Diversification, penetration supportive; alternate liabilities strategies to gain momentum

FinTech BizNews Service

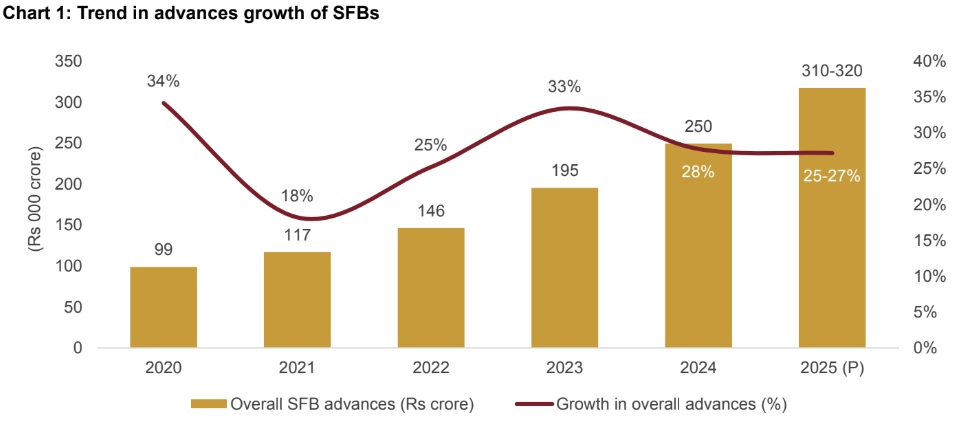

Mumbai, August 26, 2024: Small finance banks (SFBs) are expected to grow their advances by a robust 25-27% this fiscal, though a tad lower

than the previous fiscal’s 28% growth (chart 1 in annexure). Segmental and geographical expansion, underpinned by

a strong and increasing presence in semi-urban and rural markets with large unmet demand, will continue to drive

growth.

Amid challenges in mobilizing deposits and their higher cost, SFBs are likely to explore alternative, non-deposit

avenues to fund credit growth. That said, capital buffers to support growth remain healthy for SFBs.

The estimated credit growth can be divided into two segments — traditional1 and new, with the latter driving the

momentum. The constituents of new asset classes may vary across SFBs depending on their original segment focus,

but would typically include mortgage loans, loans to MSMEs, vehicle loans and unsecured personal loans.

Says Ajit Velonie, Senior Director, CRISIL Ratings, “Credit growth in new asset classes is seen at ~40% this

fiscal, while that in traditional segments will be ~20%. With this, the portfolio mix will continue to shift; the

share of new segments would cross ~40% by March 2025, twice the March 2020 level. Most of this

diversification is towards secured asset classes, resulting in the share of secured lending rising, albeit at a

moderate pace.”

In terms of geographical penetration, the SFB branch network more than doubled over the five years through March

2024, to 7,400. The maximum traction was in the east, which housed 15% of branches up from 11% as of March

2019. More than half the existing branches are in rural and semi-urban regions, which have sizeable market potential.

With the growth drivers in place, liabilities — both deposits (including other borrowings) and capital — need focus, too.

Deposit growth, at ~30% in fiscal 2024 (chart 2 in annexure), outpaced credit growth, in contrast to the overall banking

sector. Deposits now constitute ~90% of borrowings, but their growth comes at a higher cost for two reasons.

One is increase in the share of relatively more expensive bulk term deposits to almost 30% of total deposits as of

March 2024 from ~23% in fiscal 2022. The share of CASA5 deposits dropped to 28% from 35%, and that of retail term

deposits also fell.

Two, SFBs offer a premium of 50-250 basis points in interest rates over universal banks, even in the same category of

deposits.

To optimise deposit mobilisation, the reliance on term deposits will continue, given the higher opportunity cost to

maintain CASA balances for depositors in the current interest rate scenario.

Says Subha Sri Narayanan, Director, CRISIL Ratings, “SFBs will need to explore alternative funding routes to

balance growth and funding cost, especially given the growing share of lower yielding secured assets.

Securitisation is gaining currency, with transactions reaching ~Rs 9,000 crore last fiscal from ~Rs 6,300 crore

in fiscal 2023, with five SFBs tapping the market. We could also see SFBs resorting to obtaining more

refinancing lines from AIFIs, which, apart from the diversification benefit, could offer cost savings.”

These measures to diversify the resource mix are key, given the elevated credit-deposit ratio of over 90% and a more

stringent liquidity coverage ratio framework on the cards.