Global currencies depreciated against a stronger dollar

Dipanwita Mazumdar

Economist,

Bank of Baroda

Mumbai, April 29, 2024: Macro data prints in the US pointed towards robust spending and stable income growth. Core PCE deflator remained sticky on a sequential basis. The University of Michigan data for 1-year ahead inflation expectations also showed some de-anchoring. The recent speeches of US central bank officials were also tilted towards a hawkish bias amidst the growth-inflation dynamics of the region. Elsewhere in UK, consumer confidence index remained slightly upbeat. In Japan, Yen has slid past the psychological 160 mark for the first time since CY90. A plausible explanation would be considerable policy divergence with the US. However, officials have hinted time and again at intervention to check depreciation. On domestic front, month end releases will be closely watched.

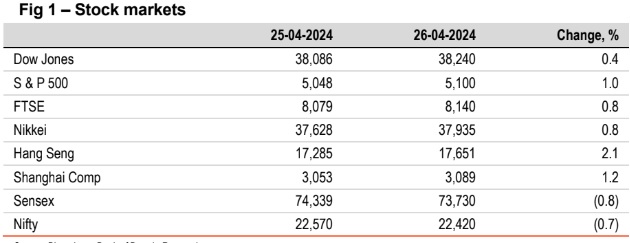

§ Except India, stocks elsewhere edged up. Stocks in China and Hong Kong rose the most, amidst a revival in foreign inflows in the region. US indices also edged up led by a rally in mega cap stocks after upbeat earnings report from tech giants. On the other hand, in India, Sensex fell by 0.8% dragged by a decline in banking and technology stocks. It is however trading higher today, in line with other Asian stocks.

Global currencies depreciated against a stronger dollar. DXY rose by 0.3% as US inflation (PCE) remained persistently sticky, strengthening the case for higher rates. JPY depreciated by 1.7%, registering its largest single day fall since Oct’23 amidst unfavourable interest rate differential. INR was marginally weaker. However, it is trading weaker today, in line with other Asian currencies.

Except China (higher), global yields closed lower. Germany’s 10Y yield fell by 5bps as inflation is expected to flatline in Apr’24 as well. Elsewhere in US and UK, 10Y yield fell by 4bps as investors have already priced in a delayed start to the rate cut cycle by Fed. In UK, timing of rate cut is divided between Jun’24/ Q3CY24. India’s 10Y yield fell by 2bps to 7.19%. It is trading at 7.20% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)