Gold has outperformed most asset classes in CY24TD

Indranil Pan, Chief Economist

Deepthi Mathew, Economist

Economics Knowledge Banking

YES BANK

Mumbai, April 13, 2024: Gold prices have had a stellar run over the last 6-1/2 months. Gold was quoted at USD 1821/oz on 10th October 2023 and is now higher by 31% at USD 2397/oz as of today. From USD 2058/oz on 2nd January 2024, gold is now higher by 16%. Importantly, the rise in the prices coincided with dollar strength and falling inflation expectations. The latest phase of rise has also coincided with stronger and more resilient data from the US, that has enabled the markets to start pushing out the start date of the Fed rate cuts. Having said, ECB has signaled for a rate cut sooner than later, given lower inflation trajectory in the region. Gold prices have challenged its historical negative relationship with US bond yields and DXY Index. What is driving gold? Strong demand:

a) The latest driver for gold prices has been the demand side story – mainly driven by central bank buying for its reserve assets. This also signifies the waning confidence in holding USD as reserve assets.

b) Rising demand for gold and silver for industrial use – specifically for the circuitry manufacturing in the electronics sector

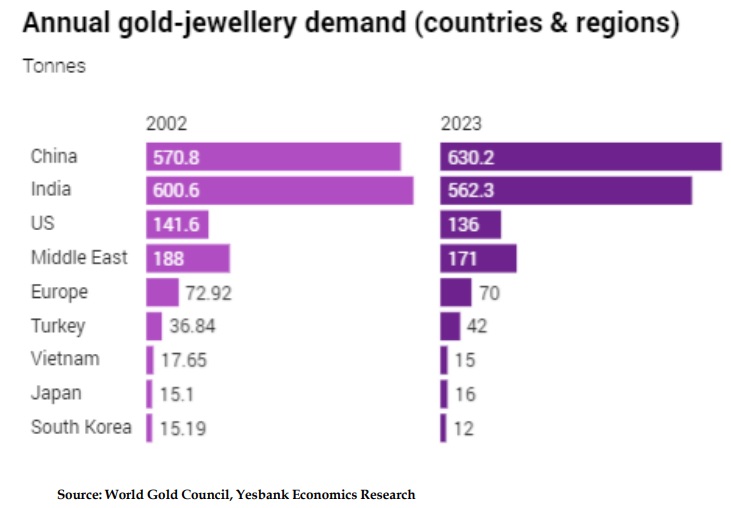

c) Rising retail demand from China. As we track in this presentation, this has enabled neutralizing money flowing out of gold ETFs. China retail demand is strong due to uncertain China economic environment – leading to residents hedging risks and parking funds into safe-haven gold. The overarching reason why gold demand has been high is the fears of uncertainty globally. The uncertainty relates to both macros and geopolitical tensions, such as the Russia-Ukraine crisis, Red Sea crisis etc. Global international relationships has seen greater degrees of confrontation, polarization and a move away from global cooperation. Macro outlook remains uncertain even as the world has shown significant growth resilience. Risks to election outcomes (64 counties representing a combined population of 49% goes to elections in 2024) remains that along with macro uncertainties can shape policy making.

Gold has outperformed most asset classes in CY24TD. US labour market strength frustrating inflation downshift.

Fed speak turns hawkish, SEP shows a firmer economic projection. Gold breaks historical inverse relationship with UST yields and DXY

Christopher Waller “..it is prudent to hold this rate at its current restrictive stance perhaps for longer than previously thought to help keep inflation on a sustainable trajectory toward 2%”

• Raphael Bostic: “….the current strength of the US economy means the Fed should cut interest rates just once this year, and not until the final quarter”

• Jerome Powell: “..policymakers will wait for clearer signs of lower inflation before cutting interest rates”

Factors driving gold prices

….as Asian markets witnessed monthly inflows

Recent lack of ETF purchases in ex-Asia was probably because gold-ETF holdings were anyways high • Russia-Ukraine conflict and SVB bank collapse had sparked some ETF buying which could now be getting reversed • Only Asia recorded net gold ETF inflows in February 2024, given the strong demand from China

Can the incessant gold rally continue? Central Bank gold holdings as a % of total FX reserves is still low in India and China and thus has scope of increase going ahead

Long gold positions had been building up in gold but is still lower than historical highs, scope for higher net long position continue with global uncertainties.

Gold has moved past the monthly break-out level of USD 2150/oz

Bullish momentum to continue as per wave theory , trend line breakout and pattern Gold in uncharted territory: Fibonacci projection target seen at USD2600/oz level

In conclusion…

Factors that can hamper gold rally:

• Signs of easing geo-political tensions (low probability) • Strong incoming data from the US to limit the possibility of an early rate cut (but geopolitics is likely to suppress this) • The rising probability for a soft landing by the global economy Factors to support gold rally: • Persistent theme of geo-political tension and geo-fragmentation • Policy uncertainty with 60 countries going into elections (49% of global population) in 2024 • Risk aversion in case of global hard landing (low probability) • Upside surprises in inflation could also support • The recent rally in gold was mainly supported by the risk aversion (geopolitical tensions) and market pricing in an early rate cut by the Fed • Central bank buying as also China retail buying supported the rally

In the near term, we expect gold to consolidate USD 2450 - USD 2500/oz as the rally has run strong in a very short time • USD 2600/oz not ruled out.

The big question: Where is the next stop for gold? We think there could be still some scope for gold to go higher unless there is clarity on uncertainties – both geopolitics and macro. Given our belief that both central bank and retail buying can continue, there remains a scope for gold to move to the USD 2450-2500/oz

DISCLAIMER

The opinion or expression made by YES BANK in this document, should not in any manner, be construed as a solicitation or endorsement of any offer for purchase or sale of any financial transaction, commodities, products of any financial instrument referred therein. All recipients of this document should carefully read, understand and investigate (either with or without professional advisors) into the risks arising out of or attached to such financial instrument or transaction or commodities or products before dealing or transacting in such financial instrument or transaction or commodities or products. By their nature, certain market risk disclosures are only estimates and could be materially different from what actually occurs in the future. As a result, actual future gains or losses could materially differ from those that have been estimated herein. Neither YES BANK nor any of its officers, directors, personnel and employees shall be liable for any loss, claim, damage of whatsoever any nature, including but not limited to, direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material or the information therein, in any manner. The investments discussed in this material may not be suitable for all investors.