Tariff Actions-Reactions Could Hinder Capex Commitments

GDP growth recovers in 3QFY25, high bar for 4Q; “A rate cut expected in April, with a likely shift towards an accommodative policy stance”

Radhika Rao,

Executive Director and Senior Economist,

DBS Bank

Mumbai, March 1, 2025: Real GDP growth recovered to 6.2% year-on-year (yoy) in 3QFY25/4Q24, in line with our and market expectations. This marks an increase from the revised 5.6% yoy in 2QFY25. GVA growth was broadly aligned with the real GDP print at 6.2%.

Key takeaways:

- There were notable revisions to past data, with upgrades to annual growth figures for the past two years and the FY25 forecast. FY24 growth was revised up to 9.2% yoy (from 8.2% previously), FY23 to 7.6%, and the FY25 forecast was marginally raised to 6.5% from 6.4% in January’s assessment.

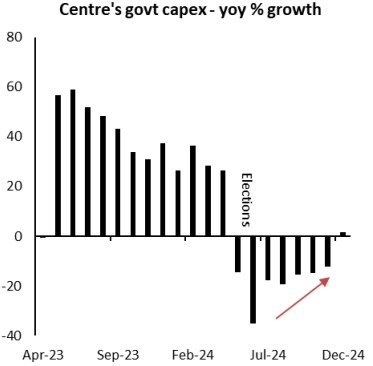

- On the demand side, an improvement in private consumption (6.9% yoy vs 5.9% in 2QFY25), government spending, and net exports contributed to the headline figure. However, investment expenditure growth remained subdued in absolute INR terms as well as in yoy trends, suggesting an absence of significant post-election momentum. Festive demand, improved rural FMCG sales, and food disinflation supported consumption but were offset by moderate wage growth. Exports rose by 10.4% yoy, while imports contracted by 1%, boosting net exports for the fourth consecutive quarter.

- Agricultural output reached a six-quarter high of 5.6% yoy, benefiting from stellar kharif output, healthy rainfall, and high reservoir levels, alongside improved utility growth and public expenditure. However, growth in manufacturing and construction remained tepid. Core GVA rose to 5.9% from 5.6% in the previous quarter, while non-agricultural growth increased to 6.4% from 6.0% in 2QFY25. Slowing credit demand weighed on financial sector growth.

- Nominal GDP growth rose to 9.9% yoy from 8.3% in the previous quarter, though trend growth remained below 10%.

Outlook:

- Strong revisions to past data indicate that growth in FY23-FY24 was significantly stronger than previously estimated, raising the base for FY25. To meet the revised FY25 projection of 6.5%, growth in the final quarter would need to accelerate sharply above 7%, which at this stage presents a high hurdle. Our forecast is in the range of 6.7-6.9%, with downside risks, to meet our baseline projection of 6.3%.

- A further catch-up in government spending, a pick-up in consumption driven by easing inflation, and positive lead indicators for rural demand are expected to support growth trends. Concurrent fiscal, monetary, and macroprudential support—demonstrated by tax incentives, the start of rate cuts, and the easing of credit restrictions—should also help boost activity. However, while we anticipate an improvement from 3Q to 4QFY25, a sharper rebound is likely to be constrained by weak credit growth, a moderating GST collection pace, and tight financial conditions. Wealth effects from strong equity markets have also started to reverse, given the sharp correction in benchmark indices over the past 3-4 months.

- The global macroeconomic environment remains challenging, as tariff actions and retaliatory measures could dampen trade activity and hinder capital expenditure commitments. (India: Growth uptick likely, tariff turbulence ahead)

- With FY25 trend growth expected to moderate to around 6% from a revised 9% in FY24, food disinflation setting in, and successive measures to ease macroprudential restrictions, policymakers have room to maintain a dovish stance. We expect a rate cut in April, with a likely shift towards an accommodative policy stance.