According to CME Fed watch tool, rate cuts are now likely (74.4% chance) in Jun'24

Jahnavi Prabhakar,

Economist,

Bank of Baroda

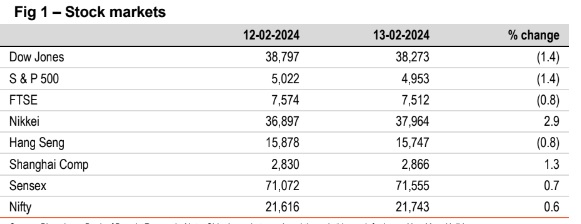

Mumbai, February 14, 2024: Investors monitored the most awaited US CPI print which surprised and came in higher than expected at 0.3% in Jan’24 on MoM basis (estimated: 0.2%) from 0.2% in Dec’23. Core CPI (excl food and fuel) was up by 0.4% (from 0.3%) highest increase since Apr’23. This has pushed back expectations of any imminent rate cuts by Fed. According to CME Fed watch tool, rate cuts are now likely (74.4% chance) in Jun’24. Japanese Yen continued to weaken with government authorities stating, they can take ‘appropriate actions’ if required. Separately, OPEC in its monthly report noted the demand for oil is expected to increase (unchanged from last month) by 2.25mn bpd and by 1.85mn bpd in CY24 and CY25 respectively. These forecasts are higher than the forecast by IEA (1.24mn bpd).

Barring Japan and India (flat), other global 10Y yields ended higher. 10Y yield in US and UK rose the most. Higher than expected CPI print in the US has pushed the possible timing of Fed rate cut from May’24 to Jun’24. India’s 10Y yield ended flat, despite inch up in oil prices. However, following global cues, it is trading higher today at 7.12%.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)