DMF shareholding surged to fresh record high levels

Prerna Singhvi, CFA

Vice President – Economic Policy and Research

National Stock Exchange of India Limited (NSE)

Mumbai, 23 November, 2024: This is the second part of the series on the quarterly report “India Inc. Ownership Tracker”, with the data available for the quarter ending September 2024. The 1st part of the series on the report was published yesterday on 23 Nov, '24. In this edition of the NSE’s quarterly report, the authors extend their analysis of ownership trends and patterns in NSE companies to include the data available for the quarter ending September 2024. Additionally, they also examine concentration of category-wise holding by analysing allocation across market cap deciles and portfolio HHIs-Herfindahl-Hirschman Index.

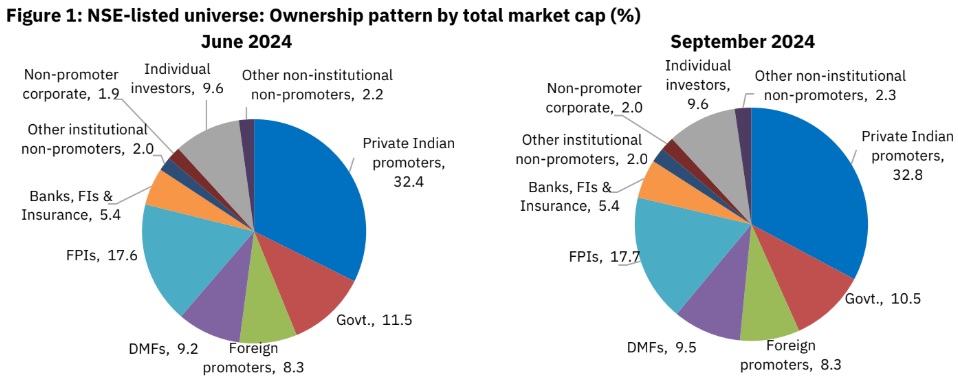

Promoter share in NSE listed companies declined for the first time in six quarters:

After rising over the previous five quarters, total promoter ownership in the NSE listed

universe declined by 46bps QoQ to 51.1%, even as the absolute holding rose by 7.3%

QoQ in value terms to an all-time high of Rs 239.2 lakh crore. Sequential increase in

private Indian promoter share—the first time in last five quarters—was more than offset

by a steep decline in Government ownership during the quarter. Private Indian promoters’

stake in the NSE listed companies inched up by 44bps QoQ to 32.8% in the quarter ending

September 2024, implying a 9.7% QoQ increase in value terms to record-high of Rs 153.6

lakh crore. This was primarily attributed to a 41bps QoQ increase in individual promoters’

(including HUFs) share to over 15-year high of 6.9% (up 34.2% in H1FY25 to an all-time

high of Rs 32.3 lakh crore), even as non-individual share remained steady at 25.9% (up

8.4% QoQ in value terms to Rs 121 lakh crore). Notably, individuals accounted for a 21%

share in the private Indian promoter holding in the NSE listed universe—the highest in

nine years. Foreign promoter ownership also remained steady at 8.3% in the September

quarter.

Government ownership declined in the September quarter:

After a steady decline between 2010 and 2022, thanks to Government’s efforts to garner higher

revenues through the disinvestment route, Government ownership (promoter and non-promoter) in

the NSE listed companies rose by a steep 2.4 percentage points (pp) in FY23, attributed

to the listing of LIC during the year, and by another 2.8pp in FY24, aided by relative

outperformance of PSUs. The trend, however, reversed in the September quarter, with the

Government share in NSE listed companies falling by a steep 96bps QoQ to 10.5%. This

was the highest QoQ decline in Government ownership in the last four years, erasing the

increase seen in the previous two quarters to a large extent and translating into a 69bps

decline in the first half of FY25. In value terms, Government holding fell by a modest 0.8%

QoQ to Rs 49.1 lakh crore as of September 2024. This decline in share was primarily led

by a significant underperformance of PSU banks relative to the broader market during the

quarter. For instance, the Nifty PSU Bank Index posted a loss of 8.3% in the September

quarter compared to the 7.5% return generated by both Nifty 50 and Nifty 500 Index.

FPI ownership inched up marginally...: After declining over the previous five quarters,

FPI share inched up by a modest 9bps QoQ to 17.7% in the quarter ending September

2024. A part of this modest increase despite strong foreign capital inflows (FPIs injected

a net amount of US$11.6bn in the September quarter) is attributed to relative

underperformance of Financials during the quarter where FPIs are heavy owners (30% of

FPIs’ investments in NSE listed companies is in Financials). For instance, Nifty Financial

Services Index generated a gain of 4.5% in the September quarter, lower than 7.5% return

posted each by Nifty 50 and Nifty 500 Index. Excluding Financials, FPI share in NSE listed

companies increased by a slightly higher 19bps QoQ to 15.8%. In value terms, FPI holding

in NSE listed companies increased by 8.8% QoQ to all-time high of Rs 82.7 lakh crore,

marking the sixth increase in a row.

...While DMF shareholding surged to fresh record high levels:

Continuing the steady upward trend seen over the previous four quarters, DMF share in the listed

universe rose by 28bps QoQ to a fresh all-time high of 9.5% in the September quarter, corroborating

with sustained buying by DMFs during this period. DMFs injected a net amount of Rs

89,336 crore into Indian equities in the second quarter of this fiscal year and record high

monthly inflows of Rs 90,771 crore in October, taking the total net inflows to Rs 2.9 lakh

crore in the first seven months, already surpassing net investments seen in any fiscal year

in the past. A part of this is attributed to sustained indirect participation of individuals via

the SIP route. SIP inflows have risen steadily in the last few years, with an average

monthly run rate rising by 14.2% QoQ to Rs 23,796 crore in the September quarter. Out

of the total DMF share of 9.5%, passive funds’ share remained broadly steady at 1.8%,

with the balance 7.7% was held by active funds, up 22 bps QoQ.

After falling steadily over the previous five quarters, the share of Banks, Financial

Institutions and Insurance companies in the NSE-listed space remained steady at 5.4%

in the September quarter, even as it remains nearly a percentage point higher than the

post-pandemic lows.

Individual investors’ holding remained steady in the September quarter: Individual

investors’ share remained steady for the fourth quarter in a row at 9.6% in the quarter

ending September 2024. A part of this is attributed to moderation in net investments by

individuals during the quarter. Individuals injected a net amount of Rs 17,810 crore in the

September quarter (NSE’s secondary markets only) from Rs 39,278 crore in the June

quarter and Rs 52,568 crore in the previous quarter. All sectors, barring Real Estate,

Materials and Industrials saw the ownership of individual investors decline or remain

broadly steady in the September quarter. Adding indirect ownership via mutual funds of

8.0% to this (Individuals—retail and HNIs put together—accounted for 84% of total

mutual fund investments into equity as of June quarter7), individuals’ share in equity

markets as non-promoter shareholders is only 7bps shy of that of the FPIs. This gap was

as high as 7.1pp in FY21, indicating the growing role and significance of individual

investors in the Indian equity markets.

Institutional ownership in NSE floating stock increased marginally:

DMF ownership in the NSE floating stock rose by 39bps QoQ to a fresh all-time high of 19.4%

in the September 2024 quarter, marking a full percentage point rise in the first half. On the other

hand, FPI holding in the floating stock of the NSE listed universe dipped for the seventh

consecutive quarter, standing at 15.5-year low of 36.3%. FPI share in the NSE floating

stock is now 9.6pp below the peak share seen eight years back (March 2014). This dip,

however, was much stronger in large and mid-cap companies, as evidenced from a 36bps

QoQ increase in FPI share in the free float stock of the NSE listed universe excluding the

Nifty 500 companies to 12.8%. On the contrary, DMF’s share in floating stock of these

companies fell by 30bos to 12.5% in the September quarter. Banks, Financial Institutions

and Insurance companies’ share in the free float of NSE-listed companies fell by 12bps

QoQ to a nine-quarter low of 11.0%. Overall institutional ownership of the NSE free float

increased by 17bps QoQ to 70.7%, 1.6pp below the all-time high of 72.3% (Mar’23).

Individual investors’ ownership of the NSE free-float market cap declined by 24bps

QoQ to 19.6% in the September quarter, almost entirely reversing the increase seen in

the previous quarter. With this, individuals’ share in NSE floating stock stands nearly

9.5% below the peak individual ownership level seen over the last 23+ years.

Long-term trend shows a steady drop in promoter ownership during 2009-2019,

followed by a marginal increase thereafter:

The long-term trend indicates a sharp rise in promoter ownership between 2001 and 2009

(To a 19-year high of 57.6% in March 2009) that gradually tapered off since, coinciding with the

SEBI’s decision to increase the minimum required free float from 10% to 25% in 2010. However, the

drop has been primarily led by a sharp decline in Government ownership over the years, and strategically

so, with the aim of expanding public partnership in the ownership of CPSEs (Central Public

Sector Enterprises) and augmenting its resources for higher expenditure towards

economic development. On the other hand, overall private promoter ownership—Indian

and foreign promoters combined—has increased by ~11.6pp between June 2010 to

December 2021. Promoter share, however, has been inching up since the last few years

barring FY23, primarily led by an increase in Government share.

( To be continued)