Fortnightly forex review

Aditi Gupta,

Economist,

Bank of Baroda

Mumbai, 18 October, 2023: INR has remained under pressure amidst a deterioration in the global economic environment. The war in Middle-East threatens to push global oil prices higher, in case it spill-overs to other countries which will have implications for global inflation and rates trajectory. The nervousness of the markets has led to a flight of safety, putting pressure on EM currencies, including India. Further complicating matters is the strength in US economy, which supports the case for higher for longer rates. After depreciating to a record low, INR continues to trade close to that level, supported by RBI’s intervention. In the near-term, the pressure on INR is likely to persist amidst uncertainty around the Middle-East conflict and FPI outflows. We are looking at a range of 83-83.5/$ in the next few weeks, with the possibility of a move towards 84/$ also possible in case oil prices rise to US$ 100/bbl.

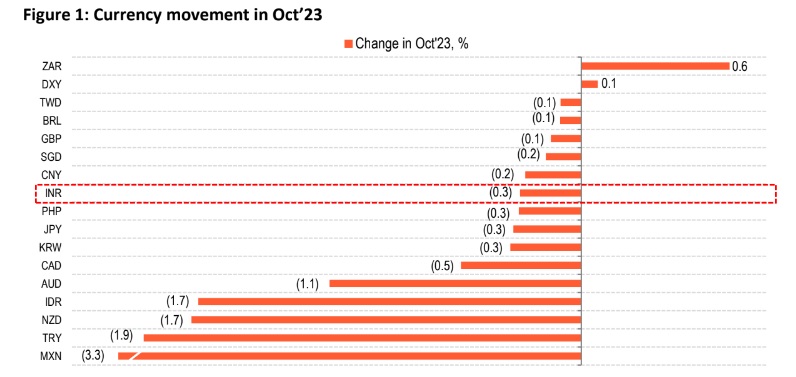

Movement in global currencies

Global currencies remained under pressure in Oct’23 amidst a risk-off sentiment. Outperformance of US economy leading to expectations of tighter US policy pushed US 10Y yields to multi-year highs. Also supporting the demand for dollar is the crisis in the Middle-East which buoyed the safe-haven appeal of the greenback. All major currencies depreciated against the dollar, with EM currencies being particularly worse off.

How did INR fare?

INR has depreciated by 0.3% in Oct’23 so far. In fact, it closed at a fresh historic low of 83.28/$ on 16 Oct 2023. It has continued to trade close to this level in the last few sessions, supported to a large extent by RBI’s intervention. The pressure on INR has come from weak investor sentiment due to the war in Israel as well as higher US yields. INR is likely to remain under pressure until the picture around the conflict in Middle-East remains hazy. RBI is likely to maintain its intervention to keep the exchange rate in a comfortable range.

Factors affecting the outlook for INR

Dollar trajectory: The US dollar has once again found support and has climbed higher. Underpinning the dollar strength is a resilient US economy, which is yet to show material signs of a slowdown. This has raised the likelihood of the Fed keeping rates at high levels so as to keep inflationary pressures in check. Fed’s projection indicated the possibility of another rate hike this year, however the chances for those look limited. Interestingly, for the next year as well, rates are expected to remain elevated. As a result, US bond yields have risen which is contributing to the dollar strength. Apart from this, geopolitical tensions in the Middle-East have also increased dollar’s safe-haven appeal. The trend is likely to continue in the near-term suggesting that we may once again witness a period of dollar dominance.

Oil prices and India’s external position

In H1FY24, India’s combined trade deficit stood at US$ 40.2bn, lower compared with US$ 75.3bn in the same period last year. Interestingly while global oil prices averaged about US$ 105/bbl last year, the corresponding figure for this year is much lower at US$ 82/bbl. This coupled with the fact that India has also been purchasing discounted oil from Russia can explain the lower oil imports. Tight supply due to output/export cuts by Saudi Arabia/Russia had already raised concerns of a supply deficit in Q4CY23, which lead to oil prices breaching the US$ 90/bbl mark in Sep’23. With the war in Israel, the situation has become even more precarious. If more Middle-Eastern nation get embroiled in the conflict, the already strained oil supply is likely to be impacted further. Higher oil prices will weigh on India’s external position. Our analysis shows that for every 10% increase in oil prices on a permanent basis, CAD is likely to inch up by 0.4% of GDP which can weigh on INR. At present, the risk of this materializing looks limited. Even so, market sentiments have remained fragile and have manifested in the form of a weakness in INR.

FPI flows

During the period Apr’23 to Aug’23, FPI inflows into India swelled to US$ 22bn, which also helped in maintaining currency stability. However, the situation has reversed since then. There is a growing belief that the Fed rates are likely to remain elevated for a longer period which has led to a surge in US yields, thereby drawing interest from foreign buyers. Uncertainty around the future course of the war has also soured investor sentiments making them risk-averse, leading to outflows. On the positive side, FPI inflows into debt have picked up post JP Morgan’s decision to include Indian bonds into its GBI-EM suite. While actual inflows into the index will start in FY25, some momentum can already be seen in the securities which are expected to be included in the index. This has helped offset the withdrawal of FPIs from the equity segment.

USD/INR swap

RBI had conducted a USD/INR sell buy swap auction of US$ 5bn in Apr’22. It must be noted that the announcement to conduct the said swap came at a time when the Russia-Ukraine caught policymakers and central banks worldwide caught off-guard. In the immediate aftermath of the war, global commodity prices increased led by oil, and global financial markets too saw heightened volatility. A flight to safety ensued which put pressure on EM currencies such as India. Hence, while the announcement for the auction was said to be to adjust the maturity profile of RBI’s forward book, it also had an impact on the exchange rate. With the maturity of the swap approaching next week (23 Oct), it is almost ironical that the world has once again found itself in the midst of another unforeseen crisis in the form of the Israel-Hamas war. INR is once again under pressure, having fallen to a fresh record-low in the last few sessions, and still trading above the 83.2/$ mark. There is an imminent possibility of more pressure on the currency from the Fed’s higher for longer rates narrative and escalation in hostilities leading to higher oil prices. In such a scenario, it looks likely that the RBI would roll-over the swap to a later date. This view also gets support from the fact that the RBI has shown an intent to keep liquidity conditions tight. The delivery of the swap could lead to potential liquidity influx of Rs40,000-42,000 crore in the system, which will be detrimental to the RBI’s effort to maintain liquidity at a level which is not inflationary. Apart from this, the fact that India’s foreign exchange reserves though declining over the past few 4 weeks, are still at comfortable levels and hence there is no pressure on RBI to build-up reserves at the present time. Overall, we expect USD/INR to trade in the range of 83-83.5$ in the near term. Higher oil prices due to escalation in tensions in the Middle-East remains a key watchable, and has the potential to push INR closer to the 84/$ mark.