FY25 Union Budget: Focusing on Viksit objective

Indranil Pan & Deepthi Mathew,

Economics Knowledge Banking

YES Bank

Mumbai, July 21, 2024: The government will have to balance objectives of fiscal consolidation and how best the additional dividend flows from the RBI could be utilized to push economic growth.

Focussing on Viksit objective

From the policy angle, the Budget is expected to further the government’s objective of Viksit

Bharat through allocation of resources in rural sector, employment generation, youth and

inclusive growth. Continuing to favour capex over revex, we however do not see major

increases in expenditure allocation towards roads and railways beyond Interim Budget’s

allocations, while transfer to states earmarked for capex can be raised. We expect GFD/GDP

at 5.0% for FY25 (5.1% in Interim Budget). Limited implications seen for G-sec yields, that

will be guided by global risks, Index related flows and expectations of an RBI rate cut.

Budget to push the government’s agenda of Viksit Bharat:

While fiscal consolidation objectives will not be surrendered, we expect the government to utilize part of the additional fiscal headroom in supporting growth. While headline growth numbers remain robust, there are pockets of softness such as the private final consumption expenditure (especially a weak rural sector), lagging private capex spend etc. Over the last few years the push to the economy has come from government’s capex while private capex is yet to take off in a significant way.

For FY25, this can continue due to the continued demand-side uncertainties. However, with

the multiplier effect higher at the state level, we expect increased transfer to states through

long-term capex loans. Thus, we do not expect any major changes to the capex spend on road and railways that were envisaged in the Interim Budget.

For the rural sector, we see the government focusing on asset building that help in job creation and stimulate demand. The focus on agriculture has to be razor sharp as the world undergoes signficant climate changes and crops are impacted due to weather related uncertainties.

Investment in research towards development of high yielding as also weather resistant

varieties are warranted. Further, we expect increased allocation towards PM Awas Yojana

and PM Gram Sadak Yojana. Importantly, employment creation as well as employability of

the youth should be critical focal points if India has to sustain a high level of real growth.

Focus and strategies around enhancing the quality of human capital – such as education,

healthcare, skilling etc. is expected to be a part of the future reforms programme.

GFD/GDP for FY25BE seen at 5.0% after overachieving at 5.6% in FY24: Armed with a large

dividend payout from the RBI and with tax collections remaining robust, government is

expected to utilize the opportunity to bring down the GFD/GDP to 5.0% vs 5.1% estimated

in FY25I. This will also be on the back of a 5.6% GFD/GDP achieved for FY24P (against 5.8%

announced as FY24RE). We see the gross tax collections for FY25BE at INR 38.2 tn with some

moderation in direct tax revenue growth. The government enjoys a buffer of around INR 1.3

tn on account of a sharply higher RBI dividend (at INR 2.1 tn or 0.6% of GDP), more than

double the estimates in interim budget. Accordingly, the total receipts is expected to outgrow the FY25I estimates by INR 1.2 tn. On the other hand, we anticipate expenditures in FY25BE to be higher by around INR 620 bn compared to FY25I on account of increased spending towards subsidy and capex. As indicated above, we do not expect any capex pickup for traditional sectors such as roads and railways but see the government enhance the loans to state for capex spend by around INR 400 bn, over the INR 1.3 trn that has already been

earmarked under FY25I. This way, the government would be able to maintain the capex/revex ratio close to the Interim Budget levels. Assuming that the government uses a

nominal GDP growth of 11%, our math on revenue and expenditure numbers point to a

GFD/GDP target of 5.0% for FY25BE (vs 5.1% in FY25I). This will leave the government a 50-

bps correction to be achieved in FY26, to reach the target of 4.5% by FY26.

G-sec net borrowings to be maintained at Interim Budget levels: We see the government

sticking to the net G-sec borrowings for FY25BE at INR 11.75 tn, unchanged from FY25I. Gross borrowings via G-secs is estimated at INR 14.1 tn with a redemption of INR 2.3 (after adjusting for the net recovery of INR 1.2 tn from the GST compenstion fund) in FY25. For states GSFD/GSDP is expected at 3.1%, with net SDL issuances expected at INR 6.4 tn. Gross SDL issuances is placed at INR 11.0 tn. Cumulative government borrowings is thus anticipated at INR 25.0 tn in FY25. Market’s comfort with the G-sec borrowings also derives from the anticipated demand for FAR securities as a part of Index inclusion inflows. We have

consistently been writing about a higher probability that the RBI does not drop the repo rate

in FY25. Thus 10-year benchmark G-sec yield could remain in a range of 6.90%-7.00% for now but can dip to 6.75% if a signal for a repo rate cut in FY25 materialises.

Budget likely to continue its support for growth

India’s real GDP grew at 8.2% YoY in FY24 vs 7.0% in FY24. Important to note, that the

government capex growth has been signficant, and continues to be the dominant driver of

growth, while consumption expenditure lags (Exhibit 1). Going forward, we see growth to

moderate in FY25 due to: (a) lagged impact of monetary policy percolating through the system as the reflection of the 250bps increase in the repo rate is still not fully seen in the lending rates on fresh loans (b) RBI holding repo rates ‘higher for longer’ while banks can aspire to bring down their credit-deposit ratios, (b) slower personal loan growth due to an increase in risk weight for some segments, (d) continuing geopolitical and geoeconomic fragmentation risks to weigh on the trade sector, (e) risks of growth moderation in AEs. Overall, we expect India’s real GDP to grow by 7.1% in FY25

Given an expected moderation in growth, along with demand concerns continuing in rural

segments, we see the government supporting the rural segment with its MNREGS

programme and through asset creation strategies such as the PM Awas Yojna. The

government will have to surrender its fiscal consolidation objective to an extent to support

growth. In this context, on the capex side, we think that the government is unlikely to boost

its own capex through larger outlays on rail and roads. On the other hand, given that INR

1.3 tn of capex loans to states were utilized to the extent of INR 1.2 trn in FY24, we see an

opportunity for the Centre to increase this loan amount for the states by INR 400 bn.

Further, the PLI scheme has not had its desired impact, expect for the hardware and mobile

manufacturing. While there can be some alterations to the policy, especially with respect to

the commitments that the aspirants would need to meet to get the subsidy from the

government, there can be an attempt to widen the PLI net to more segments, especially into

for the labour intensive sectors.

We expect the Budget to consider a nominal GDP growth of 11% YoY in FY25 vs 9.6% in

FY24, with the GDP deflator expected to rise to 3.4% YoY in FY25 vs 1.4% FY24. The pickup

in GDP defaltor is majorly on account of a higher WPI, expected to average 3% in FY25

(vs -0.7% in FY24) driven by a) unfavorable base of last year and b) food price pressures.

Receipts to get boost from higher RBI dividend

We assume total receipts to grow by 14.6% in FY25BE vs 10.4% assumed in FY25I over

FY24P (or 11.8% over FY24RE) with (a) direct tax revenue growth at 13.5% YoY (b) indirect

tax revenue to increase by 5.4% YoY (c) non-tax revenue growth at 31.3% YoY and (d) non-

debt capital receipts at 30.7% YoY (growth rates are calculated over over FY24P).

As per the provisional data for FY24, direct tax collection grew by 16% YoY to INR 19.2 tn

(or 6.5% of GDP), with corporate and income taxes registering growths of 10.3% YoY and

21.3% YoY, respectively. For FY25BE, we expect corporate tax growth to moderate as higher

input costs are likely to put pressure on the profit margins of companies. However, direct

taxes a a proportion of GDP is likely to stay unchanged as in the Interim Budget at 6.7%

(FY24P: 6.5%). On the indirect tax revenue front, we expect GST accretion to be boosted up

by INR 56 bn to INR 9.2 tn, showing a growth of 13.5% YoY (or 2.8% of GDP). The pickup in inflation and improved compliance is likely to support GST collection, as has also been

evident in the first couple of months of the FY25. We are not expecting any significant

changes in the customs and excise collection from FY25I – likely at INR 2.3 tn and INR 3.2

tn, respectively. After removing the share to states, net tax revenue is expected at INR 25.9

tn, registering a growth of 11.3% YoY (or 7.9% of GDP).

The higher RBI dividend of INR 2.1 tn is likely to boost the non-tax revenue estimate by ~

INR 1.3 tn. In the Interim Budget, governmet assumed the RBI dividend transfer from the

government INR 800 bn. Purely on account of the increase in RBI dividend, non-tax

revenues are expected higher at INR 5.3 tn (INR 4 tn in the Interim Budget), registering a

growth of 31.3% YoY (or 1.6% of GDP).

Non-debt capital receipts is likely to be maintained at INR 790 bn with disinvestment and

asset monetisation receipts expected at INR 500 bn. In FY25 so far, government has not

carried out any disinvestment of PSUs. While stock market gain can provide a boost to

disinvestments, we think that the government’s critical focus will be on asset monetisation

as it helps unlock unproductive capital.

Expenditure likely to be budgeted higher than FY25 Interim Budget

The government is likely to use the additional buffer from higher RBI dividend for (i)

increased spending towards rural sector (ii) job creation (iii) increased capex spending (iv)

higher transfer towards states (v) meet the increased requirement for subsidy expenditure.

Rural economy & Job creation

As discussed earlier, private consumption continues to lag especially in the rural

economy.To boost rural demand, government is likley to increase its spending towards the

rural sector. However, we expect the government to focus more on asset building rather

than direct cash transfer. Consequently, we expet increased spend towards PM Awas

Yojana and PM Gram Sadak Yojana. There has been a sharp increase in the allocation

towards PMAY (rural housing) in FY25I to INR 545 bn (vs INR 320 bn in FY24RE) to boost

job creation in rural areas and stimulate demand. In June 2024, Union Cabinet has approved

the proposal to sanction 3 bn houses in rural and urban areas under the PMAY.

We expect some upward revision for PMAY.

Since MNREGA is a demand driven scheme, the government will have the opportunity to assess work demand under the scheme and provide for the higher requirements, if any, at the time of the submission of the supplementary demand for grants.

Capex push through states

To sustain the growth momentum, government is likely to continue its focus on capex.

However, with capex spending at the state level having higher multilplier effect, we think

that the budget will take the route of increased allocation of loans to states for capex. In

FY25I, government has earmarked INR 1.3 tn for loans to states for capex. There has been a

good utilization of funds by the state governments under this account. For FY24, as per the

provisional estimates, the states utilized Rs 1.2 tn. Accordingly, we expect an increased

allocation of INR 400 bn towards loans to states for capex.

In FY25I, INR 750 bn (out of the total INR 1.3 tn) had been linked to support for ‘milestone

linked reforms’ at the state level. We think this may be kept unchanged and the additional

amount will be free for usage. This could be keeping in mind Bihar and Telengana who had

demands for funds from the Centre.

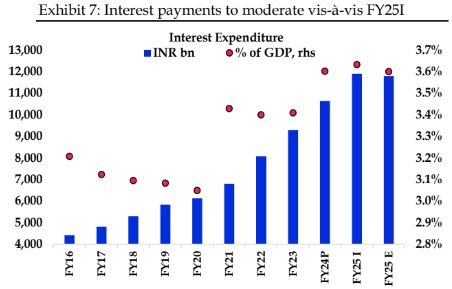

Increased subsidy expenditure; some moderation in interest payments

We see a likelihood of some upward revision to the subsidy expenditure from INR 4.1 tn in

FY25I to INR 4.4 tn. The pickup in subsidy bill is on account of increased allocation towards

oil, food and fertilizer subsidies by INR 12 bn, INR 77 bn and INR 162 bn, respectively.

Higher MSPs and higher fertilizer prices due to sticky oil prices are likely to push subsidies

higher. As a percent of GDP, subsidy expenditure is expected at 1.3%, similar to FY25I. With

the buyback of INR 230 bn worth of securities in May 2024, we expect a slight moderation

in the interest outgo bill in FY25BE. Consequently, interest payments are expected at INR

11.8 tn (3.6% as a proportion of GDP) in FY25BE v/s INR 11.9 tn in FY25I.

Factoring in the above assumptions, we see total revenue expenditure to grow at 5.2% YoY

(to INR 36.8 tn) or 11.2% of GDP; or an additional outgo of INR 220 bn over FY25I. Capital

expenditure is expected to outgrow FY25I by INR 400 bn to INR 11.5 tn, registering a growth

of 8.7% (or 3.5% of GDP vs 3.4% in FY25I). Overall, total expenditure for FY25BE is

anticipated at INR 48.2 tn vs FY245I allocation of INR 47.6 tn (higher by INR 620 bn). Even

with the increased expenditure, government will be able to improve the capex/revex ratio

to 31% from 30% assumed in the interim budget.

FY25 fiscal deficit expected to be lower at 5.0% of GDP

Overall, we model the GFD/GDP for FY25BE at 5.0%, after achieving 5.6% for FY24. In

absolute level, fiscal deficit is expected at INR 16.3 tn lower by INR 547 bn from the interim

budget of INR 16.9 tn. For FY25BE, we expect the government to meet around 72% of its

fiscal deficit through net market borrowings as we expect short-term borrowings to be lower

in FY25BE. Government has reduced borrowing via T-bills in Q1FY25 by INR 600 bn against

the calendar amount of INR 3.2 tn. Full year net t-bill issuance is likely to be (-) INR 965

bn. In FY25I, net t-bill issuance estimate was at INR 500 bn. In May 2024, government has

also cancelled the auction of INR 60 bn worth of green bonds. Consequently, we expect net

borrowings of the central government via dated securities to be maintained at the FY25I

level of INR 11.75 tn. Redemptions in FY25BE are estimated at INR 3.3 tn. After adjusting

for the net recovery from GST compensation fund (INR 1.2 tn), gross borrowing of the centre

through dated securities are likely at INR 14.1 tn.

As per the state budgets, state fiscal deficit as % of GSDP is expected at 3.1% in FY25.

Consequently, net borrowings of states for FY25 are expected at INR 6.4 tn. With

redemptions of SDL at INR 3.2 tn for FY25, gross SDL issuances will be around INR 11 tn.

Total gross supplies of government papers through dated securities (G-Secs + SDLs) for

FY25 thus amounts to INR 25 tn while net supplies are expected at INR 18.2 tn.

With JPM Bond index inclusion flows, the demand-supply dynamics in the G-sec segment

remains favorable. However, even with the increased FPI inflows into the market, India 10Y

bond yield traded in a tight range of 6.94%-7.0% in June 2024. Importantly, between 22

September 2023 (JP-Morgan inclusion announcement) and 27 June 2024, FPI holdings in

FAR securities has increased by ~ INR 900 bn. This shows some front running by the active

funds even before the passive fund flows started, implying a muted implication after the

actual start of the index inclusion flows.

India benchmark 10-year yield has also been tracking the US 10Y yield. Given that the

market is pricing in the first rate cut by the Fed in September 2024, some downward pressure on the UST yields is expected. However, with RBI’s intent to achieve the 4% inflation target on a durable basis, we expect a delayed start to the rate cutting cycle in India. Given the current uncertainties of inflation and with growth holding up strong, the RBI is unlikely to follow the Fed in its rate cutting cycle. Accordingly, we see rising probability of no rate cuts by the RBI in FY25..

To keep the LAF liquidity in a comfortable zone, RBI had resorted to VRR/VRRR auctions,

and we expect this to the most important tool for the RBI to manage liquidity. However,

recent data indicates OMO sales by the RBI to the extent of Rs 34 bn between 8th and 12th

July. For now, we do not anticipate the OMOs to become a significant tool for the RBI to

manage liquidity.

Factoring in the above, we expect G-sec 10-year to stay in a range of 6.90%-7.00% for now,

till more confidence emerges on the starting time of the rate cut cycle by the RBI, when it

can potentially dip to 6.75%, assuming that the rate cut cycle will be shallow.