Technological advancement and green energy will play a pivotal role. Higher economic activities will generate credit opportunities

FinTech BizNews Service

Mumbai, September 22, 2024: Economics Research Department of Bank of Baroda has come out with a research report titled “Credit and Economic growth: India story”, authored by Jahnavi Prabhakar, Economist.

Global economies have been tackling the challenges of uneven growth, divergence in global central

bank actions, risk of looming war and escalating geo-political tensions. India on the other hand is one

of the fastest growing emerging economies. It has the potential to achieve a robust growth of 8%

surpassing its peers by harnessing the demographic dividend to its full potential supported by strong

investment opportunities and sound macroeconomic fundamentals. Technological advancement and

green energy will play a pivotal role. Higher economic activities will generate credit opportunities in

the country. The study aims to analyze this relationship in the last few years across sectors.

India’s economy has been growing at a steady pace compared to its global counterparts. In more than

a decade (last 12-years), the economy has registered a strong and steady growth of 5.9% even as it

witnessed global health emergency such as Covid-19 pandemic. If this period is excluded, growth

scales up further to 6.6% driven by structural reform measures, prudent fiscal management coupled

with political stability. Notably in the last 12-years, the average nominal GDP growth stands at 11.1%

and the SCB’s credit growth at 11.7%. Notably, there is strong relationship between the credit growth

and GDP growth. To understand this better further, the study attempts to analyze the impact of any

change in credit growth to a change in GDP growth and this is denoted with a multiple factor or

elasticity between these two variables. The analysis has been done for the period between FY12 and

FY24 across different variables and this has been divided in to 2-phases of 5/6 years each.

The caveats to the study includes the following:

The Covid-19 period (FY21 and FY22) has been excluded for some variables in phase-2 while

calculating elasticity multiple as it doesn’t provide an accurate picture.

In order to avoid further distortion, any extreme values or outliers have also been excluded

from the estimation.

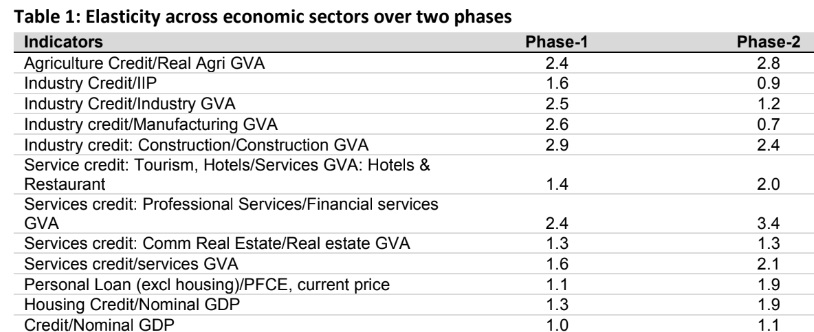

The change in credit growth to change in Nominal GDP growth has remained steady in the last 12

years, with the average multiple for both phase-1 and phase-2 standing at 1.0 and 1.1 respectively.

This simply implies if the nominal GDP of the country in FY25 is expected to grow by 10.5% as per the

Budget. The credit growth therefore for the same period is likely to expand by at least 1.1*10.5%. The

credit disbursals across sectors in the span of last 12-year has remain resilient. This can be understood

better through sectoral analysis:

Credit to agriculture sector has grown at a robust pace, with long run average growth of 11.7%

from FY12 to FY14. Notably, growth in agriculture credit continued to remain buoyant even

as other sectors were marred during the pandemic period. The steady growth in agriculture

credit was attributed to ease of credit as a major percentage of these demands were fulfilled

though institutional credit. Additionally timely initiatives such as moratorium facility, interest

subvention by RBI and government also helped in curtailing losses. Notably, the elasticity of

agriculture credit growth to Real agriculture GVA growth has noticed an improvement in

Phase 2 at 2.8 level from 2.4 in the phase-1.

The long run average growth to industry credit has remained stable at 6.7% in the last 12-

years. Banks have been cautious in terms of lending, especially before the pandemic as the

banking sector was facing a crisis due to rapidly increasing NPA. To counter the same, higher

prudential measures were introduced by banks which has created healthy balance sheet and

stronger credit system. Furthermore, to facilitate the credit to the industrial sector, special

measures were introduced during the pandemic period such as ECLGS along with collateral

free loans to cater to the MSMEs. Such schemes helped in improving the credit growth

especially in the last 2-years.

The elasticity of industrial credit to real industrial GVA has decelerated in phase 2 to 1.2 from

2.5 in Phase-1. Interestingly, the elasticity of industry credit to manufacturing GVA has also

been lower in phase-2 at 0.7 (2.6 in phase-1). Some of the reasons attributed for this

moderation include the following, there is access and easier availability of alternate sources

of credit such as NBFCs route, borrowing from bond market and ECBs. There is also AIF

(alternative investment fund) which provides access to private credit specially catering to

those who are unable to avail credit form either bond market or banks. However, it is still at

a developmental stage and needs monitoring at regulatory level.

Credit disbursal to services sector has registered an average long term growth of 13.5% for the

period ranging between FY12 and FY14. The sector recorded highest growth in FY24 at 23.5%

and has been expanding at a steady pace over the years. The elasticity between services credit

to services GVA has improved further in phase-2 to 2.1 from 1.6 in phase-1. Notably for the

real estate sector, the elasticity for commercial real estate to real estate GVA has remained

stable under both the phases. The elasticity multiple for credit to hotels and tourism to real

GVA for hotels and restaurant has rather improved in phase 2 at 2 from 1.4 in phase-1,

signifying growing credit demand from this sector.

3 Banks have been focusing on expanding its retail loan book and that has resulted in higher

credit disbursement across categories including personal loans, credit card outstanding and

housing loans. The share of consumer credit to total credit has also been growing steadily and

this includes both secured and unsecured lending. This has been further supported by higher

elasticity in phase-2 (1.9 from 1.3 in phase-1) for the variables personal loan (excl housing) to

nominal PFCE. The long run average growth for the last 12-years for Nominal PFCE has

registered double digit growth of 11.9%.