guidelines to ensure banks maintain sufficient liquidity to handle sudden cash outflows. So, the systemic LCR has declined by ~17% to 130% in Mar’24 from 147% in Mar’22....With the new LCR guidelines on digital banking channels, which may become effective from April 1, 2025, may lead to a short-term impact on credit growth

On a global comparison, Indian Banks are resilient with clear focus on stable retail deposits as opposed to wholesale deposits globally....this makes it imperative to have a fair and differential tax treatment of retail deposits as opposed to other geographies....Deciphering ITR returns data, the distribution is more evenly scattered for interest income implying bank deposits benefitting a larger cross section of society across tiers

Bank deposits, despite faring much better than riskier assets on safety and liquidity aspects, fare low on returns parameter.... Remarkably 47% of term deposits are now held by Senior Citizens, implying younger cohort is increasingly shying away from traditional avenues like bank deposits... in contrast, median age of all investors in capital markets is now 32 years with 40% of investors being less than 30 years.. Clearly, in line with MF/equity markets, we are of the considered opinion that Government should tweak the ‘tax on interest on deposits and delink tax treatment at the highest income bucket....and tax treatment should be at redemption and not at accrual basis for bank depositors....

The conversion of depositors to investors is gaining currency sure....AMFI data shows MF investor accounts (folios) growing from around 3.95 crore in Mar’14 to 19.10 crore as of June 2024, a jump of near 5X even though the number of unique investors remains around 4.7 crore (June’24) against 3.83 crore in June’23. This is around half of the investors count for NSE (~10 crore) which signifies those having direct equity exposure could eventually align with MF route (a barrage of NFOs from MFs is pulling in more new faces)

To see the sensitivity of deposits due to taxes, we used the annual data of per-capita income (PCI) on deposits from 1970-71 to 2023-24 wherein the individual income tax is used as a control variable.....The results indicate that if per-capita income increases by Rs 1000 then deposits will increase by Rs 613 by considering tax as a control variable in the model.

Otherwise, deposits could have increased by Rs 652. So, tax has a net impact of 7% on deposits of the banks in India....This makes the case for sincerely thinking about treating deposits uniformly as a different asset class...Our simulation results show that a uniform tax treatment like a short and long term will have minimal impact on Government revenues....

As a counter cyclical measure, we find that in the states with lower per capita income (PCI) than national average the preference is more towards CASA deposits while the % share of term deposits is higher mainly in the states with per capita income higher than national average...The results are quite consistent with the current demographic profile of the states also. We found that the states with per capita income higher than national average have more elder population. Subsequently, these states rely more on term deposits compared to CASA deposits....Such divergences could imply that banks in India in future need to evolve towards products that could cover the life cycle needs of the customer. Separately, since states in India exhibit different characteristics, it might be a better idea to think of having bespoke products specifically suited to the customers of different states....Possible differentiation types could be along Age based / Geography based / Environmental preferences / Interest rates types –fixed vs floating and new forms of Gold deposits

Meeting Net Zero Targets would require substantial channeling of household resources / deposits to finance the transition