Incremental total credit (bonds, non-food bank credit and CPs) expansion projected to moderate to Rs24.5 trillion in FY2025 from Rs. 25.4 trillion in FY2024

FinTech BizNews Service

Mumbai, May 7, 2024: ICRA forecasts the incremental credit flow in the Indian economy from the domestic sources to moderate to Rs.

24.5 trillion ( Tn) in FY2025, from the all-time high achieved in FY2024. ICRA expects the non-food bank credit (NFBC) to

moderate slightly in FY2025 from the record-high seen in FY2024. However, bond issuances are expected to

increase further in FY2025. As the interest rates are likely to remain elevated in developed markets, the domestic

debt capital market would remain an attractive source of borrowings for large corporates.

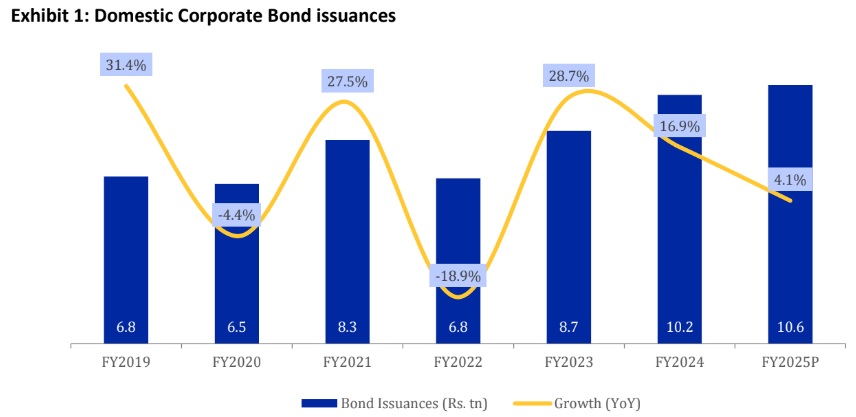

Mr. Sachin Sachdeva, Vice President & Sector Head, ICRA said: “ICRA expects the conditions for corporate bond

issuances to remain conducive for both the issuers and the investors in FY2025, which is likely to drive the bond

issuance to higher levels at Rs. 10.6 trillion in FY2025 from Rs. 10.2 trillion in FY2024. The corporate bond

outstanding is likely to increase to Rs. 50.3 trillion by end-March 2025, a YoY growth of 9.5%.”

Competitive funding conditions in domestic markets compared to developed markets meant that large corporates

tapped more domestic funding sources over the last two years. Strong demand for loans from retail borrowers and

non-bank finance companies (NBFCs) drove a significant portion of the incremental flow of credit from banks. This

resulted in the highest ever NFBC expansion of Rs. 22.3 trillion1 in FY2024 far outpacing the incremental NFBC

expansion of Rs. 18.2 trillion recorded in FY2023.

The incremental credit flow was also supported by the all-time high corporate bond issuances of Rs. 10.2 trillion in

FY2024 (YoY +16.9%, refer exhibit 1), resulting in the stock of corporate bonds outstanding rising to an estimated

Rs. 46.0 trillion (+6.6% YoY) as on March 31, 2024, from Rs. 43.1 trillion as on March 31, 2023. Besides, the stock of

commercial papers (CPs) outstanding also rose by Rs. 0.4 trillion in FY2024 to Rs. 3.9 trillion as on March 31, 2024.

Cumulatively, these three sources accounted for Rs. 25.4 trillion of incremental credit flow in the domestic market,

an all-time high (refer exhibit 2).

The recent regulatory actions on unsecured retail loans, bank funding for NBFCs and tight liquidity in the banking

system may constrain the incremental credit growth of banks. However, the yield on Indian Government Bonds

(IGBs) is likely to remain range-bound, driven by demand from foreign portfolio flows upon inclusion of IGBs in

global indices. This shall improve the competitiveness of funding from debt capital markets vis a vis bank borrowing

and would drive up corporate bond issuances.

“Growth is expected to eventually taper off from these levels on the back of tight liquidity, even as the foreign flows

in IGBs will remain supportive for growth in corporate bond issuances. Accordingly, ICRA estimates incremental total

credit (bonds, non-food bank credit and CPs) expansion to dip to Rs. 24.5 trillion in FY2025,” Sachdeva added.