A Trump victory is likely to create a more stringent tariff policy, especially for China; US elections: Policy and economics will determine global currency outlooks; Trump Presidency to be a bigger drag on fiscal than Harris’; Global risk aversions could continue to pose headwinds for FPI flows into India after a USD 11 bn outflow in October

FinTech BizNews Service

Mumbai, 2 November, 2024: Whoever is the President, trade and fiscal policy along with immigration policies will remain the focus as these are likely to determine the growth dimensions of US and rest of the world, states an extra ordinary report, authored jointly by Indranil Pan, Deepthi Mathew & Khushi Vakharia, Economics Knowledge Banking, YES Bank.

US elections: Policy and economics will determine global currency outlooks

It is becoming too close a call to predict the next US President. Popularity votes are still showing a lead for Kamala Harris, but the poll margins are too slender for comfort as they are less than the historical “polling errors”. The 7 battleground swing states thus become important, and here we see a tilt towards Donald Trump. But, whoever is the President, trade and fiscal policy along with immigration policies will remain the focus as these are likely to determine the growth dimensions of US and rest of the world.

As the authors of the report explain in the report, a Trump victory is likely to create a more stringent tariff policy, especially for China. Importantly, Trump also wants to raise tariffs on the rest of the world, effectively to prevent circular flow of goods originating from China into the US (China exports goods to Country A, who in-turn exports to US). Higher tariffs alongside political disharmony amongst regions is likely to lead to lower productivity gains across the world and a synchronous slowdown. Higher tariff is also likely to be inflationary, thereby impacting monetary policy decisions.

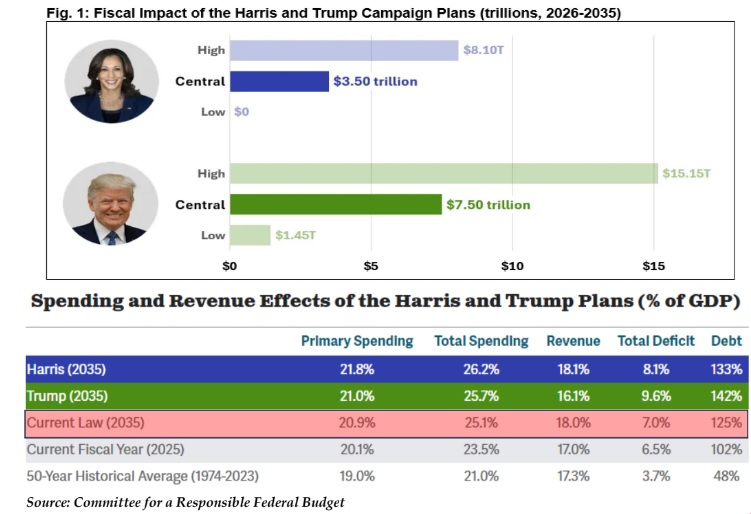

Some of the provisions under Tax Cuts & Jobs Act (TCJA), 2017 expire by 2025. The provision of a corporate income tax of 21% is permanent but Harris wants to raise it to 28% while Trump wants to reduce it to 15%. The provisions of lower personal income tax rates under this Act are to expire by the end of 2025. Harris has favoured a partial expiration whereby she would not want to raise the taxes for households earning less than $400,000 per year. On the other hand, Trump is more likely to extend the TCJA provisions on personal income taxes. Thus, as we present, both Trump and Harris administration is likely to worsen the fiscal – quantum is more for Trump than Harris. The sovereign debt dynamics will also worsen, thereby a larger share of the Federal Budget going to meet the interest payments. Trump has also proposed new barriers to discourage China investments into US, also possibly raising a tax on foreign purchases of USTs. A higher fiscal would thus mean higher sovereign bond supplies, but a smaller pool of borrowers – effectively impacting UST yields.

The immigration policy is another area where Trump is harsher than Harris. Powell had recently pointed out that large immigration had been instrumental in correcting from the demand-supply mismatch in the US labour markets, thereby reducing wage growth and helping contain inflation. A stricter immigration policy of Trump (including deportations) could thus lead to higher inflation.

The well documented report, authored jointly by Indranil Pan, Deepthi Mathew & Khushi Vakharia, Economics Knowledge Banking, YES Bank, further argues that a Trump victory is inflationary, possibly leading to a more cautious Fed and a strong dollar. If Trump carries forward all the above polices, risk aversion is likely to increase. His policies are likely contradicting his stated objectives of weakening the USD. On the other hand, a Harris win could weaken the USD. For the longer term and beyond the perspectives of the election, we still believe in the US exceptionalism theory that will benefit the USD.

Gap between Harris and Trump has tightened recently But these polls are not a good way of predicting US elections as candidates who win popularity votes may loose electoral college votes.

Harris had led these 3 states, but polls have tightened now All these 3 states had been Democratic strongholds before Trump turned them red in 2016 Biden retook them in 2020; crucial for Harris to do the same if she must win.

Trump v/s Harris – economic policies differ

Trump policies 1) Trump is proposing big tax cuts across businesses and households – but proposal to cut corporate tax rates (21% to 15%) may not be across the board and might largely apply to companies that manufacture in the US. 2) More tariffs on China and RoW – China tariff to be raised to 60% while RoW tariff at 10-20% 3) Reducing the immigration and deportation of illegal migrants Harris Policies 1) Harris is prioritizing tax cuts on low to middle income workers and for small businesses. But here again it is not likely to be across the board - the plan is to extend the TCJA 2017 tax cuts (that were set to expire in 2025) – but for only those earning less than $400,000. 2) Harris’s other economic proposals include support for first-time home buyers 3) Raising corporate tax rates from the current 21% to 28%.

Economic impact of Trump v/s Harris

• In both the Presidency, fiscal is expected to be higher – worse in Trump case compared to Harris

• Harris plan boost primary spending while Trump plan reduces revenue

• Higher fiscal to lead to higher borrowings and higher interest rates

• Higher tariffs under Trump imply higher inflation as Trump intends to raise tariff - this time also on the ex-China world => any substitution outside of China will also entail higher costs that current baseline

• Higher tariffs to lead to US$ strength – runs counter to Trump intention of weakening the dollar

• IMF studies show that tariff increases lead to consumers loosing more than producers gaining => deadweight losses

• Increased protectionism could also lead to retaliatory measures from other economies => Currency wars?

• Immigration policies of Trump and its implications

• Studies suggest positive linkage between immigration and labour productivity

• Powell had recently also highlighted that current immigration trends have helped improve the dd-ss balance in the labour market

• This balance has helped ease labour market tightness and bring down inflation by improving the wage inflation pressures

• Congressional Budget has also estimated that recent strength in immigration has a positive impact on Budget as immigrants contribute more to tax than govt’s spend on them via healthcare, social security and education

• Immigration policies under Trump could lead to tighter labour markets and higher inflation

There is emerging caution in pace of rate cutting cycle by Fed

Pace of drop in inflation could be a question under Trump policies

• Currently markets are pricing in just a 25-bps cut by the Fed

• Point to ponder – if Trump emerges winner – could the Fed miss the November rate cut date to understand the evolving policy and its impact on inflation

• Effectively, this also means a stronger dollar

But, beyond the elections, US exceptionalism can continue US economy comparatively strong then EZ and UK – GDP and PMI both suggest.

Inflation at sub-2% target in EZ and UK, while it is stickier in US Question is – how inflationary will the new administration be.

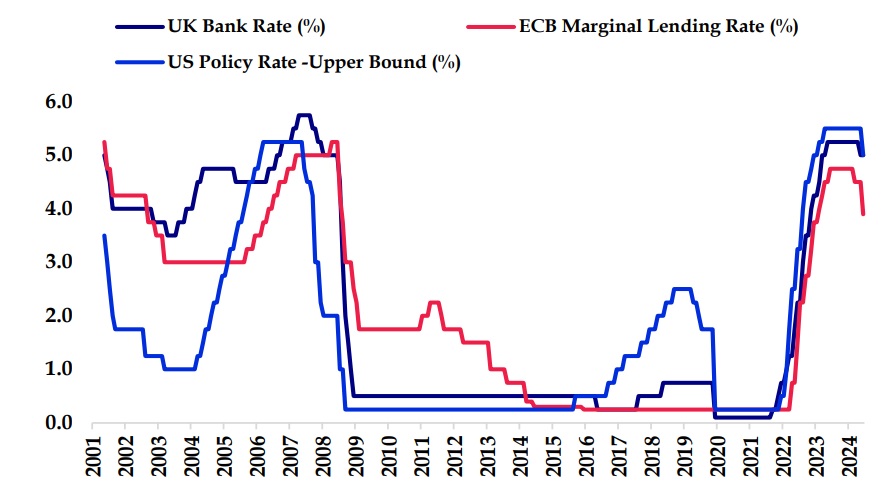

Growth concerns are pushing ECB and BoE for deeper rate cut cycle.

Fed likely to slower the pace of rate cuts.

BoE Governor: “The Bank could be a “bit more aggressive” at cutting borrowing costs, depending on the rate of inflation” • Higher global inflation but lower growth (due to trade policies and immigration policies if implemented could create monetary policy confusion • Having said, ECB and BoE could be seen cutting rates faster than the Fed

We again get reminded of the Dollar Smile Theory.

US elections: Creates an uncomfortable zone for China

China had been struggling with its economic performance. And this, despite a significant shift towards an accommodative monetary policy and looser fiscal policy. Authorities have announced other targeted measures, that includes lower interest rates on existing mortgages, reducing the minimum down payment requirement on 2 nd home. The government has also announced front-loading of some spending from 2025 into 2024. However, concrete details of a large-scale fiscal stimulus is still awaited. However, importantly, China’s recovery efforts can see significant headwinds in the form of US policies towards tariffs.

During the Trump-1, China was not hurt significantly by the higher tariffs as it could export to the rest of the world, who then exported it back to the US. However, in the current round, if Trump assumes Presidency, he will raise tariffs against China as also against the rest of the world. This would therefore make it difficult for China to wiggle out of its slowdown story. Further, with tariffs raised against China and with USD stronger, one can expect a further depreciation pressure for CNY.

India had been in a sweet spot with INR remaining ranged with the intervention measures by the RBI. Recent data does indicate a slowing economy while the RBI has remained confident on growth. RBI suggest that the recent slowdown was on account of Pitrupaksh and widespread rains in August and September. These slowdown trends, thus could be negated by festive demand and with rural demand supplementing urban demand. The monetary policy stance has eased now, thus giving more flexibility to the RBI to ease rates as Headline CPI inflation has shown a tendency to align towards the 4% target in mid-FY2025. We see the RBI easing rates at the February policy, after having seen through the recent inflation spikes on account of vegetable prices. From the external front, October MTD has seen an outflow of USD 11 bn. In the event of a sustained global risk aversion on account of Trump presidency, this situation may not reverse soon. Thus, we point out towards a CAD/GDP of 1.1% and a capital account surplus/GDP ratio of 1.6%, leading to a BoP surplus of only USD 18-20 bn. In a tariff-led world where CNY and other EM Asia currencies may depreciate, we seen a depreciation pressure continuing for the INR. USD/INR is now firmly above the 84 mark, and a depreciation pressure in the EM Asia currencies will also allow for the RBI to stay on the sidelines and allow for INR depreciation.

Weak consumer sentiments drag China’s economic recovery

China can continue to underwhelm in the face of hostile tariff policies against it and a general slowdown in global growth

China unveils stimulus measures to revive the slowing economy

Concrete fiscal measures are still awaited

Monetary stimulus:

• 20 bps cut in the benchmark reverse repo rate, effectively bringing the rate down from to 1.5% from 1.7%.

• Required reserve ratio down to 9.5% from previous 10%, a sharp 50 bps cut.

• 25 bps cut in one-year loan prime rate and five-year prime rate bringing down the rates to 3.1% and 3.6%, respectively.

Fiscal stimulus:

• Support to local governments: Debt swaps worth CNY 2.3 tn

• Support to the housing sector: State governments authorized to consolidate debts of property developers worth CNY 1 tn. Further, the Minister of Housing and Urban-Rural Development has proposed for an additional CNY 4 tn loan support by the end of the year to conclude projects on the government's “whitelist” • Support to Banks: CNY 1 tn for recapitalization of banks.

Japan continues to deal with inflationary pressures amidst slowing growth

Japan’s election results add uncertainty to BoJ rate hike plans.

Japan faces political uncertainty after the ruling party LDP failed to secure a majority in the snap election, first time since 2009.

• The loss of LDP could be attributed to the inflation run in the economy and scandals, leading to the formation of a coalition government.

• Coalition government can lead to expansionary fiscal policy and creating pressure on BoJ to limit further rate hikes

India’s RBI changed stance to ‘neutral’ as inflation aligns to a 4% target. We anticipate a February rate cut

• After the upward surprise in inflation at 5.49% for September, our model predicts a 5.76% inflation for October

• This puts to risk the 4.8% average inflation predicted by RBI for Q3 FY24

• Any damage to standing crops due to late withdrawal of SW monsoons also need to be factored

• Thus, RBI is seen to skip a December rate cut and look to cut by 25 bps in February 2025

India’s CAD deficit expected to widen to 1.1% of GDP

…while capital account surplus is revised down to 1.6% of GDP (from the earlier 2.1%) Global risk aversions could continue to pose headwinds for FPI flows into India after a USD 11 bn outflow in October.

BoP surplus expected at USD 18.7 bn vs USD 64 bn in FY24

INR depreciation much muted compared to rest of Asia RBI had supported INR to keep it in a range, may now be more comfortable to allow INR to depreciate.

After a period of higher US inflation compared to India’s, India inflation is likely to be higher than US Thus, supporting a depreciation bias for INR.

US inflation for a period was higher than India inflation – possibly supporting INR appreciation bias.

The crossover has again happened - India inflation > US inflation INR likely to depreciate, also following Asia depreciation.