The technology should focus on several key areas, enabling early corrective action; analyzing both structured and unstructured data to identify related party or preferential transactions, saving resources for lenders and resolution professionals; automating routine tasks in post-disbursement credit monitoring

FinTech BizNews Service

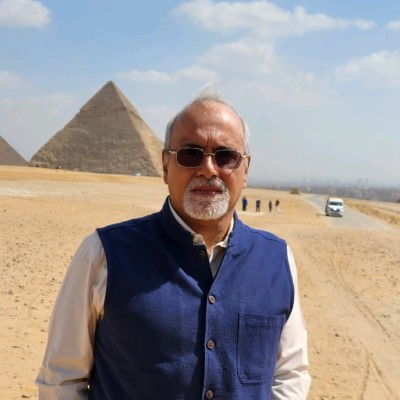

Mumbai, 17 December, 2024: M. Rajeshwar Rao, Deputy Governor, Reserve Bank of India, delivered Inaugural address on the topic of ‘Strengthening the IBC Framework for Effective Resolution’ at the International Conclave, jointly organised by the Insolvency and Bankruptcy Board of India (IBBI) and INSOL India, in New Delhi December 7, 2024. Here is the complete text of his speech:

Good Morning Ladies and Gentlemen.

At the outset, I would like to thank Shri Ravi Mital, Chairperson, Insolvency and Bankruptcy Board of India for inviting me to this international conclave on the theme ‘Insolvency Resolution: Evolution & Global Perspective’ being held in collaboration with INSOL India. A confluence in the thought processes of policy makers, practitioners and academicians would perhaps help to shape an objective assessment of the resolution & insolvency regime in the country. This should then enable us to chart out a future path for the resolution processes to make it more effective and efficient.

2. Today, let me begin by reflecting on the role of Insolvency and Bankruptcy Code (IBC) in cleaning up of banks’ balance sheets and on the possible ways we could further leverage its potential for the key stakeholders from our perspective, viz. the financial creditors. The present insolvency and bankruptcy regime in India was the outcome of the suggestions made by the Bankruptcy Law Reforms Committee headed by Dr. T K Viswanathan. The Committee's recommendations for the new insolvency and bankruptcy resolution system were based on a few core principles namely (i) facilitating the assessment of viability of the enterprise at an early stage; (ii) enabling symmetry of information between creditors and debtors;(iii) ensuring a time-bound process to better preserve economic value; (iv) respecting the rights of all creditors, with clarity on priority; and (v) ensuring finality of outcomes.

3. The outcome of the action on these recommendations was the Insolvency and Bankruptcy Code (IBC) of 2016. The code and its related ecosystem have continued to evolve since then, effectively advancing the principles mentioned above. However, its implementation being a function of the broader ecosystem in which it operates, the code has faced various criticisms in its relatively short existence, particularly regarding delays in meeting timelines and unsatisfactory recovery rates, partly due to the misaligned incentives amongst the stakeholders. While several amendments have been made to the IBC since its introduction to address some of these concerns, challenges persist.

Role of IBC in cleaning up of bank balance sheets

4. As you are aware, asset quality position of the banking system has shown a remarkable improvement over the past few years – specifically, the gross NPAs of the scheduled commercial banks have declined from the peak of 11.2% in March 2018 to 2.8% in March 20242. A good part of that reduction is attributable to resolution processes enabled under IBC. If an overall assessment of IBC is made, it shows a significant level of traction as a resolution mechanism. As of September 2024, 8,002 cases3 have been admitted into the Corporate Insolvency Resolution Process (CIRP) and approximately 75% of these cases were closed through resolution, withdrawal, review, settlement, or liquidation. Of the closed cases, 56% were either resolved, settled, or withdrawn. In a positive trend, the ratio of resolutions to liquidations has risen from 21% in 2017-18 to 61% in 2023-24. In addition to facilitating resolution outcomes, the IBC has also been effectively used by both financial and operational creditors to encourage borrowers to repay their debts. By March 2024, 28,818 cases involving an outstanding default amount of ₹10.22 lakh crore were withdrawn prior to admission.

5. In terms of the powers vested under newly inserted Section 35AA of the Banking Regulation Act, RBI had issued directions to banks in 2017 in respect of 41 entities, which accounted for more than 35% of the banking system NPAs at that point, for filing CIRP applications. So far, resolution plan has been approved in the case of 17 borrowers4, orders of liquidation have been issued in the case of 12 borrowers, settlement was reached by lenders with 2 borrowers; and in 4 cases the lenders have assigned their exposures to ARCs. The aggregate realisation for financial creditors from the 17 resolved cases has been around 50% of admitted claims and 190% of liquidation value.

6. Financial creditors are now actively leveraging the Code for resolution of stressed assets. As of September 2024, around 633 corporate debtors, where insolvency application was initiated by financial creditors, have been successfully resolved under IBC, yielding an average realization of 30.09% of admitted claims. Further, CIRP applications filed by financial creditors in 702 corporate debtor accounts have been either resolved through appeal/review/settlement or withdrawn under section 12A. Similarly, liquidation orders have been passed in respect of 1224 corporate debtors.

7. Moreover, the operationalisation of section 227 of the code in 2019 empowered Reserve Bank to leverage the IBC mechanism for resolution of Financial Service Providers (FSPs). Reserve Bank has used this avenue for initiating insolvency proceedings against four FSPs so far and all of them have been successfully resolved as on date. Evidentially, IBC seems to have played a significant role in cleaning up the bank balance sheets.

8. Although the IBC has proven to be a valuable tool for creditors, its full potential has been realized only to a limited extent. Let me elaborate on some of the factors that have constrained its effectiveness to give a clearer understanding of why the IBC's potential has not been fully harnessed.

(i) Delay in initiation

9. Time and Timing are both crucial for the effectiveness of the resolution process. While delays within the IBC process have been widely discussed, an equally important issue is the delay in initiating the IBC process itself. The IBC grants all creditors the right to initiate the CIRP upon default. However, in practice, the average time taken by financial creditors from the date of default to the filing of the CIRP is often several months. A significant amount of value is lost during this period, which ultimately impacts the recovery outcome. In this context, the role of financial creditors is vital—they must take prompt action to prevent further value erosion.

10. While IBC has gained prominence of late, we need to realise that it is just one amongst the host of mechanisms available for creditors to resolve financial stress. There are other statutory mechanisms for enforcing security, as well as out-of-court workout options for resolution, each with its own role and limitations. From a regulatory perspective, the Reserve Bank remains neutral regarding the mechanisms chosen by lenders, as long as the actions are initiated in a timely manner so as to facilitate the prompt resolution of financial distress.

(ii) Efficacy of out of court workouts

11. The real success of a formal insolvency framework lies in its role as a deterrent than based on its actual use. It is out of court workout procedures that need to work as the primary instruments of resolution, albeit under the shadow of the formal insolvency framework. In the Indian context, the RBI’s Prudential Framework on Resolution of Stressed Assets provides a viable out of court workout mechanism. This Prudential Framework provides a broad principle-based regime for early recognition of stress and time-bound resolution by the lenders. However, the efficacy of this mechanism has been constrained on account of several factors, including issues with coordination among lenders. What is therefore required is a mechanism to bridge the principle-based resolution approach under out of court workout with that of the statutory umbrella of IBC so that a resolution initiated out of court can be transitioned and get implemented under IBC.

12. Recognising this requirement, the Pre-Pack Insolvency Resolution Process (PPIRP/pre-pack) was introduced in 2021, aimed at resolution of micro, small and medium sector enterprises (MSMEs), as an alternative to a regular CIRP. The Pre-pack was envisaged to be a panacea for MSMEs as it had all the ingredients to make a successful resolution recipe: debtor in possession, cost-effective, quicker resolution timelines and base resolution plan prepared by the MSME itself. Under the pre-pack arrangement, the MSMEs and creditors have to reach a prior agreement to resolve, before formally entering into pre-pack insolvency process. Despite all the advantages, only ten applications have been admitted under PPIRP so far, out of which one was withdrawn, and resolution plans has been approved in five cases.

13. The IBBI had established an Expert Committee, which submitted its report in May 2023 on the Creditor-led Resolution Approach under the Insolvency and Bankruptcy Code, 2016. The report suggests converting the current fast-track process under the IBC into a 'creditor-led' and 'out-of-court' insolvency resolution process, similar to the PPIRP, but with key modifications to address challenges observed in the adoption of PPIRP. A suitable framework could be adopted in this regard that would be aligned with the intended objectives without undermining the essence of the IBC.

(iii) Role of Committee of Creditors (CoC)

14. The IBC assigns a central role to the Committee of Creditors (CoC) in the CIRP. However, this is an area where significant improvements are needed. There have been instances where the CoC’s performance has been found lacking in several aspects. These include disproportionate prioritization of individual creditors' interests over the collective interest of the group; disagreements among CoC members on approving a resolution plan due to concerns over undervaluation or perceived lack of viability; disagreements on the distribution of proceeds even when a resolution plan is agreed upon; non-participation in CoC meetings and lack of effective engagement, coordination, or information exchange among members. Instances have been noted regarding insufficient skill sets in areas like corporate finance, legislation, and industry knowledge; and, lastly, the nomination of financial creditors to the CoC are entrusted with responsibilities that far exceed their actual authority.

15. It is in the larger interest of the creditors that the issues relating to the conduct of the CoC are addressed by the members themselves without waiting for regulatory prescriptions or fiats. However, it is a fact that when incentives are not perfectly aligned, deviations from best practices become the norm. Therefore, we need an enforceable code of conduct for the CoC. Obviously, it would not be possible for the sectoral regulators to enforce this given the diverse set of financial creditors. Ideally, the IBBI, which is the designated regulator under the IBC, should have the powers to enforce norms around the conduct of all stakeholders under the IBC process.

(iv) Role of the Resolution Professional

16. Another key stakeholder under the IBC ecosystem is the Resolution Professional (RP) whose expertise and proficiency materially impacts the outcome of the resolution process. The resolution professional should have thorough knowledge of the industry, the business environment, laws in force and should also be adept at financial analysis and management of distressed firms. The aspect of management is very critical here as the RP takes control of the distressed corporate debtor and virtually discharges the duty of the MD/CEO, based on the advice of the CoC. Any shortcomings in the selection and in the action of the RP would be a significant impediment in the process. The code implicitly and explicitly casts lot of operational responsibilities on the RP ranging from collation of claims to finding prospective resolution applicants to providing material inputs to CoC for finalising the resolution plan. However, in many instances, the RP do not enjoy the cooperation of other stakeholders, which impairs the ability of the RP to discharge its duties satisfactorily. It is heartening to note that that IBBI has taken steps to facilitate the training of RPs through the continuing professional education (CPE) programs, trainings, workshops, webinars, and seminars. These steps together with better enforcement of conduct related regulations would go a long way in addressing these issues.

(v) Incentivising resolution professionals

17. Regulations can set the boundaries for an activity but cannot cover every detail. While regulations have helped create an ecosystem for Resolution Professionals (RPs), their compensation should be determined by the market based on commercial considerations. RPs step in after all attempts to resolve the issue by the debtor and creditors fail, and they take on the important task of managing the debtor’s affairs. Managing a corporate debtor under insolvency proceedings requires specialized skills. The market should develop compensation structures for RPs that are tied to the outcomes of the resolution process. This would address the principal-agent issue and align the RP’s goals with the CoC, maximizing value for both parties. It would also attract experienced professionals, benefiting the system as a whole.

Way Forward

18. It has been nearly eight years since the introduction of the code and several large cases have been successfully resolved under the code. Quality data is being generated, out of the insolvency process, which could be used in future as inputs for credit underwriting as well as valuation.

19. The IBC eco-system would not be complete if it cannot provide a feedback loop to the real economy through a review of experience in resolution or liquidation. A detailed study of enterprises placed under the insolvency process can provide valuable insights if we compile data from such cases. Currently such data is not compiled systematically and is disaggregated, mostly concentrated with individuals based on their experience and exposure. If this data is collected and institutionalised through a structured process, it can give us valuable insights and precedents on how to proceed in complex cases. Such data therefore needs to be gathered in a structured manner so that it can be disseminated for the benefit of all stakeholders involved.

Leveraging Data…

20. There are few key areas that could be explored further to improve the overall resolution ecosystem. First, a better understanding of the reasons behind defaults—whether this is on account of the general economic environment, specific industry challenges, or professional mismanagement. This perspective can help to tailor appropriate solutions. Second, addressing the delay resulting from lack of cooperation by some corporate debtors in the insolvency process, such as delay in submitting information, withholding valuable details, using litigation to stall progress, or creating indirect obstacles to discourage potential resolution applicants, is crucial. Finally, examining valuation, including insights on how collateral types affect realization versus valuation, the impact of time on recovery, and the relationship between resolution timelines and valuation outcomes, could provide us with information which can help us to improve the process. Perhaps better valuation at the time of appraisal is the key. Often the disparity in valuation between the appraisal and the resolution stages is indicative of over exuberance in valuation and possible lack of appropriate due diligence.

…and Technology

21. With the rise of technology, the payment ecosystem has undergone significant transformation. Fintech service providers are using technology to gain insights into consumer behaviour through the vast payment data generated. Some progress has been made in using technology for loan underwriting, particularly for small borrowers and MSMEs, through cash flow-based models. The next step should be for banks and other stakeholders to use technology to help resolve issues with stressed borrowers. The technology should focus on several key areas like predicting defaults before they happen based on the borrower’s data, enabling early corrective action; analysing both structured and unstructured data to identify related party or preferential transactions, saving resources for lenders and resolution professionals; automating routine tasks in post-disbursement credit monitoring, freeing up time for lenders to focus on more complex issues; and reading legal documents and contracts to provide valuable insights for the CoC and resolution applicants when valuing the corporate debtor. As technology and its application evolves on these fronts, there could be significant reduction in effort involved as well as costs associated with the resolution.

Conclusion

22. I would like to close my remarks with few parting thoughts! It is possible that bankruptcy or liquidation proceedings may be the only way for the company to revive and start afresh. We should, however, look to restructuring and revival of units as the first option and enable it in a quick and time bound manner. There are valuable assets vesting within an enterprise that we as a nation can ill afford to run doing even though as creditors the liquidation process appears as the safer and risk free option. For this it may be necessary to create an ecosystem that encourages revival of the enterprises. While IBC 2016 remains a landmark legislation, that has fundamentally altered the landscape of corporate practices in the country, the onus is on us to ensure that collectively, we harness the potential of the code to create a thriving ecosystem which enables value preservation.

23. In our journey to improve the resolution frameworks, let us not only look at the perceived obstacles or the roadblocks but also look back at the path we have traversed so far and the learning’s along the way. We need to think of measures which can make the code an effective option for unlocking economic value of an enterprise even as we ensure strict enforcement of the provisions of the code in case of recalcitrant or unscrupulous borrowers. The last decade has been a journey of learning, improvements, and growth for all of us who are stakeholders in this process as Regulators, financial institutions or as borrowers. This Conclave should bring out fresh insights as to how to unlock the potential of the Code which will serve to strengthen the financial system, so that it plays its role in fostering a robust growth for our nation.

Thank you and Namaskar.