On a YoY basis, the loan amount disbursed in FY 24-25 reduced by 16.9%

FinTech BizNews Service

Mumbai, June 11, 2025: Micro Finance Industry Network (MFIN) releases the 53rd edition of Micrometer for Q4 FY 24-25 based on the industry position as on March 31, 2025. Micro Finance Industry Network (MFIN) is an industry association of Banks, NBFC-MFIs, SFBs and NBFCs providing microfinance and an RBI-recognized self-regulatory organization. Micrometer is the flagship publication of MFIN which covers progress of Indian Microfinance industry on a quarterly frequency, this is the 53rd Issue.

Report insights

As on 31st Mar’25, microfinance operations are spread across 36 states/UTs and 718 districts

providing financial services to around 7.8 crore unique clients. The data for Q4 FY 24-25 shows that

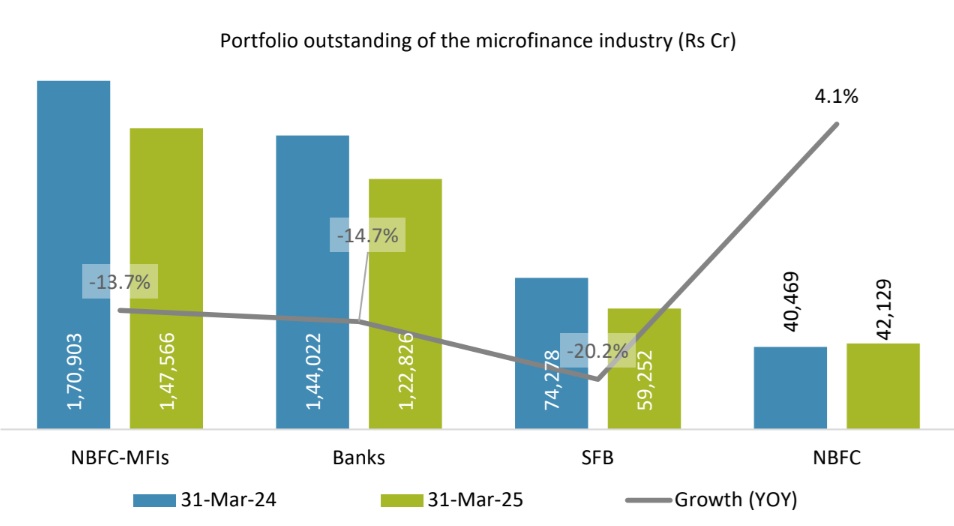

on a YoY basis the portfolio has degrown by 13.5% amounting to Rs 3,75,030 Cr. Among the

regulated entities active in microfinance space, portfolio of all entity types degrew except NBFCs

which has grown by 4.1%. on a YoY basis.

On a YoY basis, the loan amount disbursed in FY 24-25 reduced by 16.9% and the number of new

loans disbursed degrew by 25.4%. In terms of geographical coverage, East and North-East and

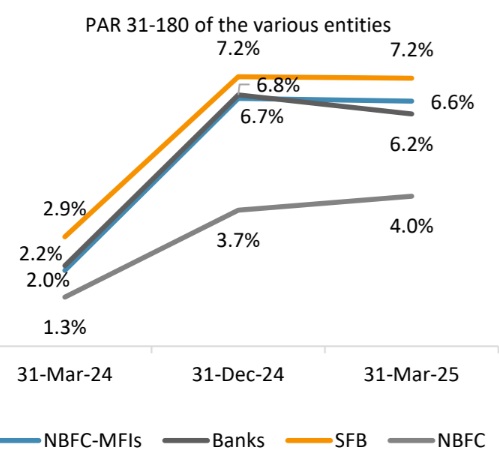

South comprise 62.7% of the total microfinance portfolio. Portfolio quality as measured by PAR 31-

180 was 6.3% as compared to 2.2% at the end of Q4 FY 24-25. The current situation looks positive in

terms of improved credit quality, liquidity ingestion by the RBI in the banking system and

relaxations of QA norms for NBFC-MFIs.

· As on 31 March 2025, 4.2 Cr clients* have loan outstanding from NBFC-MFIs, which is 9.2% lower than number of clients as on 31 March 2024.

· The Asset Under Management (AUM) of MFIs is Rs 1,47,279 Cr as on 31 March 2025, including owned portfolio Rs 1,19,548 Cr and managed portfolio (off BS) of Rs 27,732 Cr. The owned portfolio of MFIN members is 81.0% of the NBFC-MFI universe portfolio of Rs 1,47,566 Cr.

· AUM decreased by 11.9% compared to 31 March 2024 and decreased by 2.4% compared to 31 December 2024.

· Loan amount of Rs 1,12,459 Cr was disbursed in FY 24-25 through 2.2 Cr accounts, including disbursement of Owned as well as Managed portfolio. This is 25.4% lower than the amount disbursed in FY 23-24.

· Average loan amount disbursed per account during FY 24-25 was Rs 50,131 which has increased by around 12.3% in comparison to last financial year.

· As on 31 March 2025, the borrowings O/s were Rs 1,02,503 Cr. Banks contributed 58.3% of borrowings

· O/s followed by 18.0% from Non-Bank entity, 10.3% from External Commercial Borrowings (ECB), 9.1% from AIFIs and 4.4% from other sources.

· During FY 24-25, NBFC-MFIs received a total of Rs 57,307 Cr in debt funding, a 35.7% decrease from FY 23-24. Banks contributed 78.4% of the total Borrowing received followed by Non-Bank entities 11.9%, ECB 5.1%, AIFIs 3.1% and Others 1.5%.

· Total equity decreased by 1.8% as compared to end of FY 23-24 and is at Rs 35,759 Cr as on 31 March 2025.

· Portfolio at Risk PAR 31-180 days as on 31 March 2025 has deteriorated to 6.2%** as compared to 2.0%** as on 31 March 2024.

· MFIs have presence in 26 states and 6 union territories.

· In terms of regional distribution of portfolio (AUM), East and North-East accounts for 33% of the total NBFC-MFI portfolio, South 28%, North 17%, West 14%, and Central contributes 9%.

Dr Alok Misra, CEO & Director observed, last year (FY 24-25) has been a tough year with multiple

factors like heatwave, external incitement, concerns on overleveraging, Karnataka issue etc.

affecting credit quality. Consequent to that funding to the sector also shrinked. As a result, credit

costs went up and GLP fell. However, with adoption of guardrails issued by MFIN by the sector,

credit quality is getting better with PAR 1-90 of the industry at 4.22% as on 31 March 2025