A volatile west likely to trump the global south through tariff wars; credit offtake, corporate margins take a significant beating: FY25 GDP growth rate likely in 6-6.5% range

Dr. Soumya Kanti Ghosh

Group Chief Economic Adviser

State Bank of India

Mumbai, 29 November, 2024: India story appears to take a brief pause, some kind of unexpected hiatus, with economy (real GDP) growing by a mere 5.4% in Q2 FY25, chiefly dented by sluggish growth in industry. Industry decelerated to 6-quarters low to 3.6% in Q2 due to broad based sluggishness. While Services sector growth in Q2 at 7.1% is a tad higher when compared to last year (6.0%), it is al-most flat as compared to previous quarter (7.2%). Agriculture, the most consistent sector since pandemic, grew by 3.5% in Q2 (Q2 FY24: 1.7%) but proved unable to push the holistic growth as its weighted contribution is only 40 bps. The GVA grew by 5.6% and Nominal GDP grew by 8% in Q2.

With 6.0% real GDP growth in H1 FY25, the overall growth for full fiscal would be less than 6.5% (assuming 6.5-6.8% growth in H2). This manufacturing led slowdown gives a sketchy reading when juxtaposed against non-impulsive credit growth. However, one must be sanguine to look at incremental and not year on year numbers that could throw up a misleading narrative altogether. The slouch in EBIDTA has been examined in detail by us to gauge the depth, as also width of this tectonic shift (in GDP). Also, Capital expenditure growth remains constrained for states because of tied conditionalities, while consumption growth of rural households is holding but unable to match and contribute much to Urban due to lesser share in value.

In actual rupee terms the incremental growth in industry comes to merely Rs 42,515 crore in Q2 FY25 over Q2 FY24 as compared to whopping Rs 1.4 lakh crore growth in preceding corresponding period, indicating a hit of almost Rs 1 lakh crore in incremental terms in overall industry. Around 4000 Corporates in listed space reported revenue growth of only 6.13% while EBIDTA and profit after tax (PAT) growth of around 7% and 9.4% respectively in Q2FY25 as compared to Q2FY24.

Further, Corporate ex BFSI represented by more than 3000 listed entities reported revenue and PAT growth of 3.9% and 6% respectively, in Q2FY25 as compared to Q2FY24. However, ex-BFSI, corporates reported negative EBIDTA growth of around 1.5% in Q2FY25 as compared to 41% growth in Q2FY24. Major sector that contributed to the negative growth of 1.5% in EBIDTA in Q2FY25 include Refineries, Cement, Power Generation and Distribution, Paints/Varnish, Tyres, Air Transport, Paper, Textile etc. Overall EBIDTA margin also declined by 79 bps i.e. from 15.19% in Q2FY24 to 14.40% in Q2FY25.

While taking a deep dive into the numbers, we noted major sectors i.e. Automobile, Cement, Power Generation and Distribution, Tyres etc. reporting lower to negative EBIDTA growth in Q2FY25 as compared to impressive double-digit growth in Q2FY24, while the employee expenses continue to grow positively sans Refineries, which could possibly be the main dragger to the overall GDP growth numbers.

Further, corporate GVA, as measured by EBIDTA plus Employee Expenses also recorded growth of 6.64% in Q2FY25 as compared to around 47% in Q2FY24. Q2FY25 performance seems largely driven by weak performance in commodity-oriented sectors, slowing consumption, and moderation in domestic cyclical sectors like Automobile sector which too reported marginal growth of 4% in EBIDTA as compared to whopping 55% growth last year driven by low input cost and improved realization backed by strong demand.

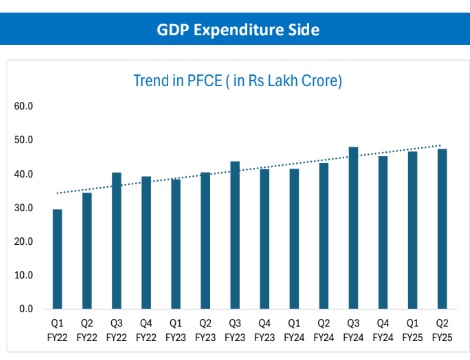

The real private consumption has held the ground with growth of 6.0% almost double of the growth rate in Q2 of FY24. The government consumption has not picked up after the budget as was natural since monsoons slow the public works. This reflects in real government consumption growth of 4.4% and capital formation real growth of 5.4%. The steadily rising rural expenditure over past few quarters reflects resilience and is driving higher rural demand.

Further, During H1 FY25, the centre's capital expenditure is merely 37.3% of full year budget estimates, which is almost 10 percentage points down from the average H1 of FY19-FY24 (47.7%). The situation of states is more precarious, our analysis of capital expenditure of states for H1 FY25 indicate that out of 17 major states only five states exhibited increase in expenditure in H1 FY25.

As per the latest data, during the current year so far (till 15 Nov 2024), ASCBs incremental credit slowed to Rs 9.3 lakh crore (YTD 5.3%) and deposits to Rs 13.7 lakh crore (YTD 6.7%), compared to last year growth Rs 19.4 lakh crore (YTD 14.2%) and Rs 16.0 lakh crore (YTD 8.9%). Clearly, credit growth needs new boosters to augment the economy.

GDP EXPANDS BY MERELY 5.4% IN Q2 FY25

¨ Against all expectations, India’s economy (real GDP)

grew by merely 5.4% in Q2 FY25 on the back of sluggish growth

in industry. The GVA grew by 5.6% and Nominal GDP grew

by 8% in Q2. Core GVA which was higher than the GVA in

previous 5 quarters is below the GVA at 5.3% in Q2 FY25.

¨ Agriculture, the most consistent sector since pan-

demic, grew by 3.5% in Q2 (Q2 FY24: 1.7%) but

unable to push the growth as weighted contribution is

only 40 bps. After 7-quarters, GDP growth plunged below

6.0% mark in Q2 FY25 primarily owing to 3.6% growth in

industry sector. In actual rupee terms the incremental growth in

industry is merely Rs 42,515 crore in Q2

FY25 over Q2 FY24 as compared to whopping Rs 1.4

lakh crore growth in preceding corresponding period.

This indicates a hit of almost Rs 1 lakh crore in incre-

mental terms in overall industry.

Services sector growth in Q2 at 7.1% while showing

smart growth compared to last year (6.0%) is almost

flat as compared to previous quarter (7.2%).

¨ With 6.0% real GDP growth in H1 FY25, the overall

growth for full fiscal would be less than 6.5%

(assuming 6.5-6.8% growth in H2).

CORPORATE RESULT Q2FY25 - MANUFACTURING

DRAG THE SHOW

¨ Around 4000 Corporate in listed space reported revenue growth

of 6.13% while EBIDTA and profit after tax (PAT) growth of around

7% and 9.4% respectively in Q2FY25 as compared to Q2FY24.

¨ Further, Corporate ex BFSI represented by more than

3000 listed entities reported revenue and PAT

growth of 3.9% and 6% respectively, in Q2FY25 as

compared to Q2FY24.

¨ However, ex-BFSI, corporates reported negative

EBIDTA growth of around 1.5% in Q2FY25 as com-

pared to 41% growth in Q2FY24.

¨ Major sector contributed to the negative growth of

1.5% in EBIDTA in Q2FY25 includes Refineries, Ce-

ment, Power Generation and Distribution, Paints/

Varnish, Tyres, Air Transport, Paper, Textile etc.

Overall EBIDTA margin also declined by 79 bps i.e.

from 15.19% in Q2FY24 to 14.40% in Q2FY25.

While taking a deep dive into the numbers, we noted

major sectors i.e. Automobile, Cement, Power Generation

and Distribution, Tyres etc. reported lower to negative EBIDTA

growth in Q2FY25 as compared to impressive double-digit growth

in Q2FY24, while the employee expenses continue to grow positively

sans Refineries, could be the main dragger to the overall GDP growth numbers.

Further, corporate GVA, as measured by EBIDTA plus Employee Expenses also

recorded growth of 6.64% in Q2FY25 as compared to around 47% in

Q2FY24.

For example, Refinery companies reported negative

EBIDTA growth in Q2FY25 over higher expenses and

weak refining margins. The cost of raw material con-

sumed or the input cost increased by around 5% i.e.

from 54.9% in Q2FY24 to around 60% in Q2FY25.

Similarly in Cement sector also the total input ex-

penditure including raw material cost increased by

around 5% in Q2FY25 as compared to the same quar-

ter previous year coupled with continuous price

drop.

Q2FY25 performance largely driven by weak perfor-

mance in commodity-oriented sectors, slowing con-

sumption, and moderation in domestic cyclical sec-

tors like Automobile sector which too reported mar-

ginal growth of 4% in EBIDTA as compared to whop-

ping 55% growth last year driven by low input cost

and improved realisation backed by strong demand.

EXPENDITURE SIDE GDP

The general demand shows a trend which is

consistent with what was happening in Q1 FY25 but

with some changes owing to seasonal factors in Q2

covered later.

The real private consumption has held the ground

with growth of 6.0%, almost double of the growth

rate in Q2 of FY24. The government consumption has

not picked up after the budget as was natural since

monsoons slow the public works. This reflects in real

government consumption growth of 4.4% and capital

formation real growth of 5.4%.

The expenditure head that has seen sharpest

increase is valuables registering a growth of 14.4%

compared to contraction in Q2 FY24 on account of

high investment demand for gold due to sharp rise in

prices.

The exports have slowed on expected line with

growth rates at 2.8% in Q2 FY25. The imports have

contracted by 2.9% in Q2 FY25 in real terms indi-

cating slowdown in capital formation owing to

seasonal reduction in intermediate demand and

reduction in consumption of petroleum products.

The expenditure side trends were impacted by high

discrepancy component. Although all expenditure

heads, barring valuables, show sequential decline,

the overall conclusion warrants caution in concluding

that demand has weaned. A part of the reason for

the unexpected drop in GVA was the impact of La

Nino in Q2 and above-normal August rainfall which

impacted the estimates for the full quarter. The shift

in weather parameters resulted in exceptional low

demand for power from agriculture, a shift in

production towards hydroelectricity and a drop in

output of coal (the high frequency indicator for

quarterly estimates of mining) due to waterlogging.

Rural Expenditure:

Taking 45% contribution of rural economy in total income share,

we calculated that Rural PCFE witnessed a 10% rise in Q2 FY25

over same quarter previous year. The steadily rising rural expenditure

over past few quarters reflects resilience and is driving higher rural demand.

CENTRE AND STATES’ CAPITAL EXPENDITURE

IS AT LOWER SIDE IN H1 FY25

During H1 FY25, the centre's capital expenditure is

merely 37.3% of full year budget estimates, which is

almost 10 percentage points down from the average

H1 of FY19-FY24 (47.7%).

The situation of states is more precarious, our analy-

sis of capital expenditure of states for H1 FY25 indi-

cate that out of 17 major states only five states ex-hibited increase in expenditure in H1 FY25 as com-pared to H1 FY24. This is one of the reasons of low

growth in Q2 FY25. Due to tied conditionalities on

expenditure of states we are not expecting any uptick

in the H2 expenditure also. This will keep the overall

growth numbers between 6-6.5% only.

CREDIT GROWTH MODERATED SIGNIFICANTLY; MAY

HAVE PUSHED GDP LOWER

In the credit market, NBFCs, including MFIs, have

drawn regulatory attention on account of exorbitant

interest rates charged to their customers. Additional-

ly, many banks are experiencing stress in small ticket

advances, credit cards and personal loans. More gen-

erally, banks have circumspectly reined in lending to

retail and services.

As per the latest data, during the current year so far

(till 15 Nov 2024), ASCBs incremental credit slowed

to Rs 9.3 lakh crore (YTD 5.3%) and deposits to Rs

13.7 lakh crore (YTD 6.7%), compared to last year

growth Rs 19.4 lakh crore (YTD 14.2%) and Rs 16.0

lakh crore (YTD 8.9%).

The sector-wise incremental credit growth for Octo-

ber 2024, indicate that credit growth has slowed

down across the sectors. Agri & Allied sector YTD

growth declined to 6.5% (Last year: 10.6%), Industry

3.3% (Last year: 3.9%), Services 4.2% (14.2%) and

Personal loans 5.9% (Last year: 19.6%). Credit to

housing has declined significantly to RS 1531 bn dur-

ing Apr-Nov’2024, compared to last year growth of

RS 5708 billion. Consumer durables credit growth

(YTD) has tuned negative of 0.3%, compared to last

year growth of 5.7%.

Among major industries, credit to ‘paper & paper

products’, ‘Rubber, Plastic and their Products’,

‘chemicals and chemical products’, and ‘construction’

recorded a higher incremental growth during Apr-

Oct’24, as compared to their respective growth rates

a year ago. Credit to all other industries has declined

significantly.

By looking the trend growth, both deposits and credit

may grow in the range of 11-12% during FY25.

EMPIRICAL RELATIONSHIP BETWEEN GDP AND CREDIT

GROWTH: ASCB CREDIT CAUSES GDP

To test the long-term relationship between GDP and

credit, we have used Johansen cointegration test for

the period FY90 to FY24. The results show that two

series have one cointegration relationship, implying

that the two tend to move together.

Additionally, Granger causality test results for the

GDP and credit data from 1990 shows that there is

one way causal relationship between GDP and ASCB

credit, with increase in credit leading to higher GDP.

So, as credit continue to decline, GDP may decline in

Q3 too.