Oil prices rose as major shipping firms announced to avoid the Red Sea route in the wake of pirate attacks. This could in turn lead to lead supply side pressures

Jahnavi Prabhakar,

Economist,

Bank of Baroda

Mumbai, December 19, 2023: Amidst the ongoing uncertainty in the global markets, BoJ continued with the ultra-loose monetary policy as the members unanimously agreed to keep the rates at -0.1% mark and also continued with the yield curve policy. Separately, RBA in its

minutes noted that the members had even considered hiking rates due to expectations that inflation will remain above the 2% threshold for longer period.

However, the decision to eventually stick to pause was based on weaker consumption demand and limiting data. In the coming week, markets will track final US GDP print for Q3CY23 and a report on PCE given the recent comments by Fed.

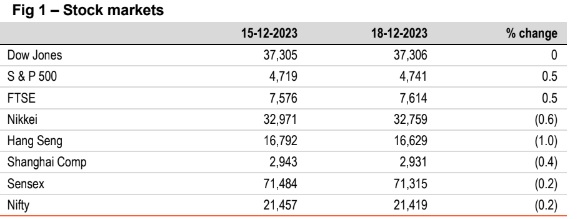

Global indices ended mixed. Investors closely monitored Fed’s commentary with

officials stating that there has been no guidance in terms of timings for rate cuts.

S&P 500 and FTSE advanced by 0.5% each. On the other hand, Hang Seng

dropped the most followed by losses in Nikkei. Sensex too ended in red and

was dragged down by real estate and banking stocks. However, it is trading

lower today, while other Asian markets are trading mixed.

Barring EUR, other global currencies ended lower against the dollar. DXY

ended flat, as investors attempt to gauge timing of Fed rate cuts. JPY and GBP

(awaiting UK inflation report) remained under pressure. Yen has weakened

further today after BoJ’s policy decision. INR fell by 0.1% as oil prices rose. It is

trading even lower today, while other Asian currencies are trading mixed.

Except yields in Asia, other global yields inched up. 10Y yield in Germany rose

the most, as ECB officials hinted that talks of rate cuts are still “premature”, thus

watering down hopes of a rate cut by Mar’24. Investors are also re-assessing

timing of Fed rate cut following statements made by some Fed officials. India’s

10Y yield ended flat, and even today it is trading broadly unchanged (7.17%).

Oil prices rose as major shipping firms announced to avoid the Red Sea route in

the wake of pirate attacks. This could in turn lead to lead supply side pressures.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)