INR depreciated and is trading at a fresh record low of 85.07/$ today, More hawkish projections for next year spooked the markets

Sonal Badhan,

Economist,

Bank of Baroda

Mumbai, 19 December, 2024: In line with market expectations, US Fed reduced policy

rates by 25bps to 4.25-4.5%, bringing the cumulative cuts since Sep’24 to 100bps. However,

more hawkish projections for next year spooked the markets. The dot plot indicates only 2 rate cuts

in CY25. In the near-term, Fed expects GDP to have performed better than expected

in CY24 (2.5% versus 2% estimated in Sep’24) and inflation will remain sticky (2.4%

versus 2.3%). Next year as well, growth is expected to be higher (2.1% versus 2%),

but worryingly, more significant jump is projected in inflation (2.5% versus 2.1%).

In Asia, BoJ kept its policy rate unchanged (est.: 25bps hike), with a split 8-1 vote.

Market expectations were split between a rate hike and pause. Uncertainty around

price trajectory and global policy developments (President-elect Trump takes charge

next month), led to this decision. Japan’s CPI has remained above BoJ’s target (2%)

for 30 consecutive months so far, however, pressures appear to be easing now.

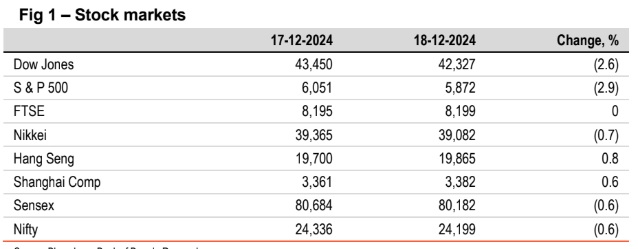

Global indices ended mixed. Stocks in US witnessed a sharp sell-off as the Fed

dot plot indicated only two rate cuts in 2025 with Fed Chair emphasising the

need to be vigilant on inflation. Sensex ended lower led by losses in power and

metal stocks. It is trading further lower today, in line with other Asian indices

following weak global cues.

The dollar rose sharply as Fed’s projection indicated fewer rate cuts in 2025.

EUR declined by over 1% as ECB is likely to cut rates more aggressively. JPY

also fell by 0.9%. INR depreciated and is trading at a fresh record low of 85.07/$

today. Asian currencies are also weaker.

Except Japan and India, other global 10Y yields closed higher. US 10Y yield

jumped the most by 12bps, as Fed’s dot plot indicates only 2 rate cuts next

year. Upward revision to growth and inflation also impacted investor sentiments.

India’s 10Y yield fell by 2bps. However, tracking global cues, and rise in oil

prices, it is trading higher at 6.78% today.