Education, Consumer, Gold Loans' De-Growth

YOY growth overall is still low at 1.8%

FinTech BizNews Service

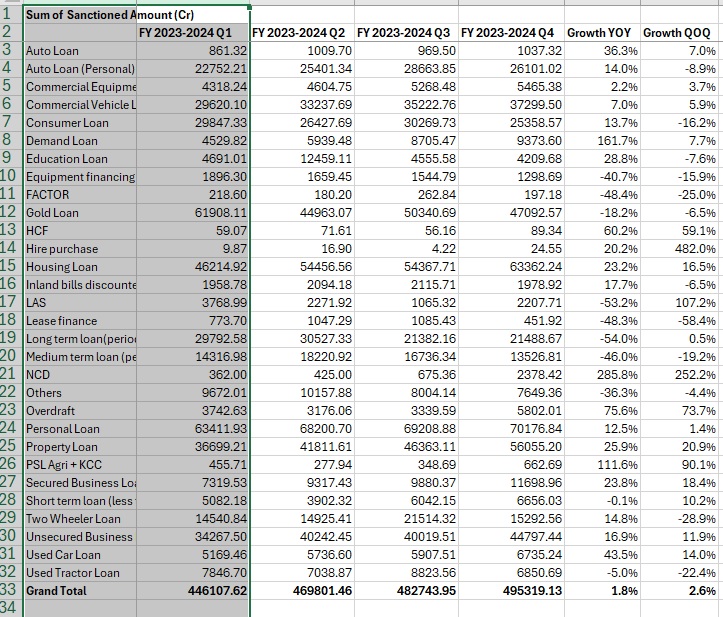

Mumbai, July 03, 2024: Finance Industry Development Council (FIDC) -CRIF data on NBFC sanctions during the last FY 2023-24 provides important indications as to trends in loan growth. Key highlights:

- YOY growth overall is still low at 1.8%. While QOQ data is not comparable due to seasonality factors, it is low at just 2.6% (usually Q4 is much higher than Q3)

- Several sectors in the consumer lending space such as education loans, consumer loans and gold loans showed negative growth QOQ perhaps reflecting the cautionary advice of the RBI

- Even sectors like auto loans, two wheeler loans and personal loans showed slow down QOQ

- Loans against commercial vehicles and equipment as well as medium and long term loans (primarily commercial usage loans) showed slow growth YOY.

- Housing loans and used car loans turned in healthy YOY growth numbers.

- Industrialised states including Delhi, Gujarat, Haryana, Maharashtra and Tamil Nadu showed slow/negative loan growth.