As per CME FedWatchTool, there is 61% probability of 25bps rate cut in Sep’24

Sonal Badhan

Economist,

Bank of Baroda

Mumbai, June 17, 2024: Currency update: INR faced significant volatility in the 1st fortnight of Jun’24 and depreciated by 0.1% to currently trade near a low of 83.57/$. Multiple factors impacted Rupee. Volatility in the domestic market post the announcement of general election results, strengthening of dollar, FPI outflows, and rise in oil prices led to increased pressure on INR. As a result, INR traded in the range of 83.15-83.57/$. In the next fortnight, we expect INR to strengthen, in the wake of renewed FPI inflows, with an expected trading range of 83.3-83.6/$. Weakness in US$ is also expected as investors price more than expected rate cuts in CY25.

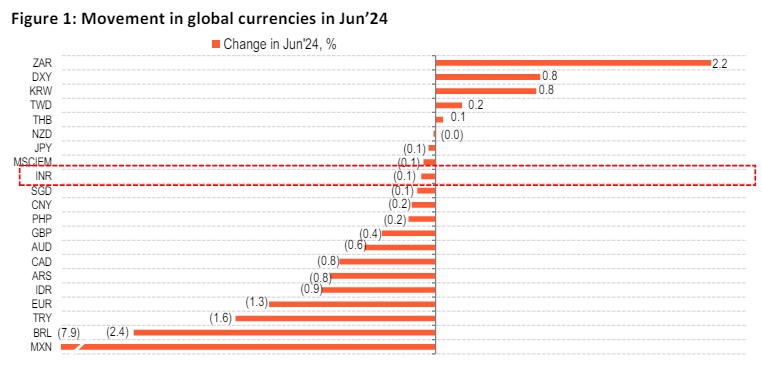

Movement in global currencies in Jun’24

In Jun’24 (as of 14 June), major global currencies depreciated against the dollar. The movement in global currencies was led by rebound in dollar. DXY index, measuring the dollar’s value against a basket of currencies is 0.8% higher in Jun’24, reversing the 1.5% loss it made last month. Dollar regaining strength can be attributed to Fed’s continued narrative of ‘higher for longer’ rate scenario. As per the latest Fed policy projections, the central bank expects growth to hold ground (2.1% in CY24) and PCE inflation to settle at 2.6% versus 2.4% estimated earlier. The Dot plot also indicates that the members are looking at 1 rate cut this year. Apart from this, weakness in other currencies EUR and JPY also supported dollar demand. Ongoing political uncertainty in Europe (European parliamentary elections and snap elections in France), has pulled EUR down by more than 1%. In case of Yen, no change in the stance by BoJ and deferred plans to announce the details of winding up of its bond purchase program impacted market sentiments.

Performance of rupee

As most global currencies fell against the dollar, INR too declined, by 0.1% in Jun’24 (as of 14 June) hovering near its lifetime low of 83.57/$. Even EM currencies depreciated by 0.1%, as oil prices began to inch up towards the end of this fortnight. Brent has risen by 1.2% as of 14 Jun, when compared with the end of the previous month. Compared with early Jun’24, prices are up by 6.6%. FPI outflows had also been maintaining pressure on the currency, and outflows were seen during most part of early Jun’24. Only towards the end of the fortnight, when there was more clarity on results of the general election, the tide changed. As of 14 Jun FPI inflows stand at US$ 57mn, compared with US$ 1.5bn of outflows recorded in May’24. Dip in US 10Y yield is also helping flows move towards India.

Trade performance in May’24

In May’24, trade deficit widened to US$ 23.8bn from US$ 19.1bn in Apr’24, as imports rose (+ US$7.8bn) at a faster pace compared with exports (+ US$3.1bn), on sequential basis. In YoY terms, exports were up by 9.9%, helped by both oil (15.7% versus 3.1%) and non-oil exports (7.8% versus 0.6%). Within non-oil exports, growth in pharma, engineering goods and textiles exports rebounded in May’24. Import growth on the other hand, moderated to 7.7% in YoY terms, from 10.3% in Apr’24, dragged by gold imports. In contrast, oil and non-oil-non-gold imports inched up. Growth in non-oil, non-gold imports was at 1.1% in May’24 versus 0.5% in Apr’24. Coal, chemical imports fell, electronic goods imports slowed, while that of capital goods and transport equipment jumped.

Outlook

Pressure on INR is likely to ease in the near term amidst regained stability in the domestic markets and revival in FPI flows. In addition, as market participants digest the latest macro prints from the US and readjust their rate cut expectations, US$ is likely to weaken in the coming fortnight. As per CME FedWatchTool, there is 61% probability of 25bps rate cut in Sep’24. To support the investor sentiment, most recently, US PPI surprised on the downside and fell by (-) 0.2% in May’24 (est.: +0.1%), following 0.5% rise in Apr’24. In addition, US initial jobless claims for the week ending 8 Jun 2024, rose to 10-month high of 242k (est.: 225k). For continuing claims, the 4-week average has jumped to 1.8mn from 1.78mn last week. In contrast, renewed volatility in oil prices will add to depreciation pressure on INR. At US$ 655.8bn, India’s forex reserves give RBI more than ample buffer to see through the volatility. On balance, we expect INR to trade the range of 83.3-83.6/$ in Jun’24.