Kotak Mahindra Bank's TOP Report: Live Better, Live Longer; 81% Ultra-HNIs reported increase in spending on health and wellness

FinTech BizNews Service

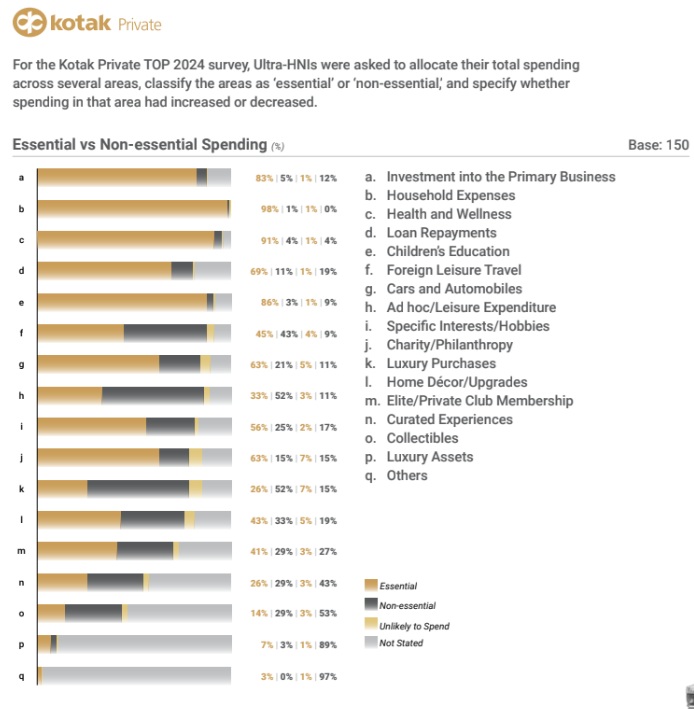

Mumbai, May 16, 2025: Post-pandemic Ultra-HNIs are placing a greater emphasis on their comprehensive well-being –both physical and mental. Over 90% of the Ultra-HNIs surveyed classify it as essential spending, underscoring its importance today. There has been an increase in spending on a range of wellness services and products by Indians over the previous year. The Ultra-HNIs surveyed in the Kotak Private TOP survey allocate 10% of their total spending towards health and wellness. 81% state that their spending for health and wellness has increased, as preventive healthcare and lifestyle modifications become key approaches to achieve their health goals.

There has been an acceleration of health and wellness travel plans, as affluent travellers across the globe increasingly seek to rejuvenate both mentally and physically. Ultra HNIs are prioritising wellness within their leisure trips by planning wellness breaks and selecting hotels offering wellness facilities. Domestic destinations in Uttarakhand and Kerala that are known for their therapeutic environments and are highly sought by Ultra-HNIs.

These destinations offer specialised programmes in Ayurveda, detoxification and rejuvenation. However, Indian Ultra-HNIs do not limit themselves to domestic destinations alone, travelling across the globe for a variety of treatments — from South Korean beauty procedures to European anti-ageing wellness retreats, among others. Indian Ultra-HNIs are also investing in home fitness solutions to maintain their fitness routines, contributing to the increased demand for high-end gym equipment.

Organically grown foods and custom diets crafted by nutritionists are appealing due to their promise of environmental sustainability and health benefits. Mental well-being, too, has come into focus. The shift towards a wellness-centric lifestyle underscores a broader trend to not only live longer but also to live better, healthier lives.

Kotak Private’s Top of the Pyramid Report is a comprehensive study that explores the evolving lifestyles, spending habits, and priorities of India’s Ultra High Net-Worth Individuals (Ultra-HNIs). Commissioned to Ernst & Young LLP (EY), the report is based on a survey of 150 affluent individuals across India and uncovers emerging trends in their investment preferences, growing global outlook, and increasing interest in luxury, wellness, and digital innovations.

With a growing population and a burgeoning middle class with increased

personal wealth and disposable income, India’s household consumption has

been on an upward trajectory, growing at a CAGR of 7% since the pandemic.

Generational shifts redefine priorities as growing affluence, coupled with evolving

personal values, blur the line between luxury and necessity. Infrastructure

developments and technological breakthroughs, such as luxury online stores,

sophisticated logistics networks and cutting-edge secure payment systems, have

improved access to goods and services, further bolstering consumer spending.

The upswing in consumer spending is not confined to the masses alone; it is

mirrored in the lives of Ultra-HNIs, signalling a sweeping transformation in the

way wealth is being used.

The year 2024 saw a series of

pivotal events that further shaped

the country’s economic landscape.

The most prominent was the general

elections, which brought with it political

uncertainty as the nation started hitting

the polls. This uncertainty spilled over

into the capital markets. The India VIX,

a volatility index, climbed relentlessly

as polling began and hit a two-year

high the day the election results were

announced. The return of the Bhartiya

Janata Party (BJP) for a third time

finally allayed market uncertainty.

In May 2024, a global rating agency upgraded

India’s sovereign rating outlook to ‘positive’ from

‘stable,’ citing robust economic growth and

improved credit metrics.

The agency projected 6.5 - 7% annual growth

over the next three years, expecting continuity in

economic reforms and fiscal policies.[2] The ratings

upgrade and the return of the Modi 3.0 boosted

investor confidence and positively impacted market

sentiments. These developments collectively shape

India’s economic landscape this year and beyond,

influencing growth trajectories, investor sentiments

and wealth creation. In FY25, India’s GDP growth is

likely to moderate to 6.4% from 8.2% in FY24,

but it remains the fastest-growing economy.

We estimate that there were 2,83,000 Ultra-HNIs

in India in 2023, with an estimated total wealth

of Rs232 trillion. With high demographic dividend,

a stable political environment and investor

confidence, India Ultra-HNI numbers and wealth

is expected to grow to reach 4,30,000 with a total

wealth of ₹359 trillion by 2028.

We take immense pleasure in introducing the

transformative edition of the Kotak Private ‘Top of

the Pyramid’ Report, which delves into the world of

the ultra-wealthy. This latest rendition is a tribute to

the intricate layers of luxury and business acumen,

offering an in-depth exploration of the behaviours

that define India’s Ultra-HNIs. With a commitment

to curating content that is as rich and rare as the

audience it serves, the report is key to understanding

the Indian Ultra-HNI – their spending habits,

investing habits and more.

The report throws light on where Ultra-HNIs spend,

what is considered essential or non-essential and

how much they spend. Ultra-HNIs spend the most

on their primary business and other essential areas

like household expenses and children’s education.

Spending on health and wellness has become

pivotal, with a majority of Ultra-HNIs surveyed

having increased healthcare spending. Apart from

the essentials, a significant amount of Ultra-HNI

spending goes into foreign travel.

Most Ultra-HNIs perceived their approach towards

investment to be aggressive. This is reflected in

their portfolio allocations that seem to prioritise

equity markets – both domestic and global.

Further, Ultra-HNIs have diversified their portfolios

beyond the conventional assets and are increasing

the allocation to alternative assets as well. All of this

is indicative of a maturing capital market with an

evolving investor mindset.

In addition to Ultra-HNI spending and investment

behaviour, the report covers three focus areas –

The Global Investor, Estate and Succession Planning

and Emerging Digital Trends in Private Banking.

The Ultra-HNIs of India are now looking beyond

national borders for astute and practical investment

opportunities. The motivations that drive them to

invest globally range from favourable business

environments to taxation to portfolio diversification.

As Ultra-HNI wealth grows and they spend in dollars,

it becomes essential to invest in dollars too.

While global investment strategies reflect the

immediate financial goals of Ultra-HNIs, their

long-term vision extends to preserving wealth and

transferring it to future generations. For Ultra-HNIs,

the approach to succession typically encompasses

moulding the next generation, nurturing their

development, and inspiring them to adopt a broader,

long-term perspective. In this manner, Ultra-HNIs

sustain their legacy.

Emerging digital technologies like Gen AI,

Blockchain, and others are rapidly reshaping private

banking, revolutionising traditional methods, and

introducing a new era characterised by increased

efficiency, accuracy, and personalised services for

Ultra-HNIs. These technologies are changing the way

Ultra-HNIs approach investments and engage with

wealth managers. Each of these technologies offers

the potential for wealth management to become

more accessible, efficient, and in tune with the

evolving demands of the digital age.

The true essence of wealth and wealth management

lies not merely in the abundance and growth of

assets but in the richness of life’s experiences and

the fulfilment of one’s deeper purpose. The report

throws light on what drives Ultra-HNIs and elevates

their gaze beyond the horizon of financial prosperity.

Kotak Private’s comprehensive solutions are

meticulously crafted to journey alongside the Indian

Ultra-HNI so that they can take their mind off their

finances, enabling them to focus on what truly

matters – living their purpose.