‘Only 1.6% of India’s Population Pays Taxes: The Unsung Heroes of Our Economy’

FinTech BizNews Service

Mumbai, July 05, 2024: Sanjiv Bajaj, Joint Chairman & Managing Director, Bajaj Capital Ltd has made very important observation in his Linkedin post for income tax and argued for a reduction in direct tax rates in the upcoming union budget.

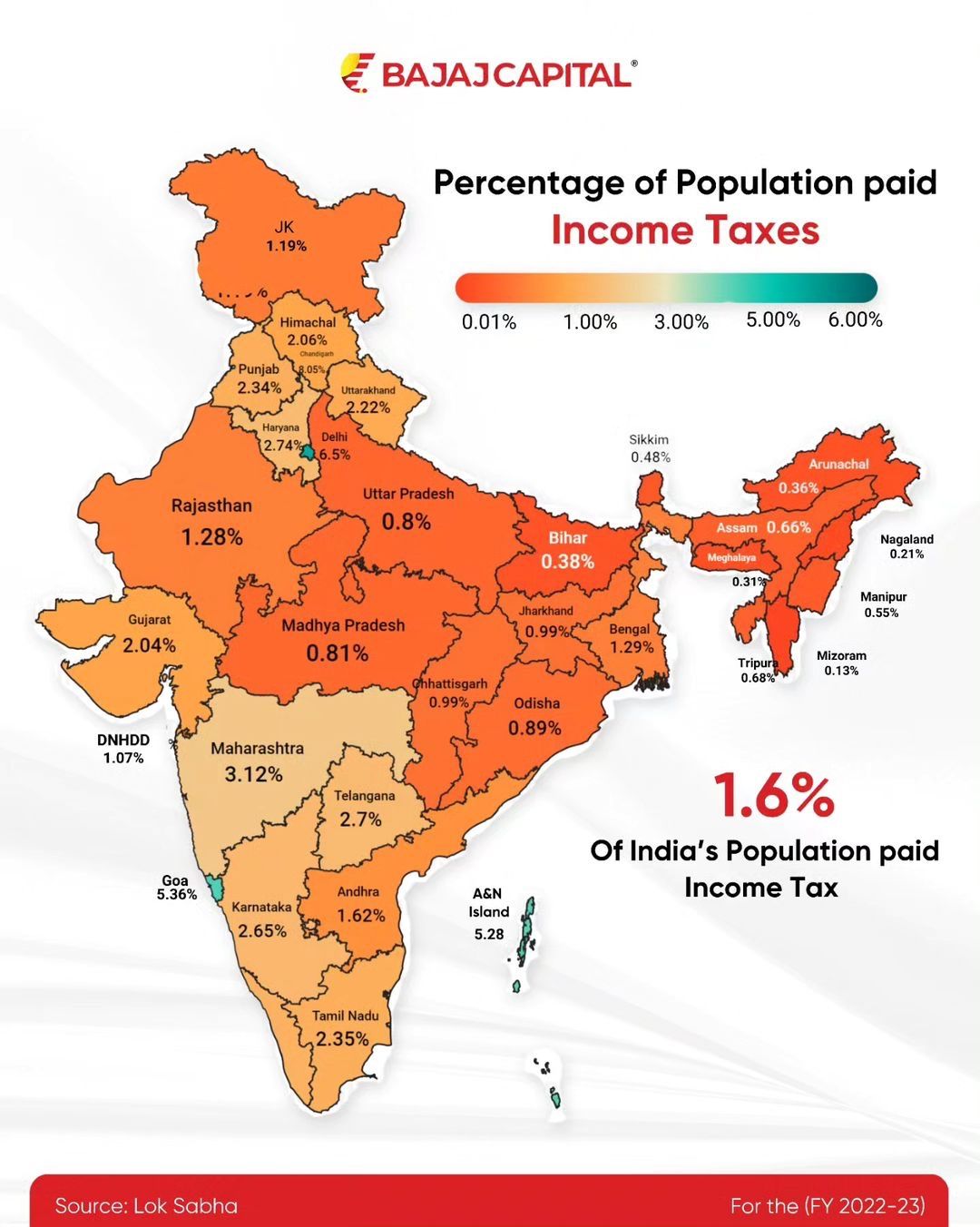

Only 1.6% of India’s Population Pays Taxes: The Unsung Heroes of Our Economy

It’s a startling fact: only 1.6% of India’s population pays income taxes. These individuals are the backbone of our economy, yet they often feel neglected and underappreciated. The much-awaited reduction of the direct tax rate to 25% remains an unfulfilled dream because it is perceived that they don’t matter.

Policies like making life insurance above Rs 5 lakh taxable, EPF above 2.5 lakh taxable, and NPS contributions taxable above a certain limit don’t significantly contribute to revenue but make life tougher for these taxpayers, sending a message that their contribution is not valued. However, I firmly believe they do matter. Each taxpayer influences at least 10 to 20 people, meaning they impact 16% to 24% of the population.

My sincere plea is not to let these people feel that India does not care for them. This budget, I hope to see a reduction in direct tax rates and the removal of unnecessary taxes that don’t contribute but cause inconvenience.

Why a Reduction in Direct Tax Rates Matters

Reducing direct tax rates to 25% can lead to better compliance and higher overall tax collection. Historical data has shown that lower tax rates often result in increased compliance, broadening the tax base and boosting overall revenue.

The Power of Asking

You have been ignored because you don’t ask for what you want. It’s better to ask. As my father says, “You grow by pushing people up, and if you try to pull people down, you will also fall.” Let’s push for a fairer tax system that values and supports the taxpayers who drive our economy.