Swiss National Bank sprang into action as it announced a 25bps rate cut; Post the rally in US indices, the week started on a sombre note as investors tried to assess the future path of interest rate ahead of the release of key inflation figure

Jahnavi Prabhakar,

Economist,

Bank of Baroda

Mumbai, March 26, 2024: Investors closely monitored the rate decision by global central banks. Fed maintained status quo and the ‘dot plot’ reflected the possibility of 3-rate cut this year. BoE also hinted at the likelihood of rate cuts. Swiss National Bank sprang into action as it announced a 25bps rate cut. On the other hand, BoJ ended the negative interest rate cycle after 17-years. The focus in the ongoing holiday-shortened week will shift towards PCE data. In Jan’24, headline PCE and core PCE inflation was at 2.4% and 2.8% respectively. It is expected to inch up to 2.5%. Thus, remaining far off from the Fed’s target of 2%. Separately in Japan, services PPI edged up to 2.1% in Feb’24 (same rate as Jan’24).

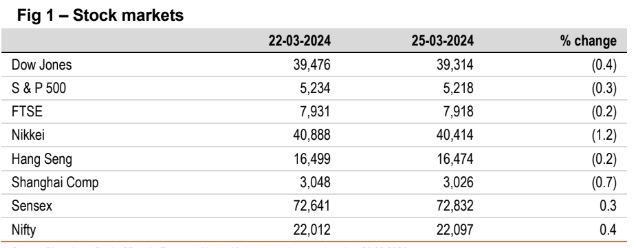

§ Global stock indices ended lower. Post the rally in US indices, the week started on a sombre note as investors tried to assess the future path of interest rate ahead of the release of key inflation figure. Amongst other indices, Nikkei (1.2%) dropped the most followed by losses in Shanghai Comp (0.7%). Sensex is trading lower in the morning session today while other Asian indices are trading mixed.

§ Except JPY (flat) and INR (lower), other global currencies closed higher against the dollar. DXY fell by another 0.2%, as investors assess Fed’s rate cut trajectory. Dip in new home sales has increased the probability of rate cut in Jun’24. INR depreciated further. However it is trading much stronger today, while other Asian currencies are trading mixed.

Barring Japan, other global 10Y yields inched up. Remarks of Fed Chair Powell are keenly awaited to gauge the timing of Fed’s first rate cut. There is 65% chance of a rate cut in Jun’24. India’s 10Y yield rose by 5bps, as oil price increase picks up pace. It is trading at similar level (7.09%) today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)