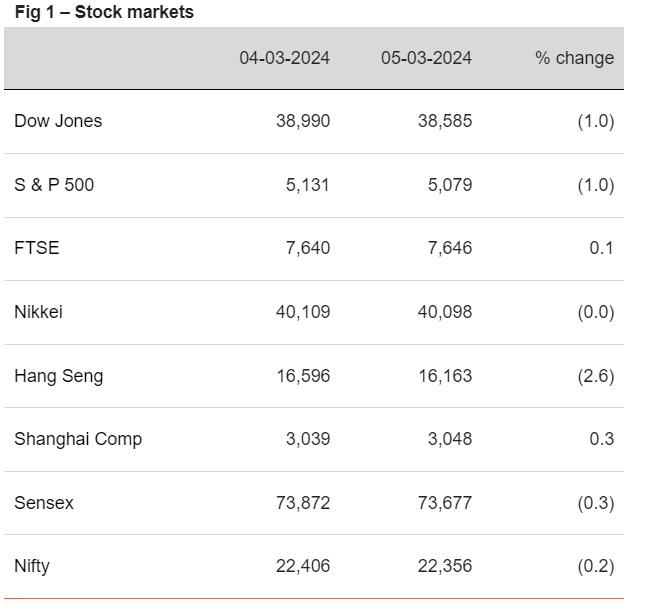

Except China and UK, stocks elsewhere closed weaker

Dipanwita Mazumdar

Economist,

Bank of Baroda

Mumbai, March 6, 2024: US macro data again raised doubts about the timing of rate cut. ISM services index softened to 52.6 in Feb’24 from 53.4 in Jan’24. Even prices and employment index moderated. This led to a 6bps fall in US 10Y yield. The reverberation was felt in 10Y yields of other economies. Elsewhere, equity markets reacted negatively to China’s bullish growth target as investors expected more sector specific fiscal measures. In Japan, OIS traders are pricing in 53% probability of a pivot by BoJ. On domestic front, India was included in Bloomberg EM Local Currency Government Bond Index. This is positive for yields as already FII inflows into debt have been higher at US$ 5.1bn in CYTD24. Inflows are expected to pick up further from Jun’24 onwards (JP Morgan Index) which can lead to India’s 10Y yield falling below the 7% mark as well.

Global yields closed lower tracking weaker macro prints in the US (ISM index

and durable goods orders). UK’s 10Y yield has fallen sharply as investor’s

remained cautious ahead of Budget announcements. India’s 10Y yield closed

stable but may see a downward bias going forward. It is trading at 7.05% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)