Excluding the impact of HDFC merger, deposits have risen by Rs 16.2 lakh crore (+9%) in FYTD24 so far

Sonal Badhan,

Economist,

Bank of Baroda

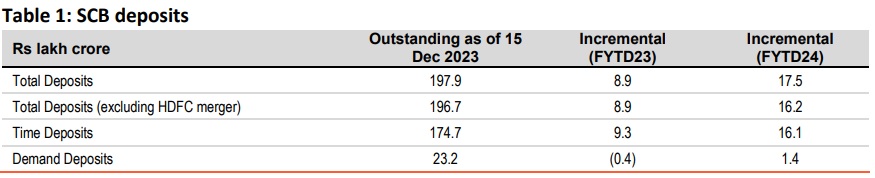

Mumbai, December 30, 2023: RBI’s fortnightly data shows that, SCBs (including

HDFC merger impact) in FYTD24, i.e. between Mar’23 and Dec’23 (as of 15th Dec),

have registered an increase of Rs 17.5 lakh crore as incremental deposit (+9.7%),

with demand deposits noting Rs 1.4 lakh crore (+6.4%) increase, and time deposits

recording Rs 16.1 lakh crore (+10.1%) increase in this period. Excluding the impact

of HDFC merger, deposits have risen by Rs 16.2 lakh crore (+9%) in FYTD24 so far.

Last year in FYTD23 (Mar-Dec), deposits had risen by Rs 8.9 lakh crore (+5.4%), as

Rs 9.3 lakh crore (+6.5%) increase in time deposits was slightly offset by Rs 0.4 lakh

crore (-1.9%) decline in demand deposits.

SCBs’ credit growth

Lending by SCBs (including HDFC merger) has risen by 15.6% in FYTD24 so far

(between Mar’23 and 15 Dec 2023), implying an incremental credit growth of Rs

21.3 lakh crore. If we exclude the impact of HDFC merger, then incremental credit

growth was only Rs 15.5 lakh crore, noting 11.4% increase, which is still slightly

higher than 10.6% increase (+ Rs 12.6 lakh crore) registered in FYTD23 during the

same period.

During this period investments increased by Rs 4.4 lkh crore (Rs 5.45 lkh cr

including HDFC). Hence on the assets side there was an increase of close to Rs 20

lkh cr (excluding HDFC) while deposit increased by Rs 16.2 lakh crore. This explains

the persistent liquidity deficit in the system witnessed for over a month now.

(Disclaimer: The views expressed in this research note are personal views of the

author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing

contained in this publication shall constitute or be deemed to constitute an offer to

sell/ purchase or as an invitation or solicitation to do so for any securities of any

entity. Bank of Baroda and/ or its Affiliates and its subsidiaries make no

representation as to the accuracy; completeness or reliability of any information

contained herein or otherwise provided and hereby disclaim any liability with regard

to the same. Bank of Baroda Group or its officers, employees, personnel, directors

may be associated in a commercial or personal capacity or may have a commercial

interest including as proprietary traders in or with the securities and/ or companies or

issues or matters as contained in this publication and such commercial capacity or

interest whether or not differing with or conflicting with this publication, shall not

make or render Bank of Baroda Group liable in any manner whatsoever & Bank of

Baroda Group or any of its officers, employees, personnel, directors shall not be

liable for any loss, damage, liability whatsoever for any direct or indirect loss arising

from the use or access of any information that may be displayed in this publication

from time to time.)