Important Clarification by Kotak Mutual Fund: This temporary restriction on lumpsum/switch-in investments should NOT be interpreted as a negative view on silver as a commodity.

FinTech BizNews Service

Mumbai, October 9, 2025: Kotak Mutual Fund Has Temporarily Suspended Lumpsum/Switch-in Subscriptions in Kotak Silver ETF Fund of Fund.

Effective Date is 10th October 2025

Market Context

As per a press release released by the Kotak Mutual Fund today late evening, global silver markets have experienced a sustained demand-supply deficit over recent years, driving prices upward. In light of this trend, we have been advising investors to consider allocating funds to silver as part of a diversified portfolio.

Current Domestic Market Situation

However, domestic silver is currently trading at a significant premium compared to international

prices due to acute scarcity in India's physical silver market.

Key observations:

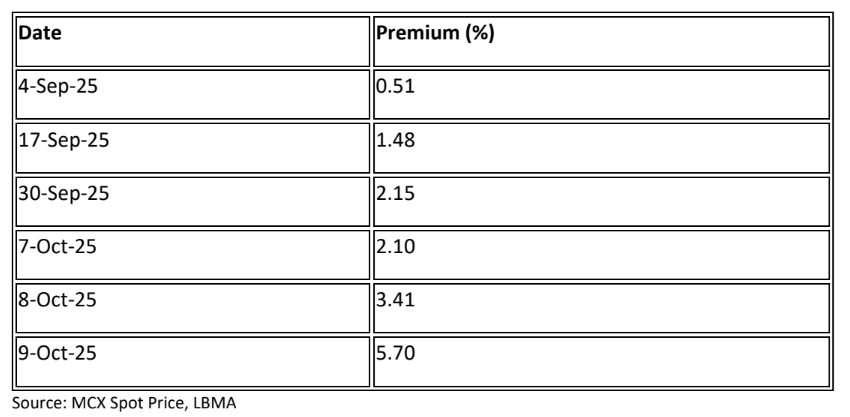

The premium has increased from approximately 0.5% in early September 2025 to 5.7% as of

9th October 2025

On 9th October, the intraday premium peaked at 12% before closing at 5.7%

Current market conditions show a buying premium of approximately 10% and a selling

premium of approximately 3%

Source: MCX Spot Price, LBMA

Supply Outlook

We anticipate that the shortage in domestic silver supply may persist through the end of October

2025.

Action Being Taken

In the best interest of our investors, we are implementing the following measures effective 10th

October 2025:

✓ Lumpsum/Switch-in investments in Kotak Silver ETF Fund of Fund will be temporarily suspended

We will resume lumpsum/switch-in subscriptions once the premium normalizes to acceptable

levels

✓ SIP (Systematic Investment Plan) / STP (Systematic Transfer Plan) investments will continue

uninterrupted

Existing SIPs/STPs in Kotak Silver ETF Fund of Fund remain active

Important Clarification

This temporary restriction on lumpsum/switch-in investments should NOT be interpreted as a

negative view on silver as a commodity.

The selling premium remains modest at approximately 3%, and we continue to maintain a constructive

outlook on silver from a long-term investment perspective. This measure is purely aimed at protecting

investors from entering at inflated domestic premiums.