The net active FPI inflows into India believed to be negligible.

FinTech BizNews Service

Mumbai, 16 February 2026: The recent sharp increase in flows into (1) EM equity ETFs and (2) domestic gold ETFs imply high levels of speculation among investors possibly and interesting implications for the Indian economy and market. We can only speculate on the reasons and duration of such flows. India continues to export capital through various routes, including gold imports, as per Kotak Institutional Equities - Strategy Note, authored by by Sanjeev Prasad, MD & Co-Head. .

Large passive flows into EMs, India gets its fair share

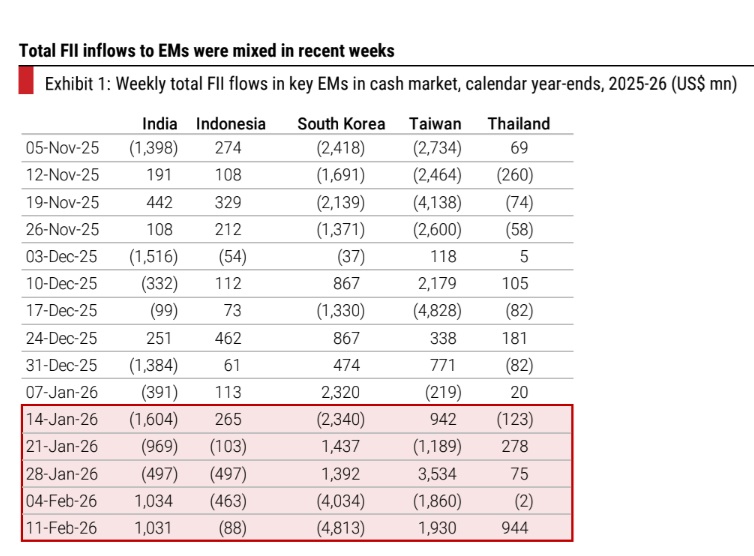

Our analysis of recent equity flows into EMs in recent weeks shows (1) a sharp surge in inflows and (2) a sharper increase in ETF flows (see Exhibits 1-2). The large inflows into EM ETFs after a period of strong performance of EMs (see Exhibit 3) show the usual pattern of flows chasing performance. India has got its fair share of EM ETF flows (see Exhibit 4), which resulted in FPI flows becoming positive after months of outflows (see Exhibit 5). We believe net active FPI inflows into India continue to be negligible.

Moderation in domestic equity inflows but still at high levels

Our analysis of recent equity flows into domestic MFs shows (1) a moderate slowdown in equity MF flows and (2) a sharp slowdown in small-cap. and thematic funds. The slowdown in flows after a period of weak performance of the Indian market (see Exhibits 8-9) and especially of mid-cap., small-cap. and thematic funds for the past 5-6 quarters implies either (1) the usual pattern of flows chasing performance (or the lack of the same) or (2) HNW investors finding new avenues of investment or speculation such as precious commodities. DII inflows into the market have moderated in recent weeks.

Massive passive flows into gold ETFs in India

Domestic gold ETFs saw a massive Rs240 bn of inflow in January 2026, dwarfing the flows in previous months. The surge in investment into gold ETFs globally implies (1) massive speculation in gold (along with silver) possibly; we are not sure if this is in lieu of the usual strong demand for physical gold or (2) loss of confidence of a section of households in the modern monetary system, the foundation of modern economies. We assume it is the former, as the latter is too frightening to comprehend.

India as an ‘indirect’ exporter of capital though being a large gold importer

We note that (1) continued large inflows into gold ETFs (and consequent purchase/import of gold by ETFs), along with unabated imports of physical gold, may pose challenges to India’s CAD, (2) any reversal in recent FPI inflows to outflows may weigh on India’s BoP and (3) large CAD and capital outflows will complicate reserve money creation, domestic liquidity and deposit creation. The purchase of financial and physical gold by households is tantamount to exports of capital from the country. The large and growing gap between net imports of precious commodities and stones and net FPI investment over the past 15-16 years is quite telling.