1 in 5 Ultra-HNIs will migrate or plan to; Kotak Private’s Top of the Pyramid Report maps the evolving investment, spending patterns and lifestyle trends of India’s Ultra-HNIs

Oisharya Das, CEO - Kotak Private Banking, Kotak Mahindra Bank

FinTech BizNews Service

Mumbai, 26 March 2025 – Kotak Private Banking, a division of Kotak Mahindra Bank Ltd. (”Bank"), has launched the latest edition of its highly anticipated ‘Top of the Pyramid (TOP) Report’. This edition celebrates the 20th anniversary of Kotak Private Banking, providing holistic financial solutions to India’s ultra-high-net-worth individuals (Ultra-HNIs).

The latest Kotak Private TOP report offers deep insights into the spending and investment patterns as well as economic indicators of India’s Ultra-HNIs. It sheds light on their lifestyle choices, motivations, and aspirations. Beyond wealth creation, the report uncovers a deeper, more meaningful journey these individuals pursue—one that brings purpose and fulfilment to their lives.

As a long-standing partner of Ultra-HNIs and with the philosophy of helping clients live their purpose, Kotak Private Banking delves deeper into subjects that are closer to their hearts, making the report a unique and archetypal narrative on India’s growing affluent class. Commissioned to Ernst & Young LLP^ (EY), Kotak Private’s TOP report surveyed 150 wealthy individuals across India, offering some novel trends in their choices of investments, including their evolving roles as global investors in luxury and emerging digital trends.

Oisharya Das, CEO - Kotak Private Banking, Kotak Mahindra Bank Ltd., states, "Kotak Private’s TOP report continues to be an invaluable resource for understanding the nuanced behaviours of India's wealthiest individuals. As India's economic landscape evolves, our report reveals how Ultra-HNIs are diversifying their portfolios and embracing both domestic and global assets, setting the stage for a significant rise in their spending by 2028. This year's edition is especially significant, as it not only captures their financial decisions but also delves deeper into their lifestyle preferences, and the dynamics of family businesses* and estate planning*, offering a comprehensive picture of their lifestyles."

Saurabh Joshi, Partner – Wealth & Asset Management, EY India, states, “Kotak Private’s TOP report has been prepared with survey results and analysis of 150 Ultra-HNIs across India. The optimism of domestic economic growth and increase in private wealth is reflected in the aspirations of Ultra-HNIs and the savviness of their investments. The Indian Ultra-HNI is embracing a global identity as they transcend borders motivated by diverse factors. The Ultra-HNIs segment is one to watch, marked by dynamic growth, evolving needs, and a transformative shift in how wealth is managed and preserved across generations.”

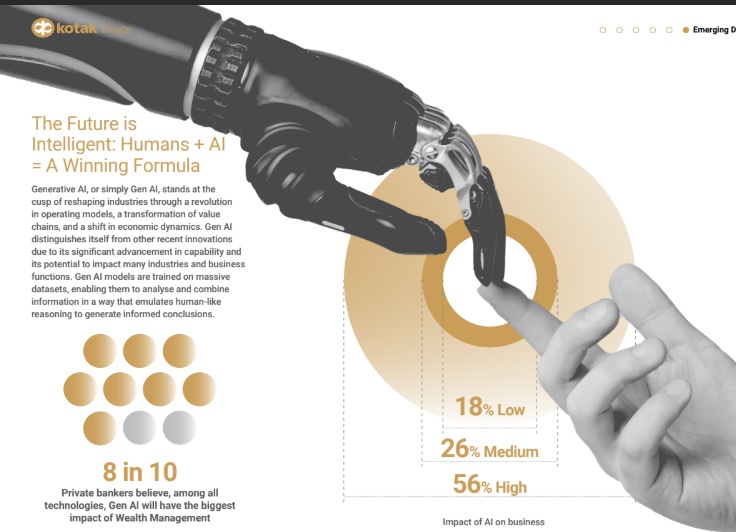

Key Findings: · Strong Economic Activity Fuels IPO Boom in India among Ultra-HNIs:

· Equity shines as the preferred asset class: Ultra-HNIs allocate 32% of their investments in equities, with 89% favoring individual stocks. Global equities, particularly in the U.S., are gaining traction. · Post-Pandemic Shift: Health & Wellness Spending Takes Center Stage: Post-pandemic, ultra-HNIs are prioritizing comprehensive well-being, with over 90% considering it essential spending. They allocate 10% of their budget to health and wellness, with 81% increasing their spending on preventive healthcare and lifestyle modifications. Wellness travel, both domestic and international, has surged, with destinations like Uttarakhand and Kerala being popular. Additionally, ultra-HNIs are investing in home fitness solutions and sustainable diets. Foreign travel for leisure is also significant, with 7% of expenses dedicated to it, and luxury, exclusive experiences are in high demand.

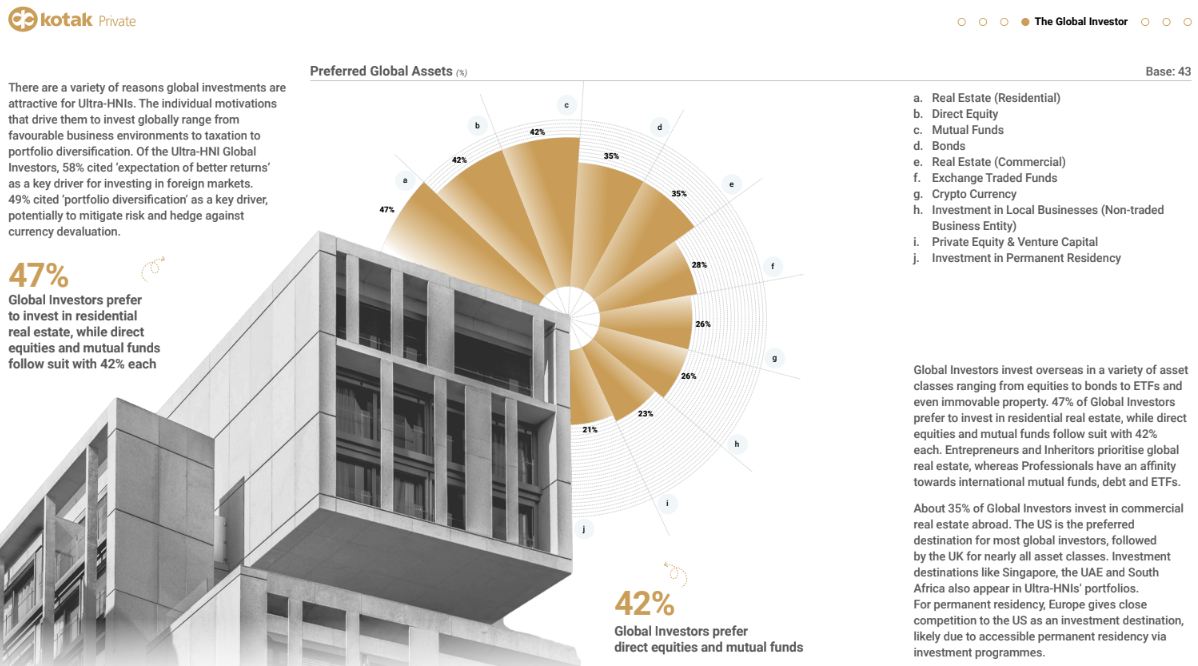

Collectibles are a significant interest for Ultra-HNIs blending personal interest, cultural appreciation, and strategic investment. Collectibles include jewellery, fine art, vintage wines, classic automobiles, rare coins, stamps, luxury bags, and NFTs. Notably, 94% of Ultra-HNIs own jewellery, 73% own art, and NFTs# are gaining favour over cryptocurrencies#, with 24% planning further digital asset purchases#. · Higher Yields Make Commercial Real Estate a Favorite Among Ultra-HNIs Commercial real estate is the top asset choice for 45% of Ultra-HNIs, offering higher yields and better leasing terms, compared to 33% for residential real estate. · The art of succession planning for Ultra-HNIs – Secure transition of wealth: 37% of Ultra-HNIs prioritize secure wealth transfer, with 43% relying on private bankers or accountants for planning. Two-thirds view estate and succession planning as essential, though 30% have yet to plan. · Global Horizons: Investing beyond Borders: 62% of Ultra-HNIs prefer aggressive equity investments, with a third having global investments, mainly in the U.S. and UK. Residential real estate, direct equities, and mutual funds are popular global assets · Unravelling Ultra-HNI Migration: 1 in 5 Ultra-HNIs surveyed are currently in the process of or plan to migrate, most of whom intend to reside in their chosen host country permanently while retaining their Indian citizenship. Professionals show a higher propensity to migrate than entrepreneurs or inheritors. Among those considering global migration, 69% cited smoothening of business operations as the key driver. · The Ultra-HNI concept of living with purpose: While Ultra-HNIs continue to create wealth and reap its benefits, there is a deeper, more significant journey fulfils and cements their life's purpose. 26% of Ultra-HNIs aspire to be recognized as innovators who drive change in both their professional and personal lives

|