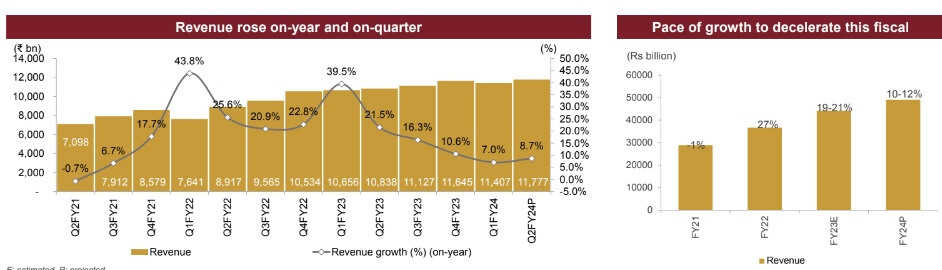

India Inc revenue growth picks up after four-quarter moderation

FinTech BizNews service

Mumbai, 18 October 2023: Revenue of Indian corporates is estimated to have grown 8-10% on-year in the September quarter, marking the first such improvement in the pace of growth after four quarters. Revenue was up sequentially, too, by an estimated 150-200 basis points (bps). An analysis of more than 300 companies (excluding financial services and oil and gas sectors) indicates as much. Of the 47 sectors CRISIL MI&A Research tracks, nine, accounting for more than 70% of overall revenue, saw a pick-up in on-year growth. The improvement in revenue growth would have been stronger had it not been for a decline in agri-linked sectors such as fertilisers, industrial commodities such as chlor-alkalis, petrochemicals and commodity chemicals, and aluminium.

Says Aniket Dani, Director- Research, CRISIL Market Intelligence and Analytics “Growth in revenue was largely skewed towards consumer discretionary products and services, where automobiles and the retail sector led the pack, and construction-linked sectors, where companies accrued benefits from an early deployment of capital expenditure by the roads and railways ministries. Truant monsoon proved to be a silver lining here as there were fewer interruptions in construction activity, thereby supporting volume growth even during a seasonally lean period.”

Automobiles Sector

The automobiles sector likely grew 12-14%, driven by three sub-segments — commercial vehicles, passenger vehicles and two-wheelers. The growth was steered by a 20-25% pick-up in passenger vehicles due to healthy demand sentiment, supported by new model launches, supply-chain improvement and more variety in product portfolio. The demand situation also gave elbow room for automakers to take multiple price hikes. Tractors remained sluggish, though, following an erratic monsoon, decline in rabi crop profitability and higher channel inventory.

Retail Kept Its Momentum

Within the consumer discretionary products segment, retail kept its momentum, growing 16-18%. Led by a 19-21% growth in media and entertainment and around 20% in the hospitality segment, comprising airline services and hotels, the consumer discretionary services vertical likely grew 13-15% on-year. The construction-linked segment was supported by the cement, steel products, roads and highways, and construction sectors. Cement companies likely recorded a 13-15% growth backed by a 12-14% volume growth over the year-ago quarter’s low base and lower impact of rains on construction activities thanks to El Nino. Steady domestic demand contributed to the 8-10% growth in revenue of steel products. Volume expanded a significant 17-19% during the quarter, as against just above 10% in the first quarter, following higher offtake of long steel products for infrastructure projects.

Muted Global Demand

Muted global demand restricted export growth to 2-4%. While merchandise exports continued to be weighed down by weak global demand, essentials such as pharmaceuticals seem on course to register a 10-12% on-year growth owing to strong domestic price growth, continued momentum in exports to regulated markets and abating pricing pressure in the US. IT services, too, likely bucked the trend in exports by recording an 18-20% growth because of deals led by increased focus on cost optimisation and consolidation. But soft global growth impacted the revenue of the aluminium industry, which contracted 12-14%. Global prices fell marginally and reflected in the premiums of major export destinations. Prices of commodity chemicals saw downward pressure owing to China’s slow recovery and widespread destocking, resulting in a likely 10-12% fall in revenue. Lower realisations amid muted demand also impacted revenue of cotton and synthetic textiles. For gems and jewellery, export demand remained weak amid modest purchasing power. However, operating profitability likely expanded by a smart 200-300 basis points on-year during the second quarter. Subsequently, overall earnings before interest, tax, depreciation and amortisation (Ebitda) margin for ~350 companies is estimated at 20-22% during the first half of this fiscal, up from around 18% a year ago.

Easing Input Costs

Says Sehul Bhatt, Associate Director- Research, CRISIL Market Intelligence and Analytics “Corporate India is expected to continue to benefit from easing input costs this fiscal which will offer further impetus to volume growth. Prices of key commodities such as crude oil and steel products have eased around 10%, while aluminium prices have fallen 13% so far. Power and freight costs have also come down. This, coupled with volume growth in the domestic market, will support operating profitability in the near term.” Barring the construction sector, the top eight industries recorded an expansion in operating profitability on-year. The cement, steel products and aluminium industry gained the most with a 700-900 bps expansion in Ebitda margin. The telecom industry managed to clock a 150-200 bps improvement in profitability due to stable costs and higher realisations from tariff revisions and migration of customers to upgraded technologies. Easing commodity costs helped the automobile industry expand its margin 150-200 bps, while the pharma sector reaped benefits from moderation in costs of some active pharmaceutical ingredients. Going forward, revenue growth is likely to get a further augmentation because of the festive season-led demand for consumer discretionary products and services. But two factors can swing corporate performance in the second half — the monsoon leaning towards inadequacy which could impact the crucial rural demand and export demand which continues to remain on the tenterhooks. Against this backdrop, favourable input costs may provide corporate India the much-needed respite.