Barring EUR (lower), other currencies closed flat against the dollar. DXY inched up ahead of US CPI data

Jahnavi Prabhakar,

Economist,

Bank of Baroda

Mumbai, February 13, 2024: A slew of economic data from the US is expected to provide guidance on Fed’s outlook on interest rates. In addition to the CPI print scheduled to release later today, PPI report and retail sales data will also be closely monitored. Investors are pricing in no rate cut in Mar’24 (84.5%), while the likelihood of rate cut in May’24 has also dropped down to 61% (95% in the beginning of the year). Additionally, Federal Reserve Bank of New York in the survey of consumer expectations noted inflation for 1Y and 3Y remain unchanged at 3% and 2.5%, with rise in inflation 3- years from now, is estimated at 2.4% (lowest since Mar’20). Separately, in India, CPI inflation moderated to 5.1% (5.7%in Dec’23) led by food inflation. Industrial production advanced higher to 3.8% (2.4% in Nov’23) in Dec’23.

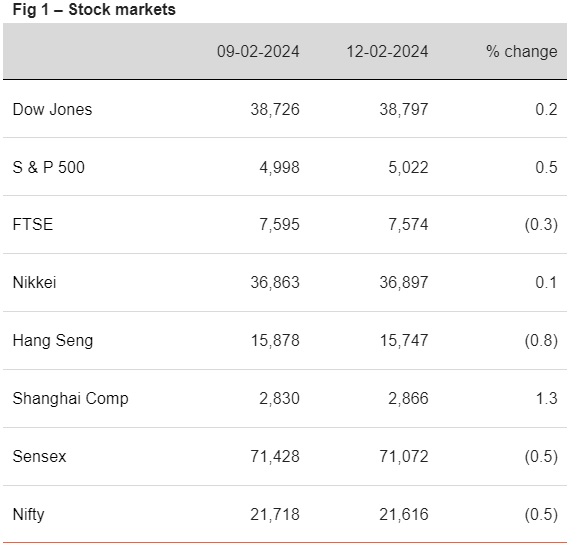

Global stocks ended mixed. US indices closed in green, awaiting the CPI report to offer some guidance as to when will Fed begin the rate cut cycle. European indices opened higher with investors monitoring corporate earnings. Sensex ended in red and was dragged down by losses in real estate and power stocks. However, it is trading higher today, in line with other Asian stocks.

Barring EUR (lower), other currencies closed flat against the dollar. Markets in Japan and China were closed. DXY inched up ahead of US CPI data. INR ended flat, despite dip in international crude oil prices. However, it is trading a bit higher today, while other Asian currencies are trading mixed.

Global 10Y yields closed mixed. 10Y yield in the US remained stable while it fell in UK and Germany. Given the strength in US economy investors are uncertain of a rate cut by Fed in May’24 as well. They await cues from CPI report due today for more guidance. India’s 10Y yield fell a tad by 1bps, as oil prices inched down. It is trading a tad higher at 7.10% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)