Strong Rebound In Gold ETF Inflows In India: Motilal Oswal Private Wealth

FinTech BizNews Service

Mumbai, May 30, 2025: According to Motilal Oswal Private Wealth’s May Alpha Strategist Report, In Q1 2025, the gold market experienced a historic surge, with prices reaching record highs amid escalating geopolitical tensions, tariff wars, and a weakening US dollar. The total supply rose modestly, but the soaring price led to a significant increase in market value. Investment demand saw a dramatic 170% y/y rise, driven by a strong rebound in gold ETF inflows, particularly in Europe, Asia, and India.

Central banks maintained robust buying, adding 244 tones, signaling continued confidence in gold as a strategic reserve asset, especially among emerging markets. Meanwhile, jewelry demand declined sharply under the weight of high prices, with India seeing a 25% drop in volume despite a slight rise in value, as consumers shifted to smaller purchases or exchanged old jewelry.

The Reserve Bank of India slowed its gold accumulation but still increased its holdings, reflecting a cautious yet strategic stance. Overall, the quarter highlighted gold's enduring appeal as a hedge against uncertainty, even as traditional consumption showed strain.

Navigating Record Prices and Shifting Demand in Early 2025

The first quarter of 2025 witnessed a dynamic gold market, marked by record-setting prices and notable shifts in demand across various sectors. Total gold supply reached 1,206 tones (t), a 1% increase year-on-year and the highest for the first quarter since 2016. This slight uptick in demand volumes translated to a significant 40% y/y rise in value, reflecting the surging price of gold.

The main factors fueling this price are the tariff wars, geopolitical uncertainty, stock market volatility, and US dollar weakness.

The domestic spot gold prices in India also mirrored this trend, rising 23% y-t-d to INR93,217/10g.

Investment Demand Surges

Investment in gold ETFs lead to a significant jump gold investment demand in Q1 2025, reaching 552t, marking a 170% y/y increase. This level almost matched that seen in Q1 2022 following the outbreak of the Russia-Ukraine war. The surge was primarily driven by a sharp revival in gold ETF inflows, which recorded their strongest quarterly demand for three years. Global gold-backed ETFs saw holdings increase by 226t during the quarter, bringing collective holdings to 3,445t. This was boosted by trade tensions and gold price momentum, with investors rushing for the safety of gold.

European-listed funds added 55t, supported by the prospect of further ECB rate cuts. Asian-listed funds rose by 34t, with the bulk of this demand coming from funds listed in China due to escalating trade tensions with the US. India also showed strong growth in ETF holdings, increasing by 11% over the period.

Central Bank Demand Remains Robust

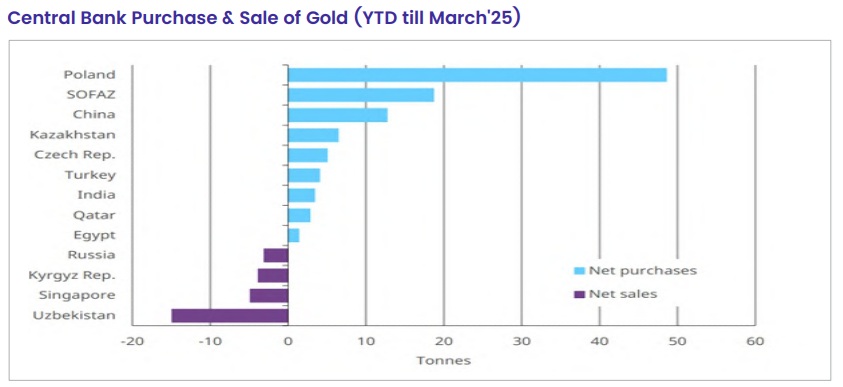

Central banks continued their impressive demand for gold, adding a further 244t to global official reserves in Q1 2025. While this was lower than the previous quarter, it was still healthy at 24% above the five-year quarterly average and just 9% below the average seen over the last three years of elevated demand. Uncertainty, which propelled the gold price to record highs, likely reinforced central banks' interest in gold as a store of value and its performance during crises. Both buying and selling remained concentrated among emerging market central banks. The diversification of central bank reserves, with a reduction in US assets, continues and is not expected to end unless geopolitical tensions shift materially.

RBI Gold Buying Moderates

The Reserve Bank of India added 0.6 tones of gold to its reserves in March, bringing total holdings to a record 879.6 tones, or 11.7% of its total foreign exchange reserves. Over the past year, the RBI increased its gold holdings by 57.5 tones, raising gold's share in reserves by nearly 4%. However, gold purchases have recently slowed, with reduced buying in January and March indicating a more cautious, strategic approach despite gold's growing importance in reserve management.

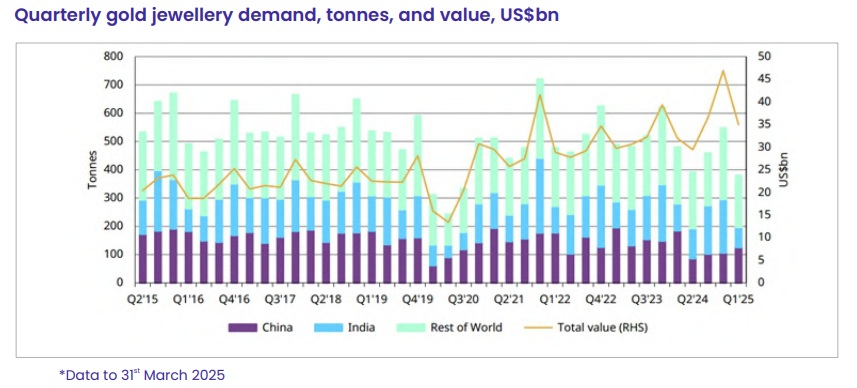

Jewelry Demand Contracts on High Prices

Gold jewelry demand fell sharply in Q1 2025 due to the record price environment. India experienced a 25% y/y fall to 71t, the lowest quarterly volume since Q3 2020, as the record price impacted affordability. Despite the volume drop, the value of demand in India was 3% higher y/y.

Consumers adapted to high prices by buying smaller or more lightweight pieces, holding back purchases, or opting to trade in old jewelry for new. In India, around 40-45% of purchases reportedly involved some form of exchange by the end of the quarter. The trend of gold loans, where jewelry is pledged as collateral, also continued to grow in India. While need based purchases like those for weddings held up relatively well, they were not enough to offset the drop in discretionary buying.

Global gold demand hit a Q1 record in 2025, driven by strong ETF inflows and continued central bank buying despite a slowdown from last year, while jewelry demand fell sharply due to high prices. India, gold jewelry consumption dropped in volume but remained resilient in value terms, with the Reserve Bank of India modestly increasing its reserves, reflecting ongoing price sensitivity and gold's continued strategic portfolio importance.