Small caps have registered 27.6% CAGR between 2017 to 2024: Bajaj Finserv

FinTech BizNews Service

Mumbai, June 18, 2025: A study by Bajaj Finserv AMC states that India’s small-cap segment has delivered remarkable growth over the past seven calendar years, with market capitalisation surging fivefold from Rs7 lakh crore in 2017 to Rs92 lakh crore by the end of 2024 — reflecting a robust compound annual growth rate (CAGR) of 27.6%1. In comparison, large-cap and mid-cap segments recorded CAGR of 14.5% and 21.6%, respectively, during the same period2.

Further, the study states that the contribution of small-caps to the overall market capitalization has grown 1.4 times over the last three years3. At the same time, their contribution to corporate profits has surged 2.5 times in the past four years4. This trend reflects the increasing prominence of the small-cap segment and the broader range of investment opportunities it now presents.

Second half of FY25 witnessed a correction in small caps, creating an opportunity to accumulate quality small caps at better valuation. As of April 2025, most small caps continue to trade below their 52-week highs, making the segment appealing from a valuation standpoint. While the small-cap index gained only 4% since FY24, profit after tax (PAT) grew by 38%, highlighting the segment’s unrealized value5. Despite the price correction, small-cap profits rose to Rs29,941 crore in FY25 from Rs21,669 crore in FY246. Moreover, 74% of the top 250 small-cap companies reported a double digit returns on capital employed (ROCE), indicating strong underlying fundamentals.

The study reflects on the importance of selecting quality small-cap stocks to avoid potential pitfalls, revealing that nearly 50% of small-cap companies from 2017 have declined into the micro-cap category. Interestingly, small caps have been at the forefront of IPO activity, with 196 listings since 20208. However, only four have transitioned to the mid-cap status, and none to large-caps, emphasizing the need for careful selection9.

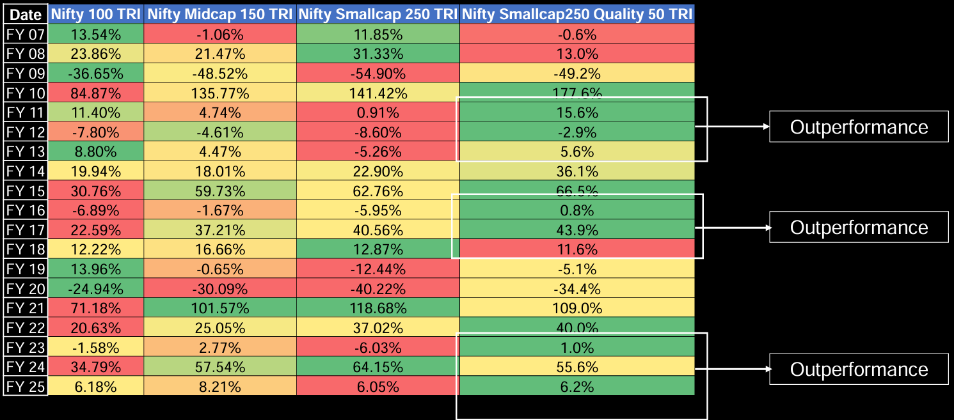

Bajaj Finserv AMC notes that the Nifty Small Cap 250 Quality 50 TRI has outperformed the Nifty Small Cap 250 TRI in 14 of the last 19 financial years10. Overall, the quality index delivered higher returns than all other indices in nine financial years from FY1011.

Additionally, the Small Cap Quality index has exhibited lower standard deviation than large caps in certain years12. The study further highlights that the Nifty Small Cap 250 Quality 50 TRI has withstood volatility much better than the Nifty Small Cap 250 TRI in 17 out of the past 19 financial years13, underscoring its resilience during periods of market fluctuation.